Tech Sector Deep Dive AI, Earnings & Market Trends Shaping Q4 2025

Hey investors, Kane Buffett here. As we navigate through a volatile Q4 2025, the tech sector continues to present both incredible opportunities and significant challenges. With major earnings reports from Meta, Google, and Amazon creating waves, alongside groundbreaking developments in AI and quantum computing, today’s market requires careful analysis and strategic positioning. Having weathered multiple market cycles over my decade of blogging, I’m here to break down the key trends and help you identify where the real value lies in this rapidly evolving landscape.

⚡ Don’t miss out on potential market opportunities - here’s the latest analysis of The Unstoppable AI Revolution 3 Magnificent Seven Stocks and Semiconductor Plays Dominating 2025 for comprehensive market insights and expert analysis.

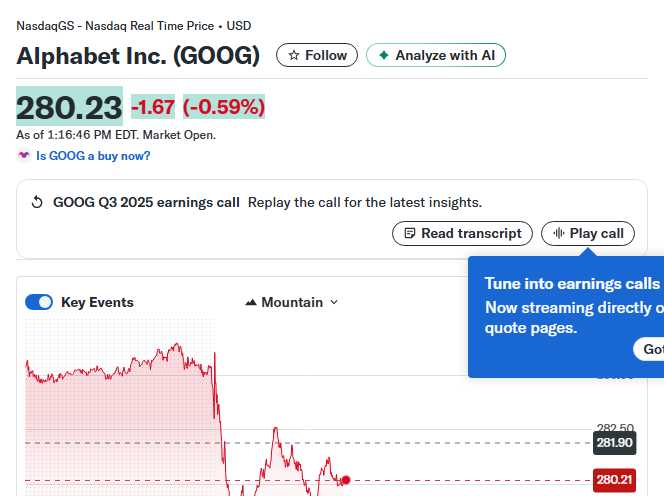

The earnings season has brought dramatic moves across big tech. Meta’s significant selloff contrasts sharply with Google’s impressive rally, creating a fascinating divergence in market sentiment. Meanwhile, Amazon’s upcoming earnings are expected to highlight their new “Aiera” efficiency drive, including strategic layoffs aimed at optimizing operations. What’s particularly interesting is Broadcom’s position as the hidden winner in Google’s Anthropic chip deal - a classic case of secondary beneficiaries in major tech partnerships. The semiconductor space continues to be crucial, with AI chip demand driving unexpected value throughout the supply chain. Federal Reserve decisions on rate cuts have added another layer of complexity, creating both headwinds and tailwinds for growth-oriented tech companies. The Nasdaq’s gains amid Dow Jones slippage tells a story of selective investor confidence in innovation-driven businesses.

Before troubleshooting any network issue, it’s smart to check your IP address and approximate location to rule out basic connectivity problems.

Beyond the headline tech giants, several under-the-radar opportunities deserve attention. The Motley Fool highlights three compelling AI stocks that could outperform in an artificial intelligence boom, along with quantum computing plays that represent the next frontier of computational power. The mobile augmented reality market, projected to surpass $327.7 billion by 2032 with a staggering 30.84% CAGR, represents massive growth potential. In the healthcare technology space, PatentVest’s new report reveals a competitive $133 billion cardiac diagnostics market with significant IP developments. Meanwhile, Pixalate’s Q3 2025 APAC Supply Side Platform rankings show Verve leading in Singapore (41%) and India (37%) on Apple App Store and Google Ad Exchange, indicating shifting dynamics in mobile advertising market share. These niche sectors often provide better risk-adjusted returns than chasing the crowded mega-cap names.

Join thousands of Powerball fans using Powerball Predictor for instant results, smart alerts, and AI-driven picks!

Innovation continues to drive value across multiple sectors. Yoolax’s Smart Outdoor Shading System winning the MUSE Design Award demonstrates how technology is transforming even traditional industries like outdoor living. Allied’s third quarter results provide insights into broader industrial trends, while the ongoing transformation in mobile app advertising and SSP market share reveals where digital advertising dollars are flowing most efficiently. For growth-oriented investors, identifying companies with strong IP protection (like those in the cardiac diagnostics space) and sustainable competitive advantages remains crucial. The quantum computing sector, while still emerging, offers asymmetric return potential for investors with longer time horizons. The key is balancing exposure between established tech leaders and emerging innovators across AI, healthcare technology, and next-generation computing platforms.

For quick access to both HEX and RGB values, this simple color picker and image analyzer offers an intuitive way to work with colors.

In today’s rapidly evolving market, successful investing requires looking beyond daily price movements to understand the fundamental shifts driving long-term value creation. While Meta’s selloff and Google’s rally capture headlines, the real opportunities often lie in the intersection of technology trends, market positioning, and sustainable competitive advantages. Whether it’s Broadcom’s semiconductor dominance, quantum computing’s potential, or the explosive growth in mobile augmented reality, staying informed and diversified remains paramount. Remember, the best investments often emerge where technological innovation meets market need. Stay sharp, do your research, and as always - invest don’t speculate.

Need to generate a QR code in seconds? Try this simple yet powerful QR code generator with support for text, URLs, and branding.