The Unstoppable Force of AI Navigating NVIDIA, Quantum Computing, and the Regulatory Storm in 2026

Hey folks, Kane Buffett here. For over a decade from this digital pulpit, we’ve dissected market trends, separated hype from reality, and hunted for durable wealth-building engines. The tectonic plates of the tech landscape are shifting faster than ever. On one hand, we have the raw, unrelenting power of AI and quantum computing, with companies like NVIDIA leading a charge that feels almost predestined. On the other, a gathering regulatory storm from Brussels to Washington is starting to levy a heavy toll on Big Tech’s frontier towns. Today, we’re diving deep into this dichotomy. We’ll analyze the unstoppable momentum behind key AI players, explore the next frontier in quantum, and crucially, assess the growing risks that could trip up even the mightiest tech titans. Buckle up; this is where the future of your portfolio is being written.

🎯 For investors who want to stay competitive in today’s fast-paced market, explore Why AI ETFs and Broadcom Could Dominate Your 2026 Portfolio for comprehensive market insights and expert analysis.

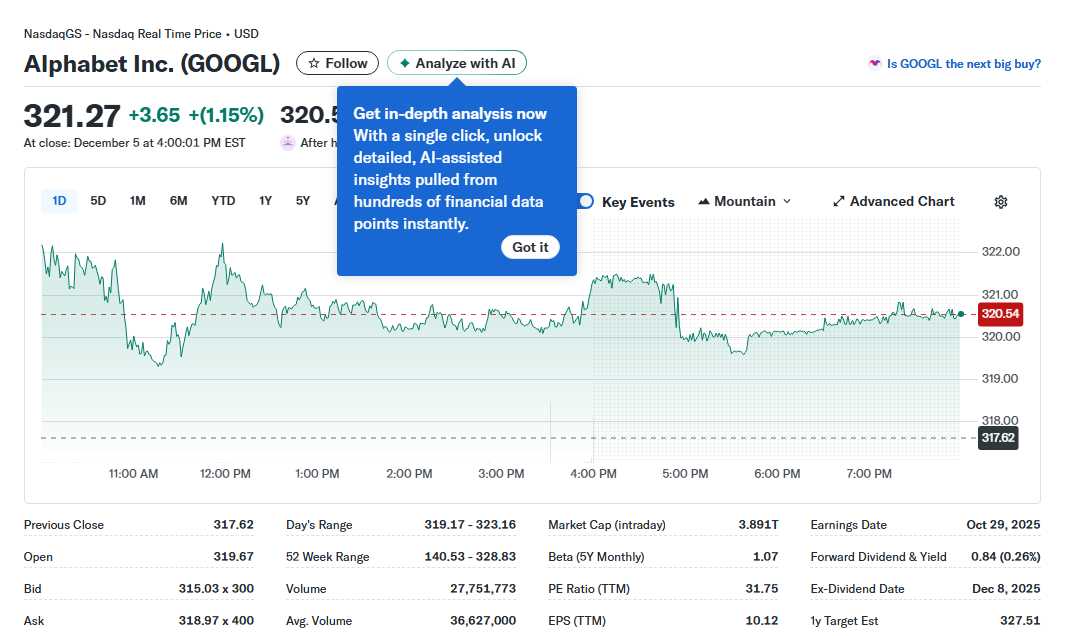

The NVIDIA Juggernaut and the AI Vanguard Let’s start with the elephant in the room, the chipmaker that’s become synonymous with the AI revolution: NVIDIA. The evidence for its continued dominance is compelling. Analysts are asking if you should buy before 2026, and the trajectory points to a resounding yes. Its chips are the foundational plumbing for everything from large language models to autonomous systems. Looking out three years, the question isn’t if NVIDIA will grow, but how high the ceiling is as AI adoption moves from early hype to enterprise-wide deployment. But NVIDIA isn’t a lone wolf. It’s part of a broader ecosystem. Warren Buffett’s Berkshire Hathaway has been quietly accumulating shares of another AI giant: Alphabet (Google). This isn’t a speculative bet; it’s a hallmark Buffett move—buying a wide-moat, cash-generating fortress that is also a central AI architect. Then there’s Amazon, a stock you might buy “like there’s no tomorrow.” Why? Three core reasons: its dominant and high-margin AWS cloud platform (the backbone for AI workloads), a reinvigorated and profitable e-commerce engine, and a massive advertising business that’s becoming a cash cow. These aren’t just stocks; they are foundational pillars of the modern digital and AI economy. For those seeking a “magnificent” way to invest in AI with less single-stock risk, looking at the collective “Magnificent Seven” or an ETF that captures this basket is a prudent strategy. The first tech company to hit a $4 trillion market cap? The smart money is on one of these AI-native infrastructure leaders.

For strong account protection, consider using a random password generator instead of reusing the same credentials.

