AI Revolution Broadcoms Hidden Win in Googles Anthropic Deal and Quantum Computing Stocks to Watch

Hey fellow investors! Kane Buffett here with another deep dive into the most exciting developments in the tech and AI space. This week has been absolutely explosive with Google’s Anthropic chip deal revealing Broadcom as the silent winner, while quantum computing and AI stocks continue to show tremendous potential. As we navigate through Fed decisions and earnings season, I’m seeing some incredible opportunities that could define the next decade of tech investing.

💡 Ready to take your portfolio to the next level? Check out this strategic analysis of The Dividend King Joining the $1 Trillion Club & Amazons Unstoppable Growth for comprehensive market insights and expert analysis.

Broadcom: The Silent Power Behind Google’s AI Ambitions

The recent Google-Anthropic chip deal has sent shockwaves through the semiconductor industry, but the real story isn’t just about Google - it’s about Broadcom’s (AVGO) strategic positioning. According to recent analysis, Broadcom stands to gain significantly as Google ramps up its AI chip production for Anthropic’s massive computational needs. This partnership underscores the growing demand for specialized AI processors beyond the usual suspects like NVIDIA.

Broadcom has been quietly building its AI chip business, and this deal could represent a watershed moment. The company’s custom silicon solutions are becoming increasingly crucial as tech giants seek to reduce reliance on generic AI chips and develop more specialized, efficient processors for their specific AI workloads. With Google’s commitment to Anthropic requiring unprecedented computing power, Broadcom’s expertise in custom ASICs positions them perfectly to capture this growing market segment.

Meanwhile, the broader semiconductor sector continues to benefit from the AI boom. Companies developing specialized chips for AI inference, training, and quantum computing applications are seeing unprecedented demand. The Google-Anthropic deal represents just one piece of the massive AI infrastructure build-out that’s underway across the entire tech industry.

If you want to improve focus and logical thinking, install Sudoku Journey with classic, daily, and story modes and challenge yourself.

Quantum Computing: The Next Frontier in Tech Investing

Quantum computing stocks are generating tremendous buzz, with several companies positioning themselves as leaders in this emerging field. Analysis from multiple sources highlights quantum computing as one of the most promising technological frontiers, with the potential to revolutionize everything from drug discovery to cryptography.

Several quantum computing stocks are emerging as particularly compelling investments. Companies focusing on quantum hardware, software, and applications are attracting significant attention from both institutional and retail investors. The quantum computing market is expected to grow exponentially over the coming years, with some estimates suggesting it could become a trillion-dollar opportunity by 2035.

What makes quantum computing particularly exciting is its potential to solve problems that are currently intractable for classical computers. From optimizing complex supply chains to developing new materials and pharmaceuticals, quantum computers could unlock entirely new industries and capabilities. Investors looking for exposure to this space should consider companies with strong IP portfolios, proven technical capabilities, and clear paths to commercialization.

The recent patent analysis in the cardiac diagnostics market also reveals how technological innovation, including potential quantum computing applications, is transforming traditional industries. As computing power increases, we’re seeing convergence between AI, quantum computing, and specialized medical diagnostics.

Curious about the next winning numbers? Powerball Predictor uses advanced AI to recommend your best picks.

Market Dynamics: Fed Decisions and Big Tech Earnings

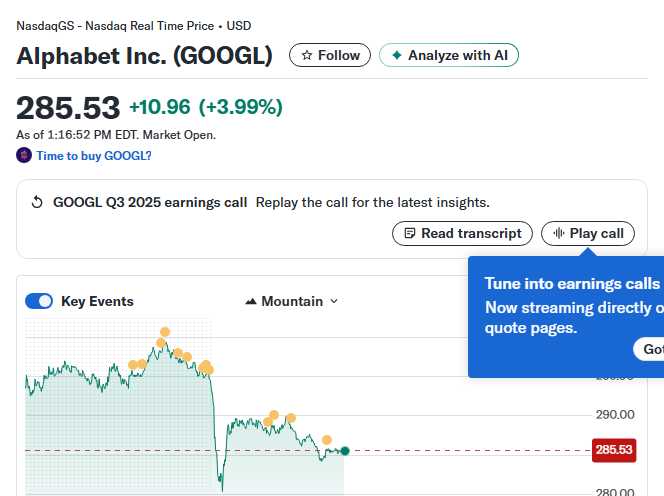

The current market environment presents both challenges and opportunities for tech investors. Recent FOMC decisions and ongoing concerns about interest rates have created some volatility, but big tech earnings continue to impress. The NASDAQ has shown resilience despite broader market uncertainty, driven by strong performances from technology leaders.

Several major tech companies are poised to report earnings that could power markets higher into year-end. The combination of robust AI-driven revenue growth, improving margins, and continued innovation suggests that the tech sector remains well-positioned despite macroeconomic headwinds.

NVIDIA continues to be a focal point for AI investors, with some analysts suggesting it could join the $3 trillion club by 2027. The company’s dominance in AI chips and its expanding software ecosystem make it a compelling long-term investment, though valuation concerns persist.

The mobile augmented reality market also represents a significant growth opportunity, with projections suggesting it could surpass $327 billion by 2032. This growth is being driven by advancements in AI, improved hardware, and expanding use cases across entertainment, education, and enterprise applications.

Want smarter Powerball play? Get real-time results, AI-powered number predictions, draw alerts, and stats—all in one place. Visit Powerball Predictor and boost your chances today!

As we look ahead, the convergence of AI, quantum computing, and specialized semiconductors is creating unprecedented investment opportunities. While market volatility may continue in the short term, the long-term trends favoring technological innovation remain intact. Remember to focus on companies with sustainable competitive advantages, strong management teams, and exposure to multiple growth vectors. Stay disciplined, keep learning, and as always - invest don’t gamble! Until next time, this is Kane Buffett signing off.

Looking for a game to boost concentration and brain activity? Sudoku Journey: Grandpa Crypto is here to help you stay sharp.