Why Northrop Grumman (NOC) Represents a Compelling Buy Opportunity in the Expanding Space Economy

Hey fellow investors! Kane Buffett here with another deep dive into a stock that’s been catching my attention lately. As we watch the space economy rapidly expand with projects like the Starlab International Space Station moving forward, one defense contractor stands out as a prime beneficiary: Northrop Grumman Corporation (NOC). After analyzing recent developments and the stock’s recent pullback, I’m seeing a setup that reminds me of some of the best opportunities I’ve witnessed in my decade of blogging about stocks. Let’s break down why NOC might be positioned for significant upside.

💡 Whether you’re day trading or long-term investing, this comprehensive guide to AI Revolution Fuels Market Rally Why S&P 500, TSMC and Nvidia Are Leading the Charge for comprehensive market insights and expert analysis.

The space infrastructure boom is real, and Northrop Grumman is squarely positioned to capitalize. The recent development that Starlab International Space Station just added Northrop Grumman as a key partner is monumental. This isn’t just another contract; it’s a strategic entry into the next frontier of human infrastructure. Northrop brings decades of expertise in space systems, satellites, and mission-critical technology that private space ventures desperately need. When you look at the broader picture, governments and private companies are pouring billions into space infrastructure, and Northrop’s established track record with NASA and the Department of Defense makes them a natural choice for these ambitious projects. Their work on the James Webb Space Telescope and various satellite constellations demonstrates technical capabilities that few can match. This partnership positions NOC not just as a defense stock, but as a dual-play defense AND space infrastructure company, significantly expanding their total addressable market.

Creating unique passwords for each account is easy with this online tool that generates strong passwords instantly.

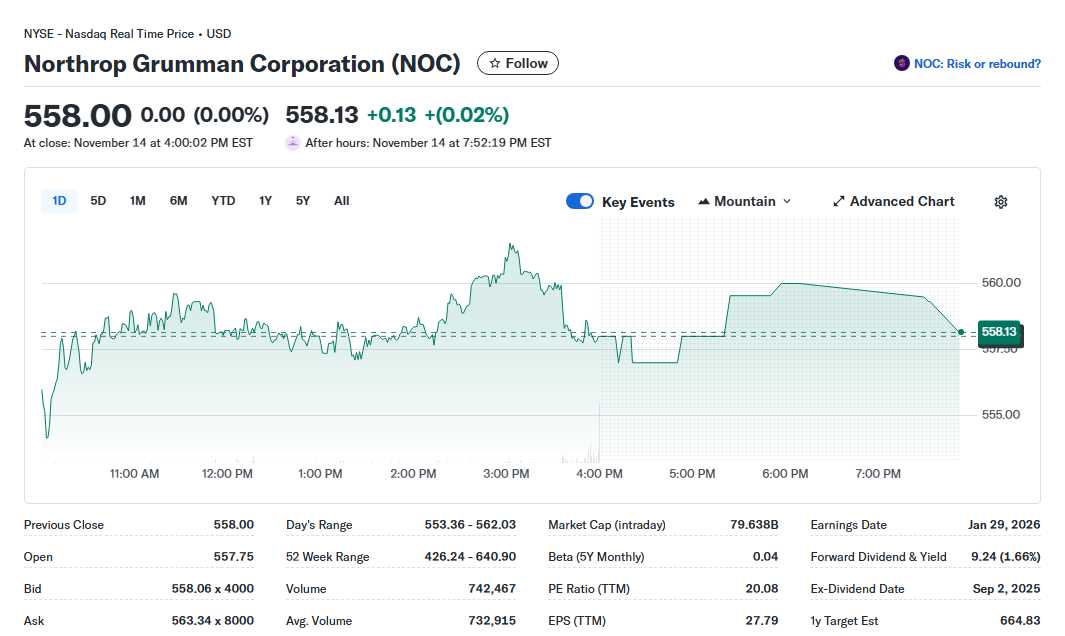

From a technical and fundamental perspective, Northrop Grumman stock appears to be in what I’d call the “analyst buy zone.” The stock has experienced a recent pullback from its highs, creating what many technical analysts would consider a better entry point for long-term investors. When you examine the valuation metrics after this price decline, the risk-reward ratio becomes increasingly attractive. Multiple analysts have pointed to Northrop’s strong fundamentals, including consistent revenue growth from classified programs and international sales. The company’s recent financial performance shows particular strength in their space systems and aeronautics segments. Furthermore, institutional investors have been accumulating shares, with recent SEC filings showing that PFG Advisors bought 1,229 additional shares of NOC. This kind of institutional buying, especially during periods of market uncertainty, often signals confidence in the company’s long-term prospects. The current valuation, when compared to historical multiples and sector peers, suggests the stock may be trading at a discount to its intrinsic value.

Stay ahead in Powerball with live results, smart notifications, and number stats. Visit Powerball Predictor now!

Looking at the competitive landscape and future growth catalysts, Northrop Grumman appears well-positioned to potentially beat Nasdaq index returns over the coming years. The defense sector typically offers stability during economic uncertainty, while the space segment provides growth optionality. Northrop’s diverse portfolio across space systems, mission systems, aeronautics, and defense systems creates multiple avenues for growth. Their work in hypersonics, missile defense, and space surveillance aligns perfectly with current national security priorities. The company’s strong free cash flow generation supports both continued research & development investment and shareholder returns through dividends and buybacks. When evaluating whether NOC can outperform the broader market, consider that defense contractors often demonstrate resilience during economic downturns due to the essential nature of their products and services. Combined with their positioning in the rapidly growing space economy, Northrop Grumman offers a unique combination of defense stability and space growth that could drive market-beating returns.

Never miss a Powerball draw again—track results, analyze stats, and get AI-powered recommendations at Powerball Predictor.

In my professional opinion, Northrop Grumman represents one of the more compelling opportunities in the aerospace and defense sector today. The combination of their strategic positioning in space infrastructure, attractive valuation after the recent pullback, strong institutional support, and diverse growth catalysts creates a bullish thesis that’s hard to ignore. As always, do your own due diligence and consider your investment timeframe and risk tolerance. But for investors seeking exposure to both defense stability and space growth, NOC deserves serious consideration. The stars might literally be aligning for this defense giant. Happy investing!

📱 Stay informed about the latest market movements and stock recommendations by exploring James Hardie Industries (JHX) Class Action Critical December 23 Deadline for Investors with Substantial Losses for comprehensive market insights and expert analysis.