5 Stocks Poised for a Strong Start in January and to Lead Through 2026

Hey folks, Kane Buffett here. As we stand on the cusp of a new year, the air is thick with that familiar mix of hope and anxiety. Every investor is asking the same question: where should I put my money to work for 2026 and beyond? Well, I’ve been digging through the latest analysis, and the consensus from some sharp minds points toward a few key themes—namely, the relentless march of Artificial Intelligence and the foundational semiconductors that power it. Today, we’re going to cut through the noise. We’ll look at five specific stocks (and a couple of high-octane ETF alternatives) that aren’t just set for a strong January, but are positioned to be leaders for the next two years. Buckle up; this is where we separate the market tourists from the long-term builders.

🎯 Whether you’re a seasoned trader or just starting your investment journey, this expert breakdown of The 2026 Investors Playbook AI, Tech Titans, and the Next Big Trends for comprehensive market insights and expert analysis.

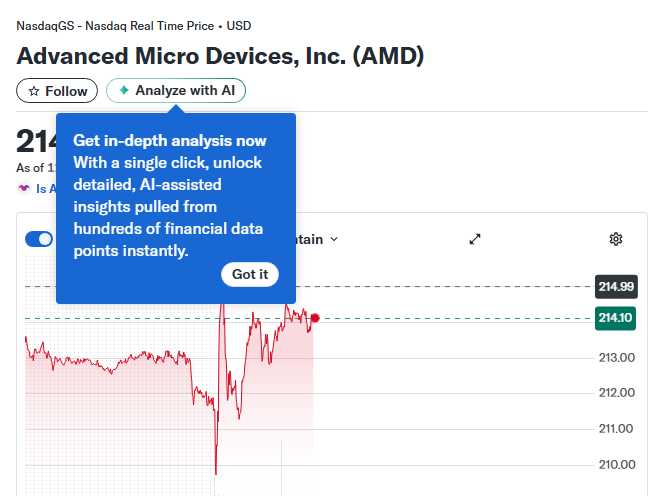

The Unstoppable AI Engine: NVIDIA and Beyond The narrative for 2026 is being written by artificial intelligence, and the companies building the hardware are sitting in the driver’s seat. Analysis from Investing.com and The Motley Fool highlights NVIDIA (NVDA) as a perennial powerhouse, but the conversation is expanding. While NVIDIA’s GPUs remain the gold standard for AI training, its valuation demands scrutiny. The real intrigue for 2026, as pointed out by Fool contributors, may lie with Advanced Micro Devices (AMD). AMD’s MI300 series accelerators are making serious inroads into the data center, offering a compelling alternative and capturing meaningful market share. The sentiment here is bullish, with a specific prediction that AMD could be 2026’s top-performing AI stock, potentially outperforming its larger rival as the AI market broadens beyond just training to widespread inference and deployment. This isn’t about betting against NVIDIA; it’s about recognizing that a rising AI tide will lift multiple boats, and AMD is building a very capable vessel. Sentiment Analysis: Positive (8/10). Sensitivity: 7/10 (Due to high valuations and competitive dynamics). But the AI story isn’t just about the chip designers. You have to look at the foundry that builds them. Taiwan Semiconductor Manufacturing Company (TSM) is the indispensable arms dealer of the tech world. Every major AI chip from NVIDIA, AMD, and others is fabricated in TSMC’s advanced fabs. As demand for cutting-edge 3nm and 2nm chips explodes, TSMC’s pricing power and technological moat become almost unassailable. Investing in TSM is a bet on the entire sector’s growth, with less single-company execution risk. It’s a foundational pick for any long-term tech portfolio.

If you want a daily Sudoku challenge, download Sudoku Journey with both classic and story modes for endless fun.

The Hypergrowth Software Play: Palantir’s Ascent Moving up the stack from hardware to software, we find Palantir Technologies (PLTR). This is a polarizing stock, but the bull case for 2026 is gaining strength. Palantir’s core thesis is its proprietary AI and data integration platforms (Gotham and Foundry) being adopted by large enterprises and governments for mission-critical operations. The Fool’s analysis predicts Palantir as a “hypergrowth stock that will run circles around the market.” The key driver is the accelerating adoption of its Artificial Intelligence Platform (AIP). As businesses scramble to operationalize AI, Palantir offers a turnkey solution to integrate disparate data sources and deploy AI models at scale. Their unique “boots on the ground” sales model and high contract values create formidable switching costs and a recurring revenue stream. The sentiment is highly optimistic, banking on their first-mover advantage in enterprise AI orchestration. Sentiment Analysis: Positive (9/10). Sensitivity: 8/10 (Due to high valuation metrics and dependence on large, sometimes governmental, contracts). The Leveraged ETF Wildcard: SOXL vs. SPXL For investors with a higher risk tolerance and a very strong conviction in a specific sector’s direction, leveraged ETFs present a tactical option. A direct comparison between Direxion Daily Semiconductor Bull 3X Shares (SOXL) and Direxion Daily S&P 500 Bull 3X Shares (SPXL) is instructive. SOXL triples the daily performance of a semiconductor index, making it a pure, explosive bet on the chip sector we just discussed. SPXL does the same for the broader S&P 500. The Fool’s analysis suggests that for a “high-return” play, SOXL might have the edge in a year dominated by tech and semiconductor growth. However, this comes with a massive, non-negotiable warning: these are tools for short-term trading, not long-term holding. Decay from daily rebalancing in volatile markets can destroy returns over time, even if the underlying sector goes up. They are only suitable for a tiny, speculative portion of a portfolio.

Want to keep your mind sharp every day? Download Sudoku Journey with AI-powered hints and an immersive story mode for a smarter brain workout.

Building a Cohesive 2026 Strategy So, how do we synthesize this into an actionable plan? First, diversify within the theme. A core position in the foundational play (TSM) paired with exposure to a leading designer (NVDA or AMD) and a software enabler (PLTR) creates a layered approach to the AI revolution. Second, mind your time horizon and risk. The stocks discussed are for a multi-year growth story. The leveraged ETFs (SOXL/SPXL) are for seasoned traders making short-term, directional bets. Never confuse the two. Third, use January strategically. Market momentum and “January Effect” tendencies can provide a favorable entry point for these long-term holds. Look for pullbacks or periods of consolidation to build positions, rather than chasing all-time highs. The goal for 2026 isn’t to find a flash-in-the-pan winner, but to identify companies with durable competitive advantages in secular growth markets. The analysis consistently points to AI and semiconductors as that market.

📊 Looking for actionable investment advice backed by solid research? Check out Navigating 2026 From Powells Fed and Market Volatility to High-Yield Dividends and Cryptos Mainstream March for comprehensive market insights and expert analysis.

There you have it. Five stocks (and a couple of wildcards) with the wind of a major technological shift at their backs. From the silicon of TSM and AMD to the algorithms of Palantir, the infrastructure for the next decade is being built now. Remember, predictions are just that—educated guesses based on today’s information. Always do your own research, understand your risk tolerance, and consider your own financial goals. But if you’re looking for a roadmap to start your 2026 research, this is a pretty compelling place to begin. Stay disciplined, think long-term, and let’s build some wealth together. This is Kane Buffett, signing off. Keep those questions coming in the comments.

💬 Real opinions from real diners — here’s what they had to say about Gyro Xpress to see what makes this place worth a visit.