Wheaton Precious Metals The Ultimate Streaming Play for Gold and Silver Exposure

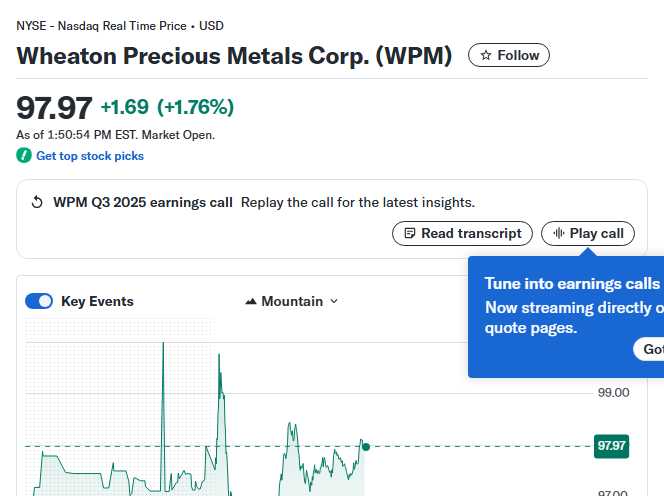

Hey fellow investors! Kane Buffett here, back with another deep dive into one of my favorite precious metals plays. Today we’re talking about Wheaton Precious Metals (WPM) - the blue-chip streaming company that’s been making waves with their recent dividend declaration and upcoming Q3 earnings. As someone who’s been through multiple market cycles, I can tell you that streaming companies like WPM offer a unique way to gain exposure to precious metals without taking on mining operational risks. Let’s unpack why this company deserves a spot on your radar.

📱 Stay informed about the latest market movements and stock recommendations by exploring Market Crossroads Navigating Divergences, Fed Policy, and Big Tech Earnings in Volatile Times for comprehensive market insights and expert analysis.

The Streaming Business Model: Gold Without the Headaches

Wheaton Precious Metals operates with a brilliant business model that separates them from traditional miners. As a streaming company, WPM provides upfront financing to mining companies in exchange for the right to purchase precious metals at predetermined low prices for the life of the mine. This model gives them incredible leverage to gold and silver prices without the operational risks, environmental liabilities, or capital-intensive projects that miners face.

According to recent analysis from Yahoo Finance, WPM’s correlation with oil markets is surprisingly low, making it an excellent diversification tool. While many resource stocks move with energy prices, WPM’s streaming model creates a different risk profile that’s more directly tied to precious metals prices. The company currently has streaming agreements with 21 operating mines and 13 development projects, providing diversified exposure across multiple jurisdictions and mining companies.

Their recent quarterly dividend declaration of $0.15 per common share demonstrates the company’s commitment to shareholder returns. This represents a sustainable payout ratio that allows for continued growth while rewarding investors. The dividend yield, while not massive, provides income while you wait for precious metals to appreciate.

📱 Get real-time market insights and expert analysis by checking out this review of Market Insights Growth Stocks, Dow Theory Warnings, and AI Investment Opportunities for comprehensive market insights and expert analysis.

Q3 Earnings Preview: What to Expect

With Q3 earnings around the corner, analysts are watching several key metrics. TradingView’s Zacks analysis suggests we should focus on several critical areas. First, pay attention to production numbers - WPM is expected to report between 150,000 to 160,000 gold equivalent ounces (GEOs) for the quarter. Second, watch the average realized prices for gold and silver, as these directly impact revenue and margins.

The company’s cost structure remains one of its most attractive features. With an average cash cost of around $450 per GEO and sustaining capital of approximately $150 per GEO, WPM maintains incredible margins compared to traditional miners. This cost advantage becomes particularly valuable when precious metals prices are volatile.

Revenue projections for Q3 sit in the $280-300 million range, with EPS estimates around $0.32-0.35. However, the real story will be in the guidance updates for full-year 2025 and any new streaming agreements announced. The company has been actively deploying capital into new streams, and investors should watch for announcements that could drive future growth.

💬 Real opinions from real diners — here’s what they had to say about Heres Looking At You to see what makes this place worth a visit.

Investment Thesis: Why WPM Belongs in Your Portfolio

From my decade of experience analyzing resource stocks, WPM represents one of the highest-quality ways to gain precious metals exposure. The streaming model provides several distinct advantages: superior margins, reduced operational risk, and incredible leverage to rising gold and silver prices. With central banks continuing to print money and geopolitical tensions rising, the case for precious metals exposure has never been stronger.

Meyka’s technical analysis shows WPM trading in a constructive pattern, with strong support around $45 and resistance near $55. The stock has been building a base that could support a breakout if gold prices continue their upward trajectory. The relative strength compared to physical metals has been impressive, demonstrating the market’s recognition of the streaming model’s advantages.

Looking forward, WPM’s growth pipeline includes several development projects that should come online over the next 2-3 years, providing organic production growth without additional capital requirements. The company’s balance sheet remains rock-solid with minimal debt and substantial liquidity to pursue new streaming opportunities as they arise.

📍 One of the most talked-about spots recently is Medusa The Greek to see what makes this place worth a visit.

There you have it, folks - Wheaton Precious Metals offers a sophisticated way to play the precious metals thesis without the operational headaches of mining. The combination of quarterly dividends, upcoming earnings potential, and the strategic streaming model makes WPM a compelling holding for both income and growth investors. Remember, in uncertain markets, quality companies with strong business models tend to outperform. As always, do your own research and consider your risk tolerance, but in my professional opinion, WPM deserves serious consideration for any well-diversified portfolio. Until next time, happy investing! - Kane Buffett

Stay ahead in Powerball with live results, smart notifications, and number stats. Visit Powerball Predictor now!