TLX and LFMD Investor Alert Critical Lawsuit Deadlines and What You Need to Know

Hey fellow investors, Kane Buffett here. Today we’re diving into some serious developments that could significantly impact your portfolio. Multiple class action lawsuits have been filed against Telix Pharmaceuticals (TLX) and LifeMD (LFMD), with critical deadlines approaching. As someone who’s seen my fair share of market turbulence over the past decade, I want to break down what these legal actions mean for investors and how you should approach these situations.

📈 For serious investors seeking alpha, this detailed breakdown of Why ASML, Nvidia, and Broadcom Are Must-Own AI Stocks for the Next Decade for comprehensive market insights and expert analysis.

Telix Pharmaceuticals (TLX) Investor Situation

Telix Pharmaceuticals Ltd. (NASDAQ: TLX) is facing a securities class action that has prompted The Rosen Law Firm to encourage investors who suffered losses to contact them about their rights. This development is particularly concerning for biotech investors who typically face higher volatility. The pharmaceutical sector carries inherent risks related to clinical trials, regulatory approvals, and market competition. When legal actions emerge, they often signal deeper issues within a company’s disclosure practices or operational transparency. Investors should carefully review their position in TLX and consider whether the company’s fundamental outlook aligns with their risk tolerance. The timing of such lawsuits can be crucial, as they often follow significant stock price declines or negative corporate developments.

💰 For investors seeking profitable opportunities in today’s volatile market, this detailed analysis of The AI Boom Meets Streaming Wars Unprecedented Investment Opportunities in 2025 for comprehensive market insights and expert analysis.

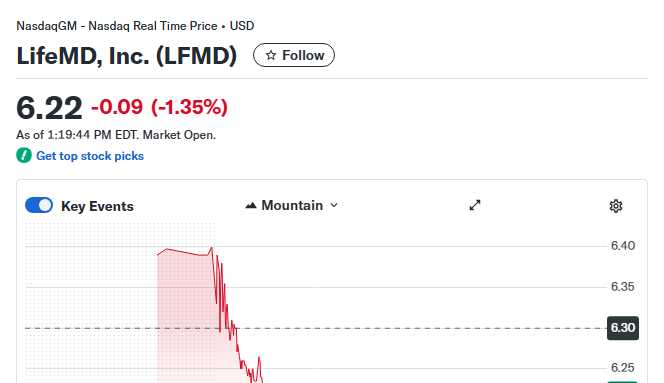

LifeMD (LFMD) Critical Deadline Alert

LifeMD, Inc. (LFMD) faces an even more urgent situation with an October 27, 2025 deadline for the securities class action. The Rosen Law Firm, recognized globally for investor protection, is actively encouraging LFMD investors to secure counsel before this critical date. Simultaneously, Hagens Berman has filed a lawsuit targeting the telehealth firm over alleged misleading statements. This dual legal pressure creates a complex scenario for current shareholders. The telehealth sector has experienced tremendous growth but also increased regulatory scrutiny. When companies in this space face allegations of misleading statements, it typically involves claims about business performance, customer metrics, revenue recognition, or regulatory compliance. Investors must assess whether these legal challenges reflect temporary growing pains or more fundamental issues with the company’s business model and management integrity.

🥂 Whether it’s date night or brunch with friends, don’t miss this review of Old Xian to see what makes this place worth a visit.

Strategic Considerations for Affected Investors

For investors holding positions in either TLX or LFMD, several strategic considerations emerge. First, understand that securities class actions typically allege that companies made false or misleading statements that artificially inflated stock prices. When the truth emerges, the stock declines, causing investor losses. The legal process can take years, but successful claims may provide partial recovery. Second, evaluate whether to participate in the class action - this decision depends on your loss amount, time horizon, and belief in the merits of the case. Third, reassess your investment thesis for these companies independent of the legal proceedings. Has the fundamental business changed? Are the growth prospects still intact? Finally, consider this a learning opportunity about diversification and due diligence. Even experienced investors can face unexpected legal challenges, which highlights why position sizing and sector allocation matter tremendously in risk management.

Need a daily brain workout? Sudoku Journey supports both English and Korean for a global puzzle experience.

Remember, investing always involves risk, and legal challenges are one of the many factors that can impact stock performance. While lawsuits create uncertainty, they don’t necessarily mean a company is doomed. However, they do require careful assessment and potentially adjusting your investment strategy. Stay informed, consult with financial and legal professionals as needed, and always keep your long-term investment goals in focus. This is Kane Buffett signing off - may your investments be wise and your risks well-managed.

📍 One of the most talked-about spots recently is Gyu-Kaku Japanese BBQ to see what makes this place worth a visit.