The AI & Cloud Infrastructure Boom 3 Stocks Poised for Explosive Growth and 1 Dividend King to Anchor Your Portfolio

Hey folks, Kane Buffett here. For over a decade on this blog, we’ve navigated bull markets, bear markets, and everything in between by sticking to a simple principle: find durable competitive advantages and hold for the long haul. Right now, the tectonic plates of the market are shifting beneath a single, powerful force: artificial intelligence. But AI isn’t just about flashy chatbots; it’s about the massive, unsexy infrastructure required to make it all work—cloud computing, data processing, and specialized hardware. Today, we’re diving deep into the engine room of this revolution. We’ll analyze a cloud stock positioned for a potential explosion, scrutinize whether the recent pullback in AI giants like Nvidia presents a buying opportunity, and highlight a timeless Dividend King that offers stability amidst the tech frenzy. Buckle up; we’re going beyond the headlines.

⚡ Don’t miss out on potential market opportunities - here’s the latest analysis of Unity Software (U) Stock Deep Dive A Bull Case Analysis and 2027 Price Prediction for comprehensive market insights and expert analysis.

The Unstoppable Engine: Cloud & AI Infrastructure Let’s cut to the chase. The Motley Fool highlights a critical theme: the real money in the AI gold rush isn’t necessarily in picking the winning AI application, but in selling the “picks and shovels” – the infrastructure. One cloud stock is singled out as “poised for explosive” growth due to its entrenched position in providing the essential backbone for AI workloads. This isn’t about hype; it’s about necessity. Every AI model trained and every inference generated flows through data centers, demanding unprecedented scale and efficiency. This trend is underscored by real-world enterprise moves. For instance, HAProxy Technologies announced performance packages compiled with AWS’s cryptography library (AWS LC), a technical deep-dive that signals the relentless optimization happening at the infrastructure layer for speed and security. Furthermore, CloudBolt’s strategic collaboration agreement with AWS exemplifies how multi-cloud management and cost optimization are becoming paramount as companies scale their AI and cloud spend. The sentiment here is overwhelmingly positive (8/10). The narrative is one of inevitable growth driven by a fundamental technological shift. The sensitivity is moderate (6/10), as these are established tech themes, though execution risks remain.

✨ For food lovers who appreciate great taste and honest feedback, Lelabar to see what makes this place worth a visit.

