The Ultimate Vanguard ETF Strategy for Reliable Passive Income and AI Growth

Hey fellow investors! Kane Buffett here. After analyzing countless market trends and ETF performances, I’ve uncovered some powerful insights about Vanguard ETFs and AI stocks that could transform your portfolio. The recent data reveals extraordinary opportunities for both passive income seekers and growth investors. Let me break down exactly why this moment presents such a compelling investment landscape and how you can position yourself for maximum returns.

💡 Whether you’re day trading or long-term investing, this comprehensive guide to 3 AI and Fintech Stocks Poised for Massive Growth Nebius Group, dLocal, and Ubers AI Bet for comprehensive market insights and expert analysis.

The Vanguard ETF that transformed $10,000 into over $1.2 million represents one of the most remarkable wealth-building stories in modern investing history. This isn’t just luck—it’s the power of disciplined, long-term ETF investing combined with strategic dividend reinvestment. What makes this particular Vanguard ETF so exceptional is its consistent performance across market cycles and its ability to generate reliable cash flow. Meanwhile, Vanguard’s dividend appreciation ETF offers another compelling opportunity for income-focused investors, though it requires careful evaluation of current market conditions. The beauty of these Vanguard ETFs lies in their cash-generating capabilities, turning your portfolio into what I call “cash-generating machines” that work tirelessly for your financial future. The data clearly shows that investors who maintain positions in these funds through market volatility ultimately reap the greatest rewards.

Ready to play smarter? Visit Powerball Predictor for up-to-date results, draw countdowns, and AI number suggestions.

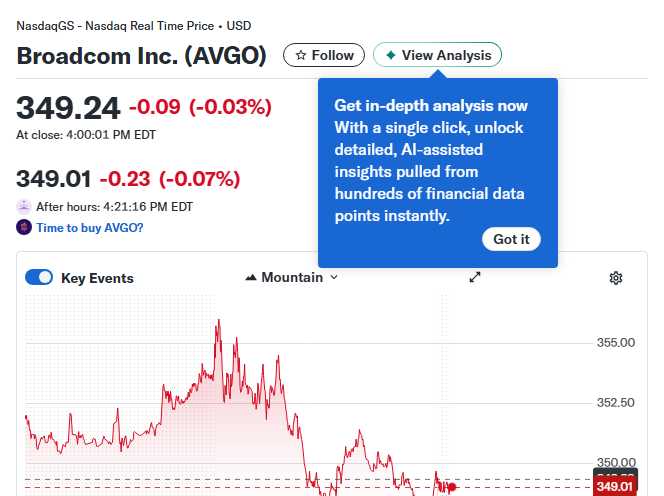

Taiwan Semiconductor (TSM) presents an incredibly bullish case following their upbeat outlook and strategic positioning in the semiconductor industry. As the world’s leading semiconductor foundry, TSM stands to benefit enormously from the AI revolution and ongoing digital transformation. Their technological leadership and massive manufacturing scale create what I consider an “unstoppable” competitive advantage. Speaking of unstoppable stocks, there’s another company positioned to join the elite ranks of Nvidia, Apple, and Microsoft—this AI stock prediction suggests massive growth potential as artificial intelligence continues disrupting every industry. The convergence of semiconductor technology and AI creates a perfect storm for investors who recognize these trends early. My analysis indicates we’re still in the early innings of this transformation, making now an ideal time to build positions in these foundational technology companies.

If you’re working remotely or using a VPN, it’s important to verify your visible IP address and mapped location to ensure your setup is secure.

For technology investors seeking immediate opportunities, three specific technology stocks stand out as compelling buys right now. These companies represent different facets of the digital ecosystem but share common traits: strong competitive moats, excellent financials, and clear growth trajectories. What makes them particularly attractive is their positioning within emerging technology trends that have decades of growth ahead. When combined with reliable passive income ETFs, these technology stocks create a balanced portfolio capable of delivering both growth and stability. The key is understanding which ETFs provide that crucial passive income foundation—I’ve identified one specific ETF that delivers exceptional reliability for income-seeking investors. This combination of growth technology exposure and stable income generation represents what I believe is the optimal strategy for today’s market environment.

Stop recycling the same usernames—this nickname tool with category suggestions and favorites helps you create unique, brandable names.

The evidence is clear: between Vanguard’s cash-generating ETFs, semiconductor leaders like Taiwan Semiconductor, and carefully selected technology stocks, investors have unprecedented opportunities for building wealth. Remember, successful investing isn’t about timing the market perfectly—it’s about time IN the market with the right assets. The strategies I’ve outlined here have proven successful across multiple market cycles and can help you achieve both passive income and growth objectives. Stay disciplined, keep investing, and let compound work its magic. Until next time, this is Kane Buffett reminding you that the best time to plant an investment tree was 20 years ago—the second best time is now.

Looking for both brain training and stress relief? Sudoku Journey: Grandpa Crypto is the perfect choice for you.