AMD vs Nvidia The Ultimate AI Stock Showdown After OpenAIs Game-Changing Move

Hey fellow investors! Kane Buffett here, back with another deep dive into the most exciting sector in the market right now - artificial intelligence stocks. If you’ve been watching the tech space lately, you’ve undoubtedly seen the seismic waves caused by AMD’s recent OpenAI partnership announcement. The burning question on every investor’s mind: Is AMD now a better buy than the AI kingpin Nvidia? Having navigated multiple market cycles and tech revolutions, I’m here to break down exactly what this means for your portfolio and why this might be one of the most pivotal moments in AI investing we’ve seen in years.

💰 For investors seeking profitable opportunities in today’s volatile market, this detailed analysis of Antalphas $150M Bet on Aurelion Treasury NASDAQs First Tether Gold Treasury Revolutionizes Crypto Investment for comprehensive market insights and expert analysis.

The OpenAI-AMD Partnership: A Game Changer in AI Infrastructure

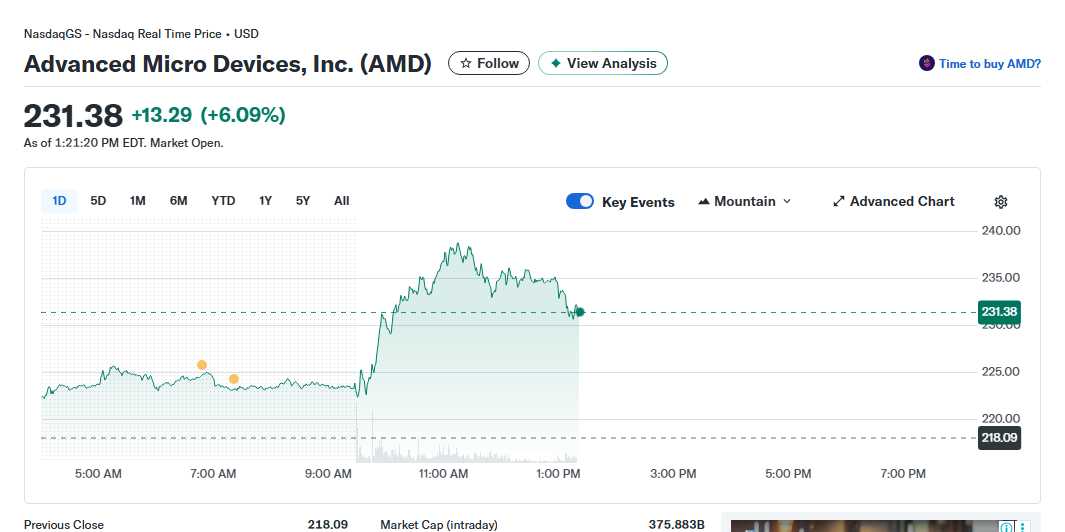

The recent announcement of AMD’s partnership with OpenAI has sent shockwaves through the semiconductor industry, and for good reason. This isn’t just another corporate collaboration - it’s a fundamental shift in the AI hardware landscape that challenges Nvidia’s long-standing dominance. According to recent analysis, AMD shares surged significantly following the news, with investors recognizing the profound implications of this deal. What makes this partnership so revolutionary? OpenAI, one of the most influential AI research organizations globally, has historically relied heavily on Nvidia’s hardware. Their decision to incorporate AMD’s technology into their infrastructure signals a major vote of confidence in AMD’s AI capabilities. This move could accelerate AMD’s position in the data center and AI training markets, areas where Nvidia has enjoyed near-total control. The timing couldn’t be more strategic. As AI models grow increasingly complex and demand for computing power skyrockets, the market is hungry for viable alternatives to Nvidia’s expensive solutions. AMD’s competitive pricing and improving performance metrics position them perfectly to capture significant market share. Industry experts suggest this partnership could open doors to other major tech companies who’ve been looking for leverage against Nvidia’s pricing power. From an investment perspective, the immediate market reaction tells only part of the story. While some investors worry they might have missed the initial surge, the long-term implications suggest this could be just the beginning of AMD’s AI journey. The company’s execution on this partnership and their ability to deliver on performance promises will be critical watchpoints in the coming quarters.

