Navigating 2026 From Powells Fed and Market Volatility to High-Yield Dividends and Cryptos Mainstream March

Hey folks, Kane Buffett here. As we stand on the precipice of 2026, the market is sending mixed signals—record highs juxtaposed with underlying tremors of uncertainty. The past year has been a masterclass in resilience, with the VIX showing fear but the S&P 500 holding strong. Now, all eyes are on Jerome Powell’s next move, the durability of the tech rally, and where savvy investors can find yield and growth. Let’s dive into the key themes I believe will define your portfolio’s performance in the coming year, synthesizing insights from earnings, central bank policy, sector-specific opportunities, and the evolving investment landscape.

💡 Stay ahead of market trends with this expert perspective on Market Records, Metals Mania, and Your 2026 Blueprint Top Stocks and ETFs to Buy Now for comprehensive market insights and expert analysis.

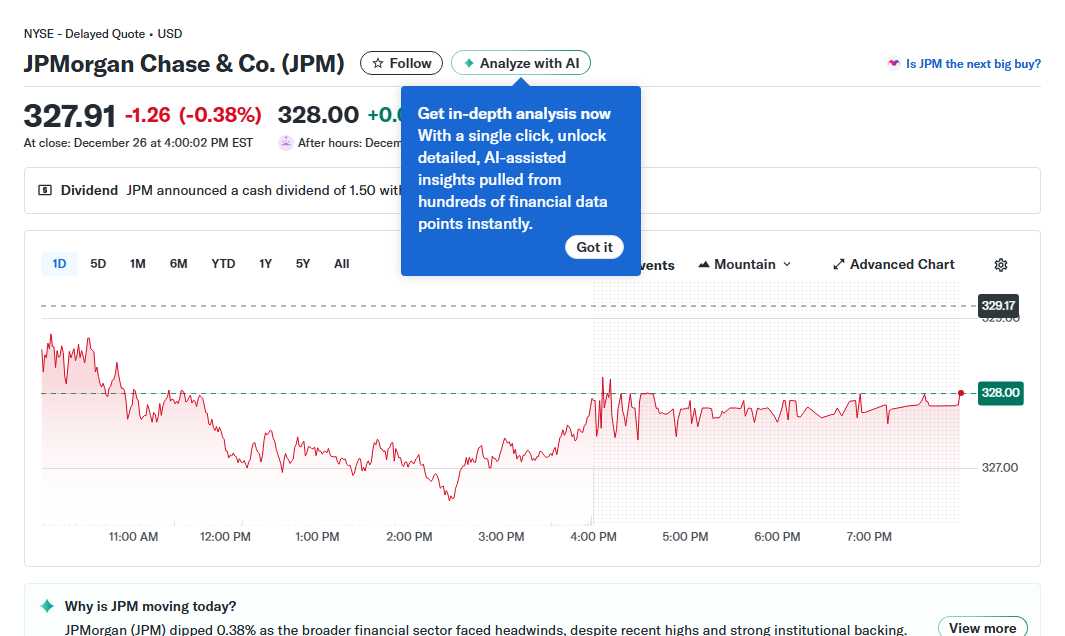

The Macro Backdrop: Powell’s Fed and the Market’s Balancing Act The dominant narrative for 2026 will undoubtedly be the Federal Reserve’s path. Recent strong GDP data has, paradoxically, cooled hopes for early interest rate cuts. The market is digesting a resilient economy that may allow the Fed to remain patient. As one analysis notes, the S&P 500 is holding near records despite this shift in expectations, suggesting investor confidence in a “soft landing” scenario. The key question for Jerome Powell in 2026 will be threading the needle between containing any reignition of inflation and not stifling economic growth. This creates a environment where stock-picking based on fundamental earnings strength becomes paramount. Companies with robust balance sheets and pricing power will be better positioned to navigate a “higher-for-longer” rate environment. Investors should closely monitor Fed commentary and economic data releases, as the market’s trajectory will be highly sensitive to any changes in this delicate balance. The overall sentiment here is cautiously optimistic, built on economic strength but tempered by policy uncertainty.

A lightweight stopwatch for timing simple tasks can help improve focus and productivity during your day.

Sector Deep Dives: Aerospace, Tech, and Real Estate Opportunities Within this macro framework, specific sectors present compelling stories. In aerospace, Boeing is a perennial topic. Analysis questions if it’s a top pick for 2026, highlighting its ongoing efforts to stabilize operations and rebuild trust. The investment thesis hinges on execution—delivering on its massive order backlog and resolving production issues. It’s a high-risk, high-potential-reward play on the cyclical recovery of air travel and defense spending. In tech, Google’s rollout of a Gmail address change feature, while a consumer product update, underscores the relentless innovation in mega-cap tech. More significantly, Coinbase’s debut in the S&P 500 in 2025 was a watershed moment, signaling cryptocurrency’s undeniable march into the financial mainstream. This institutional acceptance provides a new layer of legitimacy for the asset class in 2026. Elsewhere, niche markets like prime London real estate show vigor, as evidenced by firms like Tulip Real Estate crossing $100 million in business across real estate and hospitality assets. This points to sustained high-end demand in specific global markets, a play on wealth concentration and experiential spending.

🥂 Whether it’s date night or brunch with friends, don’t miss this review of YAZAWA to see what makes this place worth a visit.

The Income Investor’s Playbook: Chasing Yield in 2026 For investors seeking income, the hunt for yield remains challenging with elevated rates. This is where structures like Business Development Companies (BDCs) and Closed-End Funds (CEFs) enter the spotlight. Detailed analysis suggests these vehicles can be a way to “get 8% dividends in 2026.” BDCs, which lend to middle-market companies, and certain CEFs, often employing leverage to enhance distributions, can offer significantly higher yields than traditional dividend stocks. However, this comes with increased risk—credit risk in the case of BDCs and interest rate sensitivity for leveraged CEFs. The VIX, or “fear index,” which exhibited notable spikes in 2025, is a crucial gauge for such strategies. Periods of high volatility can create dislocations and opportunities in these income-focused markets. The strategy for 2026 involves careful selection, understanding the underlying assets, and ensuring portfolio diversification to mitigate the unique risks these high-yield instruments carry.

📋 For anyone interested in making informed investment decisions, this thorough examination of The AI & Cloud Infrastructure Boom 3 Stocks Poised for Explosive Growth and 1 Dividend King to Anchor Your Portfolio for comprehensive market insights and expert analysis.

So, what’s the 2026 playbook? It’s not about finding a single magic bullet. It’s about constructing a resilient, multi-faceted portfolio. Anchor yourself with quality companies that can thrive in a cautious Fed environment. Consider tactical allocations in turnaround stories like aerospace, the now-mainstream crypto ecosystem, and solid real assets. Use vehicles like BDCs and CEFs judiciously to boost income, but never forget the risk they entail. Most importantly, keep one eye on the VIX and the other on Powell. The market’s resilience will be tested, but for the prepared investor, 2026 is brimming with opportunity. Stay sharp, stay diversified, and let’s navigate it together. - Kane Buffett

Stay ahead in Powerball with live results, smart notifications, and number stats. Visit Powerball Predictor now!