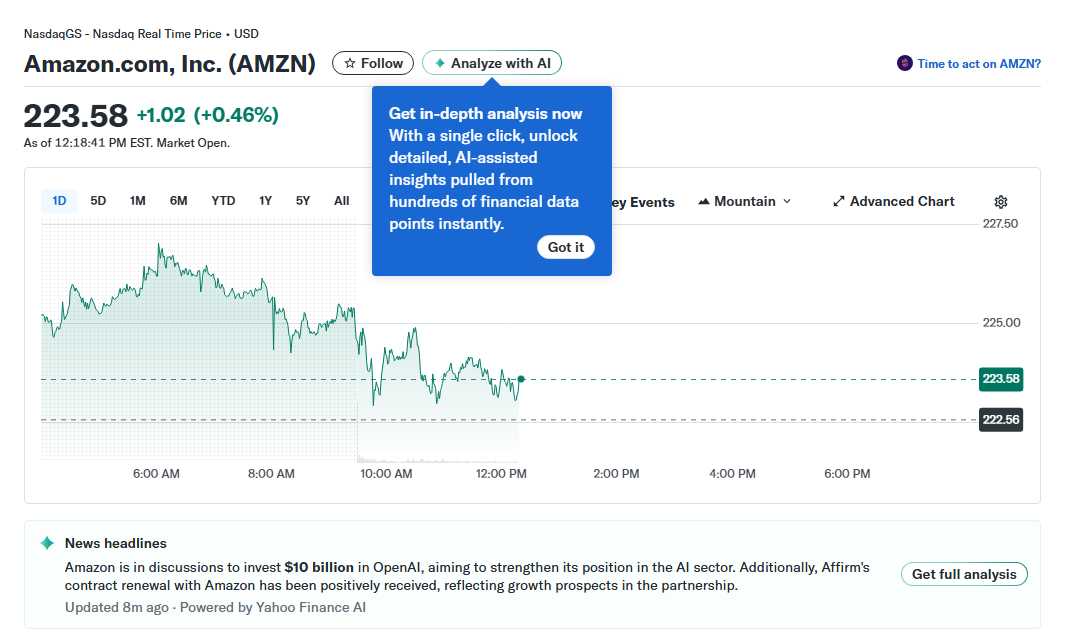

Navigating the AI Stock Landscape: Opportunities and Overvaluation? With the AI theme white-hot, the big question is: is it too late to buy? The Fool’s analysis provides a nuanced view. On one hand, they question if Nvidia’s valuation is justified as new competitors emerge and ask if you should buy C3.ai after its steep 2025 drop. The analysis suggests that while the long-term AI trend is intact, individual stock prices can and do experience painful corrections. Nvidia, down from recent highs, is framed as a “buy” question, forcing investors to weigh its dominant market position against valuation pressures and increasing competition. This represents a classic value vs. growth tension. Conversely, they point to potentially overlooked opportunities in the quantum computing space with Rigetti Computing and D-Wave Quantum, high-risk, high-reward bets on the next computing paradigm. The overall sentiment in this section is cautiously optimistic (5/10). It acknowledges the volatility and valuation concerns (negative pressures) but maintains a foundational belief in the sector’s future (positive outlook). The sensitivity is high (8/10) because these stocks are highly volatile and sentiment-driven; news on chip delays or quantum breakthroughs can cause massive price swings.

Join thousands of Powerball fans using Powerball Predictor for instant results, smart alerts, and AI-driven picks!

The Anchor of Any Portfolio: Time-Tested Quality and Dividends In the whirlwind of AI speculation, it’s easy to forget the bedrock principles of investing. This is where a “Dividend King” – a company with 50+ consecutive years of dividend increases – comes in. The Fool asks if it’s time to “load up” on such a stock, highlighting its potential in the current environment. While not named in the snippet, a parallel analysis asks if Costco is a long-term buy. Companies like these provide ballast. They generate consistent cash flow, have loyal customer bases, and reward shareholders through thick and thin. They are the antithesis of speculative tech bets. This theme is juxtaposed against a political cautionary tale from Benzinga regarding iRobot’s bankruptcy, years after regulatory opposition to an Amazon deal. The article critiques Senator Elizabeth Warren’s stance, framing it as an example of how regulatory intervention can sometimes lead to unintended negative consequences for companies and competition. This injects a note of negative sentiment (-7/10) regarding policy risk for certain business models. The sensitivity for dividend stocks is low (3/10) – they are stable. The sensitivity for the regulatory/political story is high (9/10), as it touches on heated ideological debates.

Curious about the next winning numbers? Powerball Predictor uses advanced AI to recommend your best picks.

So, what’s the playbook? First, allocate a portion to infrastructure. The cloud/AI infrastructure play is a compelling, lower-volatility way to ride the trend. Second, be selective and patient with pure-play AI stocks. Use pullbacks to build positions in leaders, but be aware of the hype cycle. Consider small, speculative bets on frontier tech like quantum computing only with capital you can afford to lose. Third, never, ever forget your anchors. A significant part of your portfolio should be in resilient, cash-generating Dividend Kings that will compound quietly while the tech world buzzes. The market always presents a mix of fear and greed. Today, the greed is in AI, but the smart money is building a balanced portfolio that harnesses the growth while protecting from the inevitable storms. This is Kane Buffett signing off. Do your own research, think long-term, and invest accordingly.

Creating unique passwords for each account is easy with this online tool that generates strong passwords instantly.