Navigating the 2026 Market AI, Quantum Leaps, and Unmissable Opportunities

Hey folks, Kane Buffett here. As we settle into 2026, the market is serving up a fascinating mix of relentless tech momentum, emerging quantum whispers, and classic investment dilemmas. The chatter is everywhere: Is AI still the golden ticket? Are we in a bubble? What’s the next big thing after semiconductors? Having navigated bull markets, bear markets, and everything in between from this blog chair for a decade, I’ve learned to tune out the noise and focus on the signal. Today, we’re diving deep into the themes shaping this year, from the unstoppable force of AI (and the one stock that could still 10x) to the quiet revolution in quantum computing and the critical ETF choices that could make or break your portfolio’s performance. Let’s break it down.

💰 For investors seeking profitable opportunities in today’s volatile market, this detailed analysis of 2026 Market Crossroads Decoding Signals, ETF Battles, and the Path to Profits for comprehensive market insights and expert analysis.

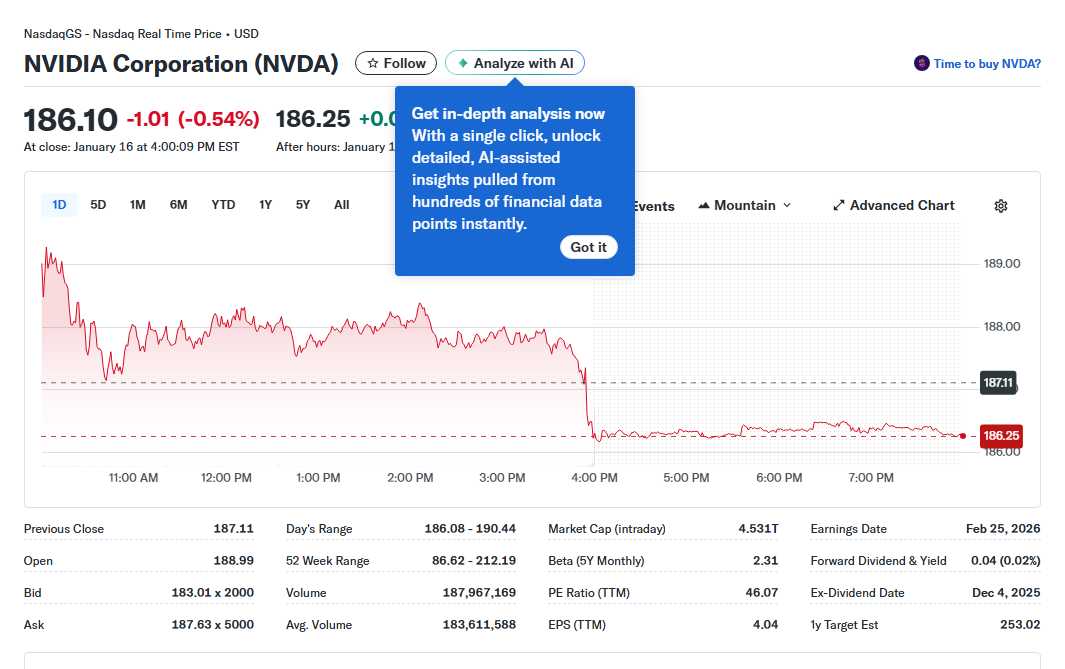

The AI Engine: Still Firing on All Cylinders, But Picking Your Spots is Key The narrative around Artificial Intelligence has evolved from “disruptive trend” to “fundamental infrastructure.” The recent earnings and outlook from giants like NVIDIA (NVDA) and Taiwan Semiconductor Manufacturing Company (TSMC) are the clearest signals. NVIDIA’s CEO Jensen Huang, while tempering some of the wildest growth expectations, continues to paint a picture of sustained, massive demand for AI data center chips. The “bad news” some headlines fretted about was merely a shift from hyper-growth to merely spectacular growth—a normalization that long-term investors should welcome. TSMC’s record quarter, fueled by insatiable demand for advanced packaging (like its CoWoS technology), underscores that this isn’t just an NVIDIA story; it’s an entire ecosystem play. My top AI picks for 2026, as highlighted in the provided research, lean into this ecosystem: think of the companies providing the picks and shovels (like TSMC), the cloud infrastructure, and the software layers that will monetize AI. Alphabet (GOOGL) hitting the $5 trillion market cap club is a testament to its AI integration across Search, Cloud, and YouTube. The key takeaway? AI is not a bubble that’s about to pop; it’s a multi-decade investment theme entering its maturation phase. The biggest risk to your portfolio isn’t being invested in AI; it’s being invested in the wrong AI companies or paying an absurd valuation for hype without substance.

