The Ultimate Guide to AI Stocks and Market Opportunities NVIDIA, Quantum Computing, and Beyond

Hey folks, Kane Buffett here. Over my decade of blogging about stocks, I’ve seen trends come and go, but the current AI revolution is something else. With the S&P 500 and Nasdaq rallying, adding billions to top tech giants, and AI stocks like NVIDIA soaring, it’s a wild time for investors. I’ve dug into over 20 recent news pieces to break down what’s really happening—from AI darlings and quantum computing to biotech gems like Recursion Pharmaceuticals. Whether you’re a seasoned investor or just starting, this guide will help you navigate the opportunities and risks. Let’s dive in.

🔍 Curious about which stocks are making waves this week? Get the inside scoop on Amazons Stock Split Potential and Dividend Kings A Winning Investment Strategy for comprehensive market insights and expert analysis.

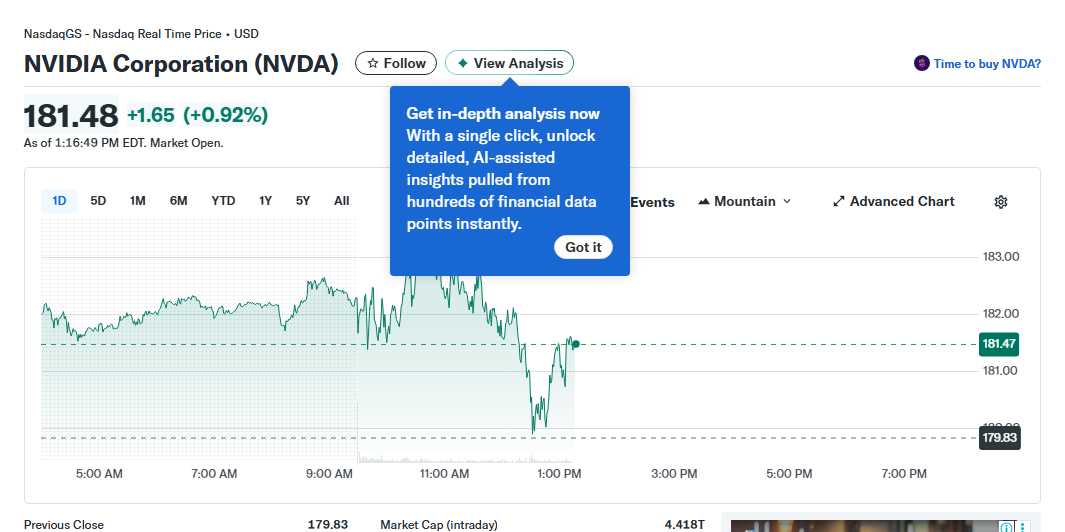

The AI and semiconductor sector is red-hot, with NVIDIA leading the charge. Despite a 43% surge in 2025, analysts see more upside, citing its dominance in AI chips and partnerships with giants like Uber, which has backed AI stocks that soared 67% in the past year. However, NVIDIA is facing selling pressure as some investors take profits, highlighting volatility. Meanwhile, AMD is emerging as a strong contender, especially after its OpenAI deal, with potential to rival NVIDIA in AI hardware. Micron Technology is also near highs, driven by structural profitability and analyst upgrades, making it a top pick. But it’s not just about hardware; AI software and robotics are key. Stocks like those in AI and robotics could soar 40%, according to some forecasts, as automation and AI integration accelerate. For broad exposure, the Vanguard 500 ETF remains a solid choice, tracking the S&P 500 and offering stability amid tech volatility. Yet, with geopolitical tensions rising, there’s a prediction that this could create the next big investment theme, possibly in quantum computing or defense tech. Quantum computing stocks, such as Rigetti Computing, are speculative but could be millionaire-makers if they breakthrough in the next three years, though they carry high risk. On the value side, Warren Buffett’s favorite valuation gauge—market cap to GDP—just flashed warning signs, suggesting the market might be overvalued. This makes “boring” stocks or dividend magnets appealing for downside protection. For instance, some backdoor AI dividend stocks are set for 119% returns, blending growth with income. Overall, the Magnificent Seven tech giants are gaining, but other stocks might crush them, like those in biotech or quantum computing. Recursion Pharmaceuticals, for example, uses AI for drug discovery and could be a millionaire-maker if its pipeline succeeds, though it’s high-risk. Similarly, AI stocks in genomics and automation are poised for growth. But be cautious: not all AI plays will win. Some, like Argent Capital Management dumping $60 million of Copart shares, show that even hot sectors have skeptics. In summary, AI and tech are driving the market, but diversification is key. Consider mixing high-growth AI stocks with stable ETFs and value picks to balance risk and reward.

