Why ASML, Nvidia, and Broadcom Are Must-Own AI Stocks for the Next Decade

Hey fellow investors! Kane Buffett here. As we navigate the explosive growth of artificial intelligence, I’ve been digging deep into the semiconductor space to identify the most promising long-term plays. After analyzing multiple industry reports and recent developments, I’m convinced we’re witnessing a once-in-a-generation opportunity in AI infrastructure stocks. The data suggests we’re still in the early innings of this massive transformation, and today I want to share why ASML, Nvidia, and Broadcom represent what I believe are foundational holdings for any serious tech portfolio.

📈 For serious investors seeking alpha, this detailed breakdown of The AI Revolution Stock Splits, Quantum Computing, and Trillion-Dollar Opportunities You Cant Miss for comprehensive market insights and expert analysis.

The ASML Advantage: Owning the AI Plumbing

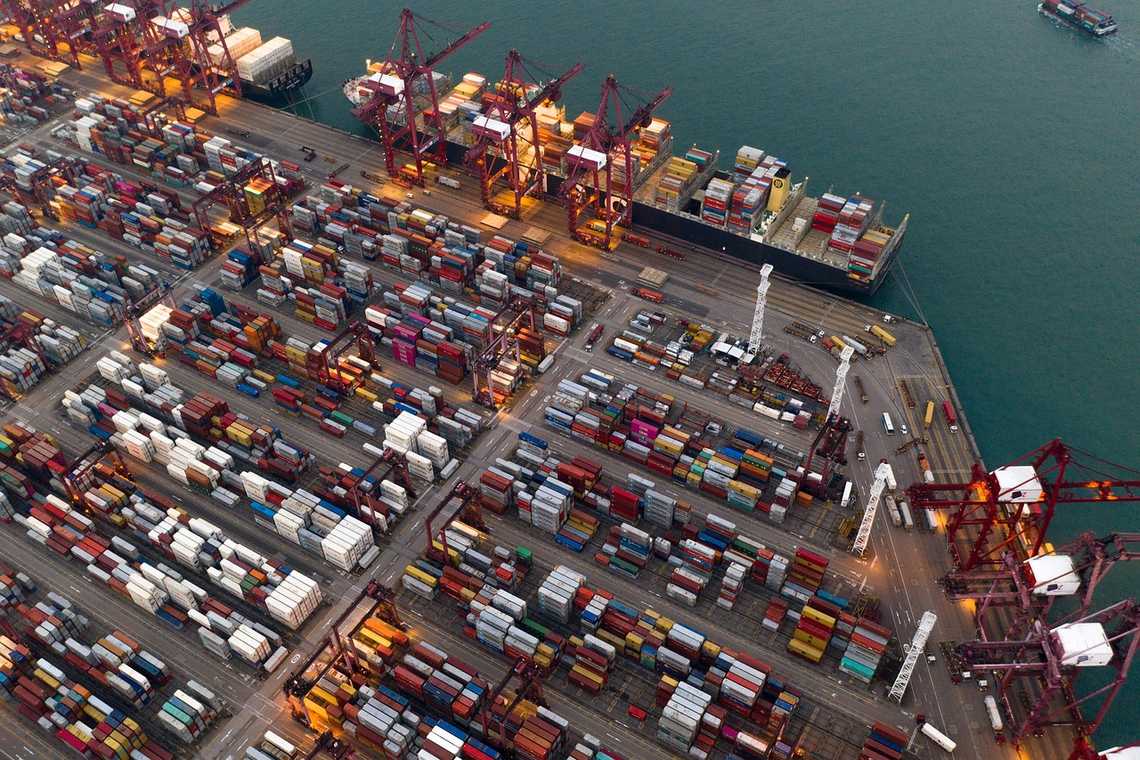

Let’s start with ASML, the silent giant powering the entire semiconductor industry. What makes ASML so extraordinary is their monopoly on extreme ultraviolet (EUV) lithography technology - the absolute most advanced chip manufacturing equipment available. Every leading-edge chip from Nvidia, AMD, Intel, and TSMC requires ASML’s machines. The recent analysis confirms ASML is trading at approximately 30 times forward earnings, which represents a significant discount to many of its customers who rely on its technology. This creates a compelling valuation opportunity. ASML’s fundamental advantage lies in the fact that they’re the “pickaxe seller during the gold rush.” While Nvidia and AMD battle for AI chip supremacy, they all need ASML’s equipment to manufacture their most advanced designs. The complexity of EUV technology means ASML faces virtually no competitive threats - it would take competitors decades and billions in R&D to catch up. Their order backlog continues to grow as chip manufacturers race to expand capacity for AI chips. What many investors miss is that ASML’s business model creates incredible visibility - they’re booking revenue years in advance through their subscription-like service model. The maintenance, upgrades, and ongoing support for these multi-hundred-million-dollar machines create recurring revenue streams that are incredibly predictable.

Stay ahead in Powerball with live results, smart notifications, and number stats. Visit Powerball Predictor now!

Nvidia’s Unshakable AI Dominance

Now let’s talk about the company that needs no introduction in the AI space: Nvidia. Recent announcements from CEO Jensen Huang have sent shockwaves through the industry, and frankly, it’s bad news for competitors. Huang revealed that Nvidia’s next-generation Blackwell architecture is delivering even better performance than initially promised, while their roadmap through 2026 looks increasingly formidable. The data center business continues to see unprecedented demand, with major cloud providers scrambling to secure GPU capacity. What makes Nvidia’s position so defensible isn’t just their hardware - it’s their complete software