2026 Market Crossroads Decoding Signals, ETF Battles, and the Path to Profits

Hey folks, Kane Buffett here. The market’s sending mixed signals as we kick off 2026. On one hand, we’ve got mega-caps like Alphabet hitting the exclusive $5 trillion club, and tech titans gearing up for what analysts like Dan Ives are calling a “mid-1996 moment” with potentially blockbuster earnings. On the other, there’s palpable nervousness—Nvidia leading tech losses as AI hype cools, and historical patterns flashing warnings of a potential big move. It’s a classic tug-of-war between momentum and caution. In this post, we’ll cut through the noise, break down the critical ETF choices you face (QQQ vs. RSP, SCHG vs. VUG, IWY vs. IWO), and unpack the major predictions and signals shaping the year. Strap in; this is where we separate the noise from the actionable insight.

📱 Get real-time market insights and expert analysis by checking out this review of Buffetts Google Bet & The AI Wave Your 2026 Tech Investing Blueprint for comprehensive market insights and expert analysis.

The Great ETF Showdown: Concentration vs. Breadth The core of your 2026 portfolio construction hinges on a fundamental choice: Do you bet on the elite or the ensemble? Two ETFs embody this debate: the Invesco QQQ Trust (QQQ) and the Invesco S&P 500 Equal Weight ETF (RSP). QQQ tracks the Nasdaq-100, a market-cap-weighted index heavily concentrated in the “Magnificent 7” tech giants. Its performance is tied to the fortunes of a few behemoths. RSP, however, takes all 500 companies in the S&P 500 and gives each an equal 0.2% weighting. This approach dilutes the influence of mega-caps and gives broader exposure to the overall market’s health. The question for 2026 is: will leadership remain narrow, or will it broaden? If you believe the AI-driven tech rally still has legs, QQQ’s concentration is powerful. If you’re wary of stretched valuations in big tech and foresee a sector rotation, RSP offers stability and diversification. It’s not about which is better, but which aligns with your market outlook and risk tolerance.

Ready to play smarter? Visit Powerball Predictor for up-to-date results, draw countdowns, and AI number suggestions.

Growth ETF Granularity and Small-Cap Speculation Beyond the S&P 500, the growth and small-cap spaces present their own nuanced decisions. Take the Schwab U.S. Large-Cap Growth ETF (SCHG) versus the Vanguard Growth ETF (VUG). Both target large-cap growth, but their methodologies differ. SCHG uses a fundamental screen (sales growth, cash flow growth, etc.) to pick stocks, while VUG simply selects growth stocks from the large-cap universe based on traditional metrics. The result? SCHG tends to be more concentrated and pure-play on its growth factors. For 2026, if you want a more aggressive, focused growth tilt, SCHG might be your pick. For a broader, more traditional growth exposure, VUG is a stalwart. Then there’s the iShares Russell Top 200 Growth ETF (IWY) vs. the iShares Russell 2000 Growth ETF (IWO). This is a size play. IWY is all about mega-cap growth (heavy on Microsoft, Alphabet, Amazon), while IWO dives into small-cap growth companies. IWO is a bet on economic expansion and risk appetite returning to smaller, more volatile companies. Given the current focus on mega-cap safety and earnings, IWY seems the less risky 2026 play, but IWO could be the rocket fuel if the market mood shifts decisively bullish.

🌮 Curious about the local dining scene? Here’s a closer look at 3 Little Pigs Chi to see what makes this place worth a visit.

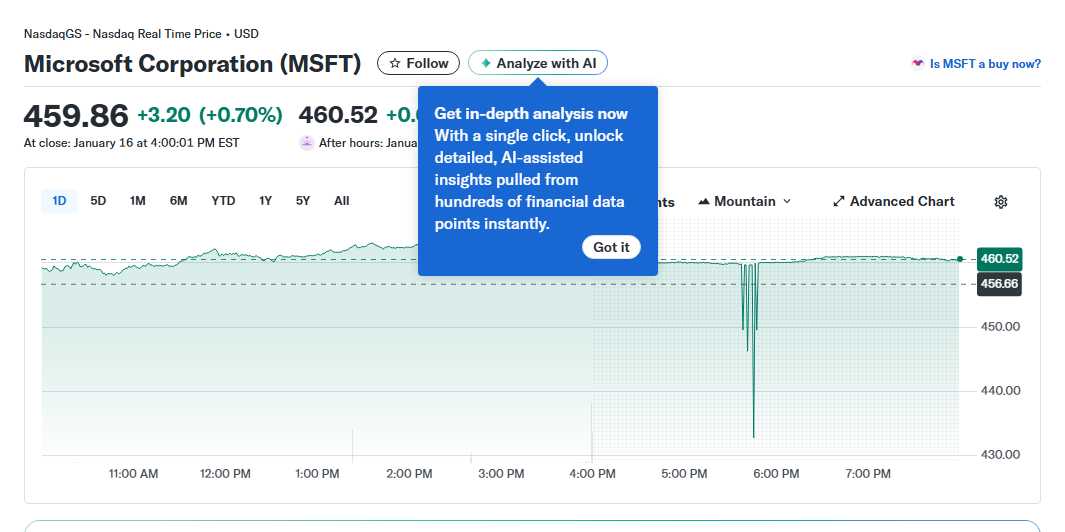

2026 Signals, Predictions, and Stock-Specific Landmines & Goldmines The macro picture is buzzing with clues. One Fool article highlights 7 historical technical and sentiment indicators that, when they’ve all lined up before, have preceded significant market moves. This suggests we’re at an inflection point. Specific predictions for 2026 include continued AI dominance but with more selectivity, potential regulatory headwinds for big tech, and a possible resurgence in overlooked value sectors. Stock-wise, it’s a tale of extremes. Alphabet soaring into the $5 trillion club shows undeniable strength, but it also raises questions about sustainability. Microsoft, Alphabet, and Amazon are poised for “very strong” Q4 earnings according to Wedbush’s Dan Ives, who sees a major tech infrastructure wave. Conversely, Nvidia’s recent pullback as “investors cool on AI” is a stark reminder that even the hottest trends face volatility. A $10,000 investment in Nvidia years ago made millionaires, but chasing past returns is dangerous. Palantir remains a polarizing “buy or avoid” debate, hinging on its government contracts and commercial AI platform adoption. The lesson? 2026 demands selectivity. Blindly buying the dip in overhyped names or ignoring fundamental shifts could be costly.

💰 Don’t let market opportunities pass you by - here’s what you need to know about The 2026 Investors Playbook Top Stocks, AI Trends, and Market Predictions from Wall Streets Latest Moves for comprehensive market insights and expert analysis.

So, what’s the Kane Buffett take? 2026 looks like a year for strategic balance and active monitoring. Don’t go all-in on a single theme. Consider a core position in a broad ETF like RSP for stability, then use strategic satellite positions in focused ETFs like QQQ or SCHG to capture growth—but be ready to rebalance. Keep a keen eye on the earnings from the mega-cap tech trio; they will set the tone. Respect the historical signals warning of volatility. Most importantly, tune out the day-to-day noise and focus on the long-term trajectory of the companies and trends you believe in. The market is giving us both warning signs and opportunities. Your job is to have a plan for both. Stay disciplined, stay informed, and let’s navigate this together. Until next time, invest wisely.

Stay ahead in Powerball with live results, smart notifications, and number stats. Visit Powerball Predictor now!