Join thousands of Powerball fans using Powerball Predictor for instant results, smart alerts, and AI-driven picks!

Diving deeper into specific stocks, NVIDIA is a standout but not the only player. Its stock is up significantly, yet another super investment might be in quantum computing or AI-adjacent fields. For example, Rigetti Computing, while risky, could transform computing in three years if it achieves quantum advantage. Meanwhile, AMD’s partnership with OpenAI makes it a compelling buy, potentially offering better value than NVIDIA after its run-up. In biotech, Recursion Pharmaceuticals leverages AI to accelerate drug development, targeting diseases with high unmet needs. Its stock could multiply if clinical trials succeed, but it’s volatile—ideal for risk-tolerant investors. On the ETF front, the Vanguard 500 ETF is a cornerstone for many portfolios, providing exposure to the broad market, including AI leaders. It’s a “should you still invest?” yes for long-term holders, as it reduces single-stock risk. Another angle is “boring” stocks that offer steady growth, like some dividend payers in tech or industrials, which can outperform in uncertain times. For instance, a stock set to join NVIDIA and Apple in the trillion-dollar club might be a hidden gem in cloud computing or semiconductors. Geopolitical tensions, as noted, could spur investments in cybersecurity or energy, creating new opportunities. Also, don’t ignore profit-taking: NVIDIA’s recent pressure shows that even winners need monitoring. In quantum computing, three stocks could make you rich, but they’re speculative—spread bets to manage risk. Lastly, growth stocks like those in AI and robotics are where $1,000 could multiply, but always assess valuation. Warren Buffett’s gauge reminding us of market froth means balancing excitement with caution. Overall, the key is to focus on companies with strong fundamentals, not just hype.

Want to boost your memory and focus? Sudoku Journey offers various modes to keep your mind engaged.

Let’s talk strategy and broader trends. The market rally has added $60 billion to the top 10 billionaires’ wealth, driven by tech and AI. This underscores the concentration risk in mega-caps, making ETFs like Vanguard 500 a smart hedge. For AI, consider both hardware and software plays. NVIDIA and AMD are leaders, but also look at AI stocks in data analytics or autonomous vehicles. Quantum computing is the frontier—stocks like Rigetti are long shots but could pay off huge. In biotech, Recursion represents AI’s convergence with healthcare, a trend with massive potential. However, sensitivity is high here: clinical failures can crash stocks. On the value side, Warren Buffett’s approach—focusing on undervalued, durable businesses—is timeless. His valuation gauge hitting highs suggests looking for “boring” stocks with moats. For example, some dividend magnets in AI infrastructure could offer 119% returns with less volatility. Also, keep an eye on insider moves: when firms like Argent Capital dump shares, it might signal overvaluation. In terms of sectors, AI and robotics are set for 40% gains, but diversify into ETFs to capture broader growth. Geopolitical risks could boost defense or energy stocks, adding another layer to your portfolio. Finally, remember that timing matters—buying before November, as some suggest, could capitalize on year-end rallies. In conclusion, blend high-growth AI bets with stable assets, stay informed on trends, and always manage risk. The market’s hot, but discipline wins long-term.

🥂 Whether it’s date night or brunch with friends, don’t miss this review of Zazas Pizzeria to see what makes this place worth a visit.

So there you have it, friends—the AI and investing landscape through my lens. From NVIDIA’s dominance to quantum computing’s promise, and even Warren Buffett’s wisdom, there’s a lot to digest. Remember, investing isn’t about chasing every hot stock; it’s about building a resilient portfolio that can weather storms. I’ve shared insights from countless analyses, but always do your own research. Thanks for reading, and keep investing smartly. Until next time, this is Kane Buffett signing off. Stay bullish, but stay cautious!

🥂 Whether it’s date night or brunch with friends, don’t miss this review of La Crosta Woodfire Pizzeria Italiana to see what makes this place worth a visit.