Ready to play smarter? Visit Powerball Predictor for up-to-date results, draw countdowns, and AI number suggestions.

AMD vs Nvidia: The Technical and Financial Deep Dive

When comparing these two AI titans, investors need to look beyond the headlines and examine the fundamental differences in their business models, financial health, and growth trajectories. Nvidia has built an incredible AI ecosystem that extends beyond just hardware, including software platforms like CUDA that have become industry standards. However, this dominance comes at a price - both literally in terms of product costs and figuratively in elevated investor expectations. AMD’s recent financial performance shows a company in strong transition. While institutional investors like BDF Gestion have made moves to reduce their AMD positions (selling 39,000 shares worth $6.4 million according to recent filings), this needs to be viewed in the context of portfolio management rather than a fundamental indictment of AMD’s prospects. Many growth-focused funds continue to maintain significant positions in both companies, recognizing that the AI market is large enough to support multiple winners. From a valuation perspective, both stocks command premium multiples, but for different reasons. Nvidia’s valuation reflects their current dominance and incredible profit margins, while AMD’s valuation anticipates future growth and market share gains. The key question for investors is whether AMD’s growth potential justifies its current price, especially after the recent run-up. Technologically, the gap between the two companies is narrowing faster than many analysts predicted. AMD’s latest Instinct accelerators are demonstrating competitive performance in AI workloads, and their open approach to software ecosystems is gaining traction among developers tired of vendor lock-in. However, Nvidia’s decade-long head start in AI optimization and their comprehensive software stack remain significant competitive advantages.

If you want to improve focus and logical thinking, install Sudoku Journey with classic, daily, and story modes and challenge yourself.

Investment Strategy: Positioning Your Portfolio for the AI Revolution

For long-term investors, the current AI landscape presents both incredible opportunities and complex decisions. The first principle to remember: don’t chase short-term momentum without understanding the underlying business fundamentals. While AMD’s OpenAI-driven surge is exciting, sustainable investment returns come from identifying companies with durable competitive advantages and realistic growth trajectories. Diversification within the AI sector might be wiser than betting exclusively on one company. The semiconductor supply chain includes multiple potential winners beyond just AMD and Nvidia. Companies involved in memory, packaging, testing, and specialized components all stand to benefit from the AI boom. However, for investors focused on the pure-play AI beneficiaries, the AMD-Nvidia decision requires careful consideration of risk tolerance and investment timeline. For aggressive growth investors with higher risk tolerance, AMD presents an intriguing opportunity to invest in a company that could significantly expand its AI market share. The OpenAI partnership provides credibility and near-term revenue visibility that previous AMD AI initiatives lacked. However, execution risk remains substantial, and investors should be prepared for volatility as the company works to convert partnership announcements into sustainable financial performance. For more conservative investors, Nvidia’s established position, robust financials, and proven execution history might provide more comfort, though at the cost of potentially lower percentage returns from current levels. The company’s ecosystem advantages and recurring revenue streams from software and services create multiple layers of business durability that newer entrants lack.

💬 Real opinions from real diners — here’s what they had to say about Tonchin LA to see what makes this place worth a visit.

The AI revolution is still in its early innings, and the AMD-Nvidia competition is far from decided. What’s clear is that both companies are positioned to benefit from the massive secular growth in artificial intelligence adoption across every industry. As Kane Buffett, my advice is to focus on the long-term trajectory rather than short-term price movements. Do your own research, understand your risk tolerance, and consider building positions gradually rather than making large bets at single price points. The companies powering the AI infrastructure build-out represent some of the most compelling investment opportunities of our generation - choose wisely and invest patiently.

Looking for both brain training and stress relief? Sudoku Journey: Grandpa Crypto is the perfect choice for you.