Kraft Heinz at a Crossroads Bearish Signals, Impending Split, and Investment Outlook

Hey folks, Kane Buffett here. As we navigate the volatile markets of late 2025, one stock that’s been generating significant discussion in my investment circles is The Kraft Heinz Company (KHC). Today, we’re diving deep into the mixed signals surrounding this consumer staples giant. From bearish analyst reports and institutional selling to the company’s planned split and continued brand investments, we’ve got a complex picture to unpack. Having followed consumer staples for over a decade, I’ve seen similar crossroads before – let’s examine whether KHC represents a value opportunity or a value trap.

💡 Want to understand the factors influencing stock performance? This analysis of Why Northrop Grumman (NOC) Represents a Compelling Buy Opportunity in the Expanding Space Economy for comprehensive market insights and expert analysis.

The Bear Case: Why Analysts Remain Pessimistic

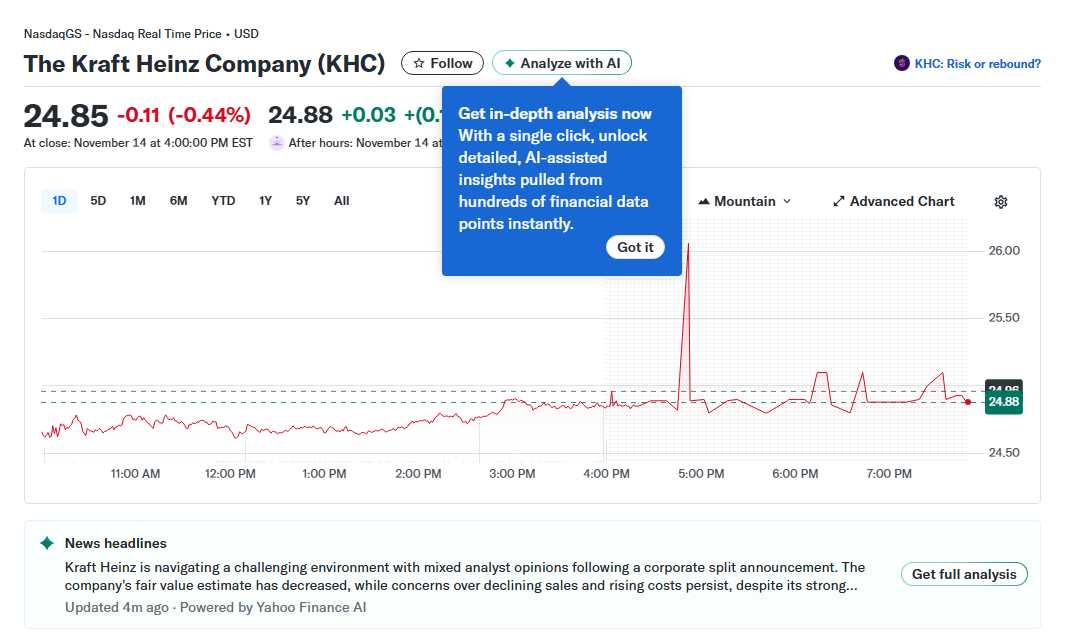

The bearish sentiment around Kraft Heinz isn’t without foundation. Multiple sources point to concerning fundamentals that have investors questioning the company’s near-term prospects. According to recent analysis, bears highlight several persistent challenges: declining market share in key product categories, ongoing margin pressure from input cost inflation, and what some describe as an innovation deficit compared to newer, more agile competitors in the food space. The technical picture adds to concerns, with KHC recently experiencing what technical analysts describe as a “trendline breakdown” – breaking below key support levels that had previously held during 2024. This pattern often signals further downside potential and reflects deteriorating market sentiment. The stock’s performance relative to both the broader market and the consumer staples sector has been disappointing, with KHC underperforming significantly year-to-date. Adding fuel to the bearish fire, recent SEC filings reveal that Luther Capital Management Corp significantly reduced its stake in Kraft Heinz during the third quarter of 2025. When institutional investors of this caliber trim positions, it’s worth noting – they typically have access to deeper research and may see headwinds that retail investors might miss. This selling pressure contributes to the negative technical setup and suggests professional money managers are growing cautious about KHC’s prospects.

Need to generate a QR code in seconds? Try this simple yet powerful QR code generator with support for text, URLs, and branding.

The Impending Split: Strategic Move or Distraction?

The most significant development on Kraft Heinz’s horizon is undoubtedly the planned company split, which has generated mixed reactions across the investment community. The separation, expected to create two distinct publicly-traded entities, aims to unlock value by allowing each business to pursue more focused strategies. However, analysts are divided on whether this corporate action represents a genuine value-creation opportunity or merely a distraction from underlying business challenges. Proponents argue that the split could enable each entity to better address its specific market dynamics – potentially separating faster-growing international or emerging brands from the more stable but slower-growing North American staple businesses. This could allow for more tailored capital allocation strategies and potentially make each company more attractive to different investor bases seeking either growth or income. However, skeptics question the timing and strategic rationale. Some analysts suggest investors “wait for the split before taking action,” noting that the transaction creates near-term uncertainty and execution risk. Corporate splits often involve significant one-time costs, management distraction, and complex operational separations that can temporarily impact financial performance. The concern is whether Kraft Heinz’s management team can navigate this complex transition while simultaneously addressing the fundamental business challenges that have plagued the company in recent years.

For timing tasks, breaks, or productivity sprints, a browser-based stopwatch tool can be surprisingly effective.

Silver Linings: Brand Investment and Potential Opportunities

Despite the overwhelming bearish sentiment, there are glimmers of potential optimism for long-term investors. Morningstar’s analysis highlights Kraft Heinz’s “steadfast commitment to brand investments,” noting that the company continues to allocate meaningful resources to marketing and product innovation even as the split looms. This suggests management recognizes the need to reinvigorate its iconic brand portfolio rather than simply milking them for cash flow. The company’s dividend yield, while potentially at risk according to some bears, remains attractive relative to many other consumer staples stocks. For income-focused investors, this yield could provide some downside protection if the business stabilization and split execution proceed better than expected. The company’s scale and distribution capabilities, while sometimes framed as liabilities in an era of niche brands, could become advantages if management successfully leverages them to support innovation. From a valuation perspective, some contrarian investors might see the current pessimism as creating a potential entry point. If the split unlocks hidden value or if management’s brand investment initiatives begin to bear fruit, the current depressed valuation multiples could expand significantly. However, this remains a speculative thesis that requires careful monitoring of quarterly execution and consumer response to the company’s innovation efforts.

Get the edge in Powerball! Visit Powerball Predictor for live results, AI predictions, and personalized alerts.

So where does this leave us with Kraft Heinz? The evidence suggests a company at a critical juncture, facing significant operational challenges while undertaking a major corporate transformation. The bearish signals – from technical breakdowns to institutional selling – cannot be ignored. However, the company’s continued brand investments and the potential value-unlocking from the split provide threads of optimism for patient investors. Personally, I’m maintaining a watchful waiting approach for now. The risk-reward profile doesn’t yet justify a significant position, but I’ll be monitoring execution closely, particularly post-split. Sometimes the best investment is the one you don’t make – and with KHC, patience may indeed be the wisest strategy. Remember, in markets like these, preserving capital is often more important than chasing uncertain returns.

Make every Powerball draw smarter—check results, get AI number picks, and set reminders with Powerball Predictor.