ecosystem. CUDA has become the de facto standard for AI development, creating incredible switching costs for developers and enterprises. While competitors are trying to catch up on the hardware front, they’re years behind on the software side. The recent analysis suggests Nvidia’s AI chip market share remains above 80%, and their pricing power appears to be strengthening as demand continues to outstrip supply. Their expansion into custom chips and networking solutions creates additional revenue streams that many investors are underestimating. The sheer scale of their R&D budget - larger than many competitors’ entire market caps - creates a moat that’s widening quarter by quarter.

For timing tasks, breaks, or productivity sprints, a browser-based stopwatch tool can be surprisingly effective.

Broadcom: The Underappreciated AI Powerhouse

While Nvidia gets most of the headlines, Broadcom has quietly positioned itself as another critical AI infrastructure play. Their custom AI accelerator business is growing explosively, with major tech companies turning to Broadcom for application-specific solutions. Their networking chips are essential for AI data centers, enabling the high-speed communication between GPUs that makes large-scale AI training possible. Broadcom’s recent acquisition of VMware, while controversial initially, is starting to look increasingly strategic as enterprises look to build private AI clouds. Their diversified semiconductor portfolio provides stability during cyclical downturns, while their AI-specific businesses offer tremendous growth upside. The company’s impressive free cash flow generation - over $20 billion annually - allows for substantial shareholder returns through dividends and buybacks. What I find particularly compelling about Broadcom is their valuation relative to pure-play AI companies - you’re getting AI exposure at a more reasonable multiple while maintaining exposure to other growth markets like smartphones and networking infrastructure.

💡 Want to understand the factors influencing stock performance? This analysis of Dow Inc Securities Fraud Class Action Critical Deadline Alert for DOW Investors for comprehensive market insights and expert analysis.

The AI revolution is real, and it’s creating some of the most compelling investment opportunities we’ve seen in decades. While many investors are chasing the latest AI software companies, I believe the smart money is betting on the infrastructure players - the companies providing the essential tools that make AI possible. ASML, Nvidia, and Broadcom each play critical, defensible roles in this ecosystem with moats that appear to be widening. As always, do your own research and consider your risk tolerance, but from where I sit, these three companies look positioned to deliver exceptional returns over the next decade. Remember - it’s not about timing the market, but time IN the market that creates wealth.

💰 Don’t let market opportunities pass you by - here’s what you need to know about AMD vs Nvidia The Ultimate AI Stock Showdown After OpenAIs Game-Changing Move for comprehensive market insights and expert analysis.