Market Crossroads Navigating Divergences, Fed Policy, and Big Tech Earnings in Volatile Times

Welcome back, fellow investors! Kane Buffett here with your comprehensive market breakdown. As we navigate through one of the most intriguing periods in recent market history, we’re seeing significant divergences between indices, mixed earnings results from tech giants, and ongoing Federal Reserve policy uncertainties. The current landscape presents both challenges and opportunities that require careful analysis and strategic positioning. Let’s dive deep into what’s moving the markets and how you can position your portfolio for success.

📱 Get real-time market insights and expert analysis by checking out this review of The AI Boom Meets Streaming Wars Unprecedented Investment Opportunities in 2025 for comprehensive market insights and expert analysis.

Market Divergences and Dow Theory Concerns

The current market environment is showing concerning divergences that seasoned investors should note. According to Dow Theory analysis, we’re witnessing a significant split between the Dow Jones Industrial Average and the Transportation Average. This classical technical indicator suggests potential trouble ahead when these two averages fail to confirm each other’s movements. The Dow Jones has been struggling while the NASDAQ shows relative strength, creating a confusing picture for market participants. This divergence isn’t just technical - it reflects underlying economic concerns about consumer spending, industrial production, and transportation demand. Historical data shows that such divergences often precede broader market corrections, making this a critical time for risk management and portfolio rebalancing. The transportation sector’s weakness could indicate slowing economic activity, while the NASDAQ’s resilience points to continued tech sector optimism despite macroeconomic headwinds.

If you want a daily Sudoku challenge, download Sudoku Journey with both classic and story modes for endless fun.

Big Tech Earnings: The Mixed Bag of Q3 2025

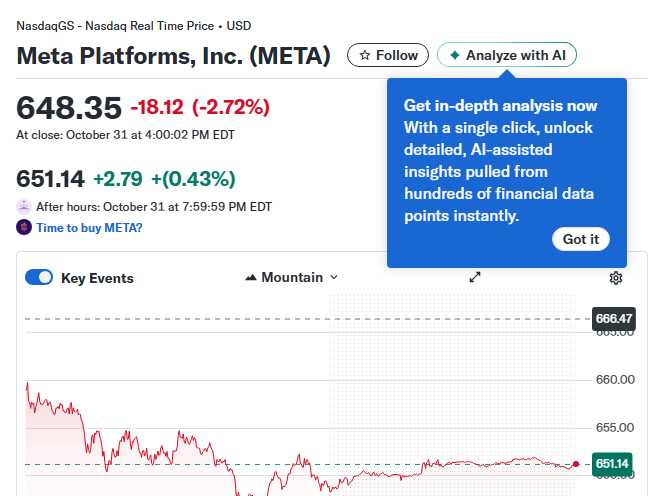

This earnings season has delivered a rollercoaster of results from technology giants. Meta Platforms faced significant selling pressure despite reporting solid numbers, as investors questioned the company’s massive AI capital expenditures and monetization timeline. The market’s reaction highlights the current sensitivity to forward guidance and spending plans, particularly around artificial intelligence investments. Meanwhile, Alphabet (Google) delivered a strong rally driven by better-than-expected cloud revenue and advertising growth. The divergence between these two tech behemoths demonstrates the market’s selective appetite for growth stories. Amazon and Intel continue their cost-cutting measures with additional layoffs, signaling ongoing efficiency efforts amid uncertain demand environments. These moves reflect corporate caution despite generally positive economic indicators. The tech sector’s mixed performance underscores the importance of company-specific analysis rather than broad sector bets in the current market environment.

🤖 Looking for expert insights on market trends and investment opportunities? Check out this analysis of AI Revolution Broadcoms Hidden Win in Googles Anthropic Deal and Quantum Computing Stocks to Watch for comprehensive market insights and expert analysis.

Federal Reserve Policy and Economic Indicators

The Federal Reserve remains the central focus for market participants, with recent rate cuts creating both opportunities and uncertainties. The FOMC’s latest decisions have injected liquidity into the system but also raised questions about the economic outlook that prompted such moves. Consumer confidence data has shown concerning trends, with recent reports indicating a significant beating to consumer sentiment. This is particularly noteworthy given the simultaneous layoff announcements from major corporations like Amazon and Intel. The relationship between Fed policy, corporate behavior, and consumer sentiment creates a complex web of interconnected factors that will determine market direction in the coming quarters. Historical analysis suggests that Fed easing cycles typically support equity markets, but the current environment’s unique characteristics - including geopolitical tensions, election uncertainties, and structural economic shifts - make this cycle particularly challenging to navigate. Investors should monitor upcoming economic data releases closely, especially employment figures and inflation metrics, for clues about the Fed’s next moves.

Need a daily brain game? Download Sudoku Journey with English support and start your mental fitness journey today.

In these volatile times, remember that market divergences often create the best opportunities for disciplined investors. While the current environment presents challenges with mixed earnings, Fed uncertainty, and technical warning signs, it also offers potential for those who can identify quality companies at reasonable valuations. The key is maintaining a long-term perspective, diversifying appropriately, and staying informed about both macroeconomic trends and company-specific developments. As always, do your own research and consider your risk tolerance before making any investment decisions. Stay sharp, stay invested, and I’ll see you in the next update! - Kane Buffett

Need to extract colors from an image for your next project? Try this free image-based color picker tool to get accurate HEX and RGB values.