The AI Engine Roars Decoding TSMs Record Quarter and the Unstoppable Chipmaker Rally

Hey folks, Kane Buffett here. If you’ve been watching the tape this week, you know something big is happening. The semiconductor sector, the undeniable heartbeat of the AI revolution, is not just ticking—it’s pounding. We’ve just witnessed a historic earnings report from Taiwan Semiconductor Manufacturing Co. (TSM), and the ripple effects are sending shockwaves through the entire tech ecosystem, from AI server builders like Super Micro Computer to the cloud titans. The narrative that AI is a bubble is getting a serious reality check. Let’s dive into the numbers Wall Street might be overlooking and what this means for your portfolio.

💡 Ready to take your portfolio to the next level? Check out this strategic analysis of The 2026 Investors Playbook Top Stocks, AI Trends, and Market Predictions from Wall Streets Latest Moves for comprehensive market insights and expert analysis.

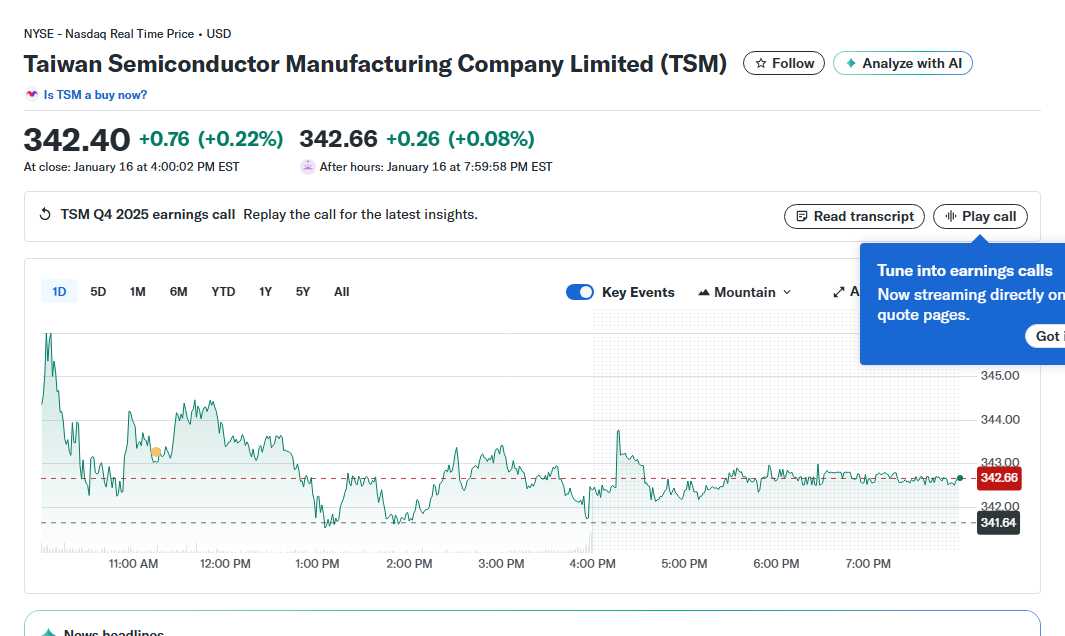

TSMC’s Masterclass: The Numbers Behind the AI Surge

Taiwan Semiconductor’s Q4 2025 results were nothing short of a masterclass in execution and a powerful indicator of sustainable AI demand. While headlines celebrated the top and bottom-line beats, the real story is in the guidance and the mix. TSM isn’t just forecasting growth; it’s forecasting accelerated growth, fueled directly by high-performance computing (HPC) and AI-related chips. This is critical. It means the demand for advanced semiconductors (think 3nm and 5nm technology) isn’t a fleeting trend but a structural shift. Companies like NVIDIA, AMD, and Apple are lining up for this capacity. TSM’s confidence essentially acts as a leading indicator for the entire tech food chain. When the world’s most advanced foundry says AI demand is stronger than ever, it’s time to listen. This report single-handedly dampened the pervasive “AI bubble” fears that had been creeping into the market, providing a fundamental bedrock for the sector’s valuation.

If you want a daily Sudoku challenge, download Sudoku Journey with both classic and story modes for endless fun.

The Ripple Effect: Super Micro, NVIDIA, and the Broader Market Rally

The dominoes began falling immediately. Super Micro Computer (SMCI), a premier builder of AI-optimized servers, saw its stock jump significantly on the back of TSM’s report. Why? Because SMCI’s growth is directly tied to the availability of these advanced AI chips. If TSM is ramping production, it means SMCI can build and ship more servers. This symbiotic relationship is a pure-play on AI infrastructure deployment. Meanwhile, NVIDIA continued its ascent, buoyed by unwavering optimism around AI demand and data center growth. The “chipmaker rally” wasn’t isolated. It lifted the entire market, with S&P 500 and Nasdaq futures gaining as tech stocks rebounded powerfully. This wasn’t a speculative bounce; it was a sector-wide re-rating based on concrete evidence of demand strength. Even the Dow Jones found support, with stocks like Chevron providing balance. The message is clear: the AI trade is broadening from pure chip designers to enablers and infrastructure providers.

Ready to play smarter? Visit Powerball Predictor for up-to-date results, draw countdowns, and AI number suggestions.

The Big Tech Catalyst and Strategic Portfolio Moves

Looking ahead, the stage is set for a massive earnings season from the “hyperscalers.” Wedbush’s Dan Ives called this a “mid-1996 moment” for tech, anticipating “very strong Q4 earnings” from Microsoft, Alphabet, and Amazon. These companies are the primary customers for AI servers and chips, spending billions on data center capex. Their earnings will validate the demand TSM is seeing from the other side of the equation. Strong results from them could ignite the next leg up for the entire sector. On the strategic front, the concentration of smart money is telling. One notable portfolio now has a staggering 17% allocation to a single Asia-focused ETF, a massive $28 million bet signaling profound conviction in the region’s tech and growth story, with TSM often as a top holding. This underscores a major theme: gaining exposure to the AI revolution often means looking through a global lens, particularly at the Asian semiconductor supply chain that powers it all.

🌮 Curious about the local dining scene? Here’s a closer look at Michael Jordans Steak House - Chicago to see what makes this place worth a visit.

So, what’s the takeaway from Kane’s Corner? The AI growth theme is not only intact; it’s accelerating. TSM’s report was the exclamation point on a week filled with bullish signals. While selectivity is always key—focusing on companies with tangible exposure to AI infrastructure and genuine earnings power—the fear of a bubble has been significantly overblown. We are in the early innings of a multi-year deployment cycle. The strategic move into Asian tech ETFs by major investors highlights where the real engine of growth lies. Stay long quality, focus on the enablers, and don’t get shaken out by noise. The fundamentals are speaking loudly. Until next time, invest wisely.

If you want a daily Sudoku challenge, download Sudoku Journey with both classic and story modes for endless fun.