3 AI and Fintech Stocks Poised for Massive Growth Nebius Group, dLocal, and Ubers AI Bet

Hey fellow investors! Kane Buffett here with another deep dive into some exciting opportunities in the tech space. As we navigate the ever-evolving landscape of artificial intelligence and financial technology, I’ve identified three stocks that are capturing significant attention and showing tremendous potential. Having analyzed Nebius Group’s cloud infrastructure play, dLocal’s explosive growth in emerging markets, and Uber’s strategic AI investments, I’m excited to share why these companies represent compelling opportunities for growth-oriented investors looking to capitalize on the next wave of technological transformation.

📋 For anyone interested in making informed investment decisions, this thorough examination of The Future is Now Space Data Centers, AI Dividends, and Market Giants - Your Ultimate Investment Guide for comprehensive market insights and expert analysis.

Nebius Group: The Cloud Infrastructure Powerhouse

Nebius Group is emerging as a formidable player in the cloud computing infrastructure space, positioned to potentially become a millionaire-maker stock for early investors. The company provides comprehensive cloud services that compete directly with industry giants, offering infrastructure-as-a-service solutions that are crucial for businesses undergoing digital transformation. What makes Nebius particularly intriguing is its strategic focus on serving the growing demand for AI and machine learning workloads, which require substantial computational resources and specialized infrastructure.

The cloud computing market continues to expand at an accelerated pace, with businesses across all sectors migrating their operations to cloud environments. Nebius Group’s timing appears impeccable as the global shift toward digital acceleration creates unprecedented demand for reliable, scalable cloud solutions. Their infrastructure supports everything from basic data storage to complex AI model training, positioning them at the intersection of multiple high-growth technology trends.

What sets Nebius apart from larger competitors is their potential for capturing market share in underserved regions and specialized verticals. While AWS, Azure, and Google Cloud dominate the broader market, there remains significant opportunity for niche players who can offer competitive pricing, superior customer service, or specialized capabilities. Nebius’s growth trajectory suggests they’re successfully executing this strategy, though investors should carefully monitor their ability to compete against well-capitalized incumbents.

Financial metrics and market positioning indicate that Nebius could deliver substantial returns if they continue executing their growth strategy effectively. The company’s focus on AI-ready infrastructure is particularly promising given the explosive growth in artificial intelligence applications across industries. As more companies integrate AI into their operations, the demand for specialized cloud infrastructure will only increase, creating a substantial tailwind for companies like Nebius Group.

Looking for the perfect username for your next game or social profile? Try this random nickname generator with category filters to get inspired.

dLocal Stock: Explosive Growth in Emerging Markets

dLocal has been experiencing remarkable momentum, with the stock soaring significantly in recent trading sessions. The company operates as a payments platform specializing in cross-border transactions in emerging markets, addressing one of the most significant challenges in global e-commerce. Their technology enables global merchants to accept payments in local currencies across Latin America, Africa, Asia, and the Middle East, while also facilitating payouts to partners and customers in these regions.

The recent surge in dLocal’s stock price reflects growing investor confidence in their business model and execution capabilities. Emerging markets represent the next frontier for digital commerce growth, with millions of new consumers coming online each year and adopting digital payment methods. dLocal’s platform solves critical pain points for international businesses seeking to expand into these markets, including currency conversion, local payment method integration, regulatory compliance, and fraud prevention.

Financial results have been impressive, with dLocal consistently reporting strong revenue growth and expanding margins. Their unique position as a specialized payments provider in high-growth regions has allowed them to capture significant market share while maintaining competitive advantages. The company’s technology platform handles complex regulatory requirements across multiple jurisdictions, creating barriers to entry that protect their market position.

Looking forward, dLocal’s opportunity remains substantial as digital payment adoption in emerging markets continues to accelerate. The company’s expansion into new geographic markets and additional payment verticals provides multiple avenues for continued growth. However, investors should remain mindful of the inherent risks in emerging markets, including currency volatility, political instability, and regulatory changes that could impact operations.

Ready to play smarter? Visit Powerball Predictor for up-to-date results, draw countdowns, and AI number suggestions.