💰 For investors seeking profitable opportunities in today’s volatile market, this detailed analysis of The AI Engine Roars Decoding TSMs Record Quarter and the Unstoppable Chipmaker Rally for comprehensive market insights and expert analysis.

Beyond AI: The Quantum Computing Horizon and Semiconductor Dominance While AI dominates today, the seeds for the next paradigm shift are being planted in quantum computing. This isn’t science fiction anymore; it’s a real, albeit early-stage, race with staggering potential. Articles point to companies like D-Wave Quantum and others as speculative but high-potential plays. The investment thesis here is about optionality—allocating a small, risk-capital portion of your portfolio to the companies that could solve problems (in logistics, drug discovery, cryptography) that are impossible for classical computers. It’s a binary outcome: most may fail, but the one that succeeds could deliver thousand-percent returns. Parallel to this, the iShares Semiconductor ETF (SOXX) jumping 40% tells a clear story: semiconductors are the new oil. Whether it’s for AI, quantum, automotive, or IoT, the world runs on chips. This creates a “once-in-a-decade” opportunity for a company like AMD (AMD), which is aggressively competing in data center CPUs and GPUs. If it can continue to execute and capture even a fraction of the market leader’s margins, the stock could see significant upside. The lesson is to build a robust core in proven tech (semiconductors via ETFs or leaders) while allowing for a small, targeted exploration of the next frontier (quantum).

If you want a daily Sudoku challenge, download Sudoku Journey with both classic and story modes for endless fun.

The Portfolio Architect’s Dilemma: ETFs, Market Signals, and Managing Risk This is where experience pays off. With countless ETFs available, choosing the right vehicle is critical. The debate between QQQ (Nasdaq-100) and RSP (S&P 500 Equal Weight) encapsulates a core strategy decision: Do you want concentrated exposure to mega-cap tech (QQQ) or a diversified bet on the broader market (RSP)? Similarly, the choice between growth ETFs like SCHG vs. VUG comes down to expense ratios, holdings concentration, and tracking methodology. My view? For most investors, a core position in a low-cost S&P 500 ETF (like Vanguard’s VOO) is non-negotiable. From there, you can use satellite positions in QQQ for tech tilt or a growth ETF for more aggressive exposure. Now, about market signals: historical data suggests that when the S&P 500 achieves a specific pattern of gains (like the “7 times” signal mentioned), it often precedes further strength, not a crash. Combined with analysis suggesting a potential Trump administration’s tax policy could fuel a “trillion-dollar trend,” the macro backdrop appears supportive for equities in 2026. However, the single biggest risk to your portfolio, as one article brilliantly notes, is not market volatility, but behavioral mistakes—panic selling, chasing hype, and failing to rebalance. Your strategy must be built to survive your own emotions.

Need a fun puzzle game for brain health? Install Sudoku Journey, featuring Grandpa Crypto’s wisdom and enjoy daily challenges.

So, where does this leave us for 2026? The landscape is rich with opportunity but requires discernment. Double down on the durable AI leaders and the semiconductor bedrock they’re built on. Take a calculated, small bet on the future with quantum computing. And most importantly, build your portfolio on a solid, diversified foundation using smart ETF choices, insulating yourself from the noise and your own worst impulses. The market is giving us a playbook; it’s up to us to execute it with discipline. Stay sharp, invest wisely, and I’ll see you in the next post. - Kane Buffett

🎯 For investors who want to stay competitive in today’s fast-paced market, explore 2026 Market Crossroads Decoding Signals, ETF Battles, and the Path to Profits for comprehensive market insights and expert analysis.