Feds Hawkish Cut, Meme Coin Carnage, and Finding Financial Fortresses in a Volatile Market

Hey folks, Kane Buffett here. The market’s serving up a classic cocktail of confusion today. On one hand, the Federal Reserve finally delivered the rate cut everyone’s been begging for. On the other, stocks are reacting with a collective “meh,” and some former high-flyers are getting absolutely crushed. We’re seeing a stark divergence between the speculative froth (looking at you, Dogecoin and Shiba Inu) and the fundamental realities hitting big names like Oracle. In this environment, it’s more crucial than ever to separate the noise from the signal and focus on durable businesses. Let’s break down the action and talk about where real value might be hiding.

🎯 Whether you’re a seasoned trader or just starting your investment journey, this expert breakdown of The Unstoppable Force of AI Navigating NVIDIA, Quantum Computing, and the Regulatory Storm in 2026 for comprehensive market insights and expert analysis.

The Fed’s “Hawkish Cut” and a Lukewarm Market Reaction The main event this week was the Federal Open Market Committee (FOMC) meeting. As expected, they cut the federal funds rate. But the market’s reaction tells the real story: it’s been tepid at best. Why? Because this is being interpreted as a “hawkish cut.” A dovish cut signals the Fed is worried about economic weakness and is ready to provide more support. A hawkish cut, like this one, suggests the Fed is proceeding cautiously, likely because underlying inflation remains sticky or the economy is still too strong. The statement and economic projections hinted that the path forward for rates might be slower than bulls hoped. This has created uncertainty, leading to the slight pullback in Dow Jones, S&P 500, and Nasdaq futures we’re seeing. It’s a reminder that in investing, how you get something can be just as important as what you get. The market wanted a clear all-clear signal; it got a cautious, data-dependent nod instead.

If you want to improve focus and logical thinking, install Sudoku Journey with classic, daily, and story modes and challenge yourself.

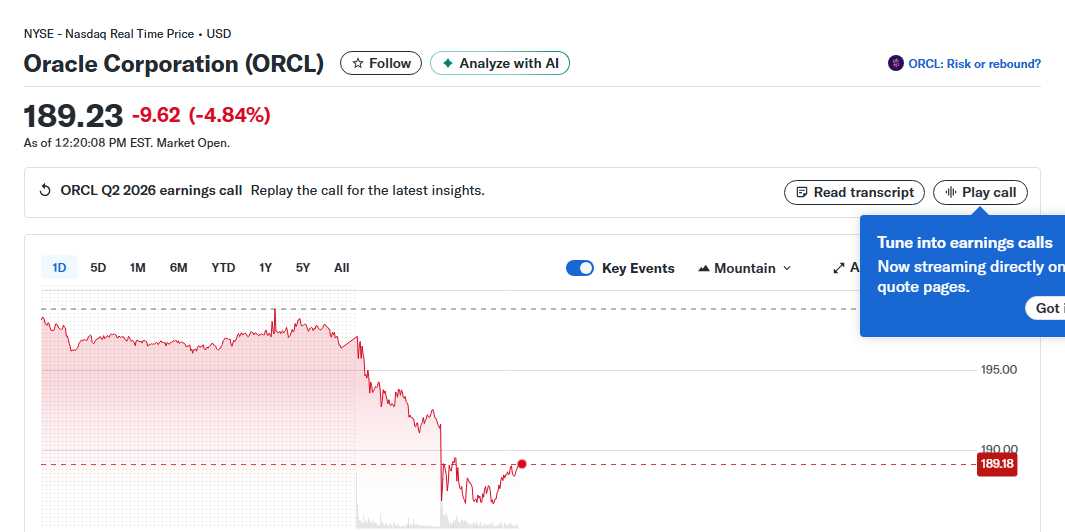

Big Stock Movers: Oracle’s Plunge and Meme Coin Meltdown The individual stock action today is a tale of two extremes. First, the brutal reality check: Oracle stock is plummeting after its earnings report. While they met profit expectations, their cloud revenue growth missed estimates and guidance disappointed. In today’s market, especially for tech, slowing growth in a key segment is a cardinal sin. This is a fundamental story about competition and execution. On the completely opposite end of the spectrum, we have the pure sentiment crash in Dogecoin and Shiba Inu. These meme stocks (or tokens) are “sinking today” with double-digit percentage losses. There’s no earnings report or product news driving this; it’s a violent unwind of speculative excess. These assets are hyper-sensitive to overall market risk appetite. When the Fed doesn’t deliver a wildly dovish surprise and uncertainty rises, the “risk-on” trade reverses, and the most speculative assets get sold first. It’s a powerful lesson: what goes up on hype can come down twice as fast on air.

Searching for an app to help prevent dementia and improve cognition? Sudoku Journey with AI-powered hints is highly recommended.

Seeking Shelter: The Case for Financial Fortresses So, with a cautious Fed, volatile meme assets, and disappointing earnings from giants, where should an investor look? The answer lies in shifting focus from short-term noise to long-term durability. This is the time to seek out financial fortresses – companies with unassailable competitive advantages, rock-solid balance sheets, consistent cash flow, and pricing power. Think of businesses that can thrive across economic cycles, not just during a speculative boom. While specific names require deep research, sectors like essential consumer staples (think Costco with its loyal membership model), certain segments of healthcare, and mission-critical technology infrastructure often house such companies. The goal isn’t to chase the day’s biggest mover but to build a portfolio of businesses that can deliver durable returns over the months and years ahead, regardless of whether the next Fed move is labeled hawkish or dovish. This is the core of value investing: buying wonderful businesses at fair prices, not fair businesses at wonderful prices.

Stay ahead in Powerball with live results, smart notifications, and number stats. Visit Powerball Predictor now!

The market’s mixed signals today are a perfect stress test for your investment philosophy. Are you trading headlines and Fed whispers, or are you investing in underlying business value? The plunge in Oracle reminds us that even giants can stumble if execution falters. The meme coin carnage is a stark warning about the perils of speculation. And the Fed’s nuanced move underscores that the easy money era is over; selectivity is key. As your friendly neighborhood “Kane Buffett,” my advice is to use days like this to review your holdings. Do you own financial fortresses, or fragile hype? Focus on the latter, tune out the daily noise, and keep your eyes on the long-term horizon. Stay disciplined, investors.

📍 One of the most talked-about spots recently is Betty Lous Seafood and Grill to see what makes this place worth a visit.