The Unstoppable AI Revolution 3 Magnificent Seven Stocks and Semiconductor Plays Dominating 2025

Welcome back, fellow investors! Kane Buffett here with another deep dive into the most exciting opportunities in today’s market. If you’re not paying attention to the artificial intelligence revolution, you’re missing what could be the biggest wealth creation event of our lifetimes. The data pouring in from multiple sources confirms we’re still in the early innings of this massive transformation. Today, I’m breaking down why certain Magnificent Seven stocks and semiconductor plays continue to defy expectations and deliver extraordinary returns.

🔍 Curious about which stocks are making waves this week? Get the inside scoop on The Ultimate Guide to AI Stocks and Market Opportunities NVIDIA, Quantum Computing, and Beyond for comprehensive market insights and expert analysis.

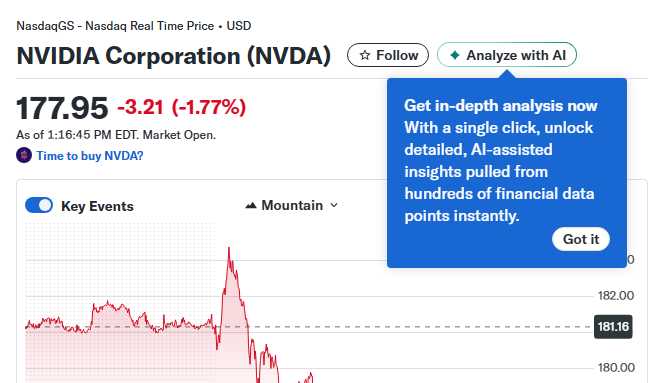

The semiconductor sector remains the beating heart of the AI revolution, and recent developments suggest the momentum is accelerating. NVIDIA continues to dominate the AI hardware space with its recent announcement of the first US-made Blackwell wafer in partnership with Taiwan Semiconductor. This technological breakthrough represents a significant milestone in American chip manufacturing capability. However, analyst Ming-Chi Kuo raises important concerns about overlooked supply chain challenges that could impact production scalability. Meanwhile, Taiwan Semiconductor’s upbeat outlook for 2025, driven by robust AI demand and pricing power, suggests the semiconductor supercycle has plenty of room to run. The company’s strategic position as the world’s leading foundry makes it indispensable to virtually every major tech player. Intel Foundry is emerging as a potential dark horse in this race, with predictions suggesting it could become a massive AI winner as companies seek geographic diversification in their chip supply chains. The geopolitical landscape, including recent APEC summit discussions featuring NVIDIA CEO Jensen Huang meeting with global leaders and Korean chip executives, underscores the strategic importance of semiconductor independence.

🤖 Looking for expert insights on market trends and investment opportunities? Check out this analysis of AMD vs Nvidia The Ultimate AI Stock Showdown After OpenAI Deal for comprehensive market insights and expert analysis.

Beyond the obvious semiconductor plays, several growth stocks offer compelling risk-reward profiles for long-term investors. ASML represents a critical pick-and-shovel play in the semiconductor ecosystem, with its monopoly on extreme ultraviolet lithography equipment essential for manufacturing advanced chips. The company’s technological moat is virtually unbreachable. Broadcom and AMD continue to execute brilliantly, with Broadcom’s diversified semiconductor portfolio and AMD’s growing AI accelerator presence making both companies essential holdings. What many investors miss is the quantum computing angle - while IonQ represents a pure-play quantum opportunity, the risk-reward profile favors established players like NVIDIA for most investors. The massive AI spending we’re witnessing isn’t just hype - it’s driving real productivity gains and creating sustainable competitive advantages for early adopters. Companies that successfully leverage AI are seeing dramatic improvements in operational efficiency and customer engagement, translating directly to bottom-line results.

Worried about memory loss? Enhance your cognitive skills with Sudoku Journey’s AI hint system and keep your mind active.

For investors seeking diversified exposure, the Vanguard Growth ETF has demonstrated remarkable performance, turning $10,000 investments into substantial sums over recent years. This ETF provides exposure to the leading AI players while mitigating single-stock risk. Meanwhile, Apple’s record highs signal a broader tech reawakening in this liquidity-driven market. The company’s ecosystem approach and services revenue growth provide stability alongside innovation potential. For those worried about missing the NVIDIA boat, the number one strategy remains dollar-cost averaging into quality AI names during periods of volatility. History shows that trying to time perfection entry points often leads to missed opportunities in transformative technological shifts. The current market offers multiple entry points across the AI value chain, from hardware manufacturers to software enablers and infrastructure providers.

Website administrators often need to check their server’s public IP and geolocation for testing or analytics purposes.

The AI revolution continues to create unprecedented investment opportunities for those with the patience and perspective to think long-term. While volatility is inevitable in this rapidly evolving space, the fundamental drivers remain intact. Focus on companies with sustainable competitive advantages, strong management teams, and exposure to multiple AI growth vectors. Remember: successful investing isn’t about timing the market perfectly but about time IN the market with quality companies. Stay disciplined, keep learning, and may your investments prosper!

🔎 Looking for a hidden gem or trending restaurant? Check out Little Original Joes to see what makes this place worth a visit.