AI and Robotics: The Next Frontier and Uber’s Strategic Bet

The artificial intelligence and robotics sector continues to generate exceptional investment opportunities, with one particular stock identified as having 40% upside potential based on current analysis. This company operates at the intersection of AI software and robotics hardware, developing solutions that are transforming industrial automation, logistics, and service industries. Their technology platform combines advanced machine learning algorithms with physical robotics systems, creating intelligent automation solutions that learn and adapt to complex environments.

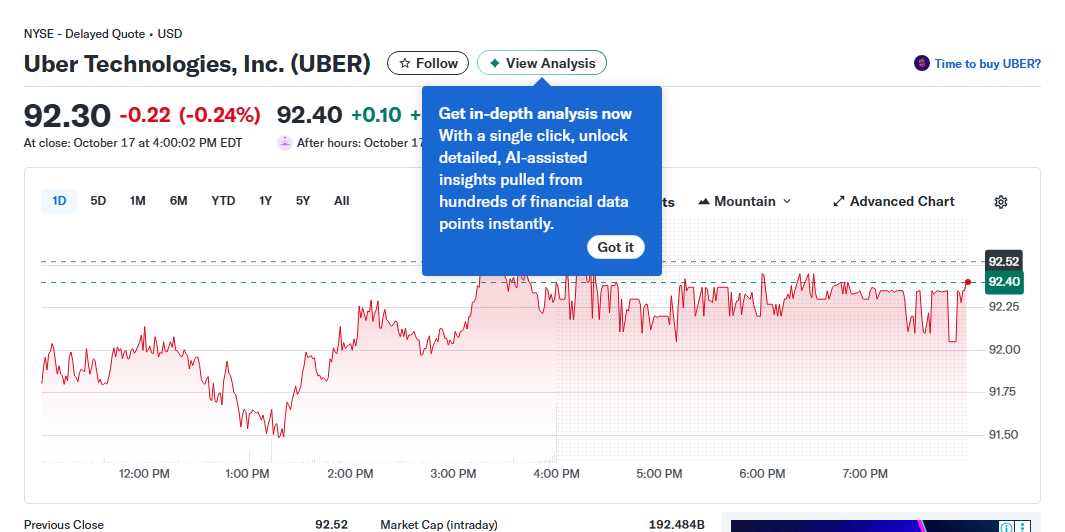

Meanwhile, Uber’s strategic investment in another AI stock that has soared 67% over the past year highlights the growing convergence between ride-sharing platforms and artificial intelligence technologies. Uber’s bet reflects their recognition that AI capabilities will be crucial for optimizing their core operations, including route optimization, pricing algorithms, autonomous vehicle development, and customer experience personalization. The specific AI company Uber is backing has developed proprietary technology that complements Uber’s existing platform while opening new revenue opportunities.

The AI robotics stock with 40% potential appears fundamentally undervalued relative to its growth prospects and technological advantages. Analysis suggests the market hasn’t fully priced in their recent technological breakthroughs and expanding customer pipeline. The company’s solutions are gaining traction across multiple industries, including manufacturing, healthcare, and retail, where automation can drive significant cost savings and operational improvements.

Both investments highlight the broadening application of AI technologies beyond traditional software into physical world applications. As companies increasingly seek to automate complex tasks and make data-driven decisions in real-time, the demand for integrated AI-robotics solutions is expected to grow exponentially. This trend creates a substantial opportunity for companies that can deliver practical, scalable solutions that demonstrate clear return on investment for enterprise customers.

If you want to improve focus and logical thinking, install Sudoku Journey with classic, daily, and story modes and challenge yourself.

As we wrap up this analysis, it’s clear that the convergence of cloud infrastructure, emerging markets payments, and AI robotics represents one of the most exciting investment themes for the coming years. Nebius Group’s cloud platform, dLocal’s payment solutions, and the advancing AI robotics sector all offer compelling growth stories for investors willing to embrace technological transformation. However, remember that with high potential returns come elevated risks—always conduct your own thorough research, consider your risk tolerance, and maintain a diversified portfolio. The technological revolution is accelerating, and these companies are positioned to ride that wave. Stay invested, stay informed, and as always, happy investing! - Kane Buffett

Want to develop problem-solving and logical reasoning? Install Sudoku Journey with multiple difficulty levels and test your skills.