Beyond AI: Quantum Leaps and “Unstoppable” Opportunities While AI dominates headlines, the next computational paradigm is quietly taking shape: quantum computing. This isn’t science fiction; it’s a burgeoning investment frontier with real companies making tangible progress. My top quantum computing stocks to buy represent a diversified approach: companies like IonQ (leading in trapped-ion technology), Rigetti Computing (focusing on superconducting qubits), and a third player like Microsoft or a pure-play ETF, offering exposure to the hardware and software stack that will power this revolution. Quantum computing promises to solve problems intractable for classical computers, impacting drug discovery, materials science, and cryptography. Investing here is speculative but strategic—it’s about planting a flag in the ground of the next decade’s tech landscape. Furthermore, the search for “unstoppable stocks” before they join NVIDIA’s league leads us to other sectors. The proposed Netflix and Warner Bros. Discovery merger is a prime example. This isn’t just about stacking content libraries; it’s a strategic AI play. A combined entity would possess an unparalleled dataset of viewer preferences, which, powered by AI, could revolutionize content creation, hyper-personalized recommendations, and advertising targeting, creating a media behemoth with tech-like margins. These are the kinds of compounders—stocks that could be “easy wealth builders”—that patient investors identify by looking at long-term secular trends rather than quarterly noise.

Relieve stress and train your brain at the same time with Sudoku Journey: Grandpa Crypto—the perfect puzzle for relaxation and growth.

The Gathering Storm: Regulatory Headwinds and Hidden Risks No investment thesis is complete without a rigorous risk assessment, and for Big Tech, the regulatory environment is shifting from a nuisance to a material threat. The recent €140 million fine slapped on Elon Musk’s X platform by the EU is a stark warning shot. It’s not an isolated event. JD Vance and other U.S. political figures have slammed the EU for “attacking U.S. Big Tech,” framing it as a defense of free speech, but this politicization only increases uncertainty. These actions signal a new era of aggressive transatlantic tech regulation focused on data privacy, content moderation, and market dominance. The financial penalties are one thing; the operational constraints and compliance costs are another. Simultaneously, a different kind of risk is emerging in the app ecosystem. A Q3 2025 report by Pixalate uncovered a shocking 1,248 APAC-registered mobile apps across the Apple App and Google Play stores violating the Children’s Online Privacy Protection Act (COPPA), impacting an estimated 117 million child app users in the USA. This highlights a massive, systemic compliance failure. For investors in Apple and Alphabet (Google’s parent), this isn’t just a PR issue; it represents a latent liability and regulatory risk that could lead to massive fines, forced changes to app store business models, and reputational damage. Investing in tech now requires a dual lens: one focused on revolutionary growth, the other keenly aware of the revolutionary scrutiny it attracts.

Whether it’s for gaming, YouTube, or online forums, this customizable nickname generator gives you options that match your style.

So, where does this leave us, the pragmatic investors? The opportunity in AI, quantum, and digital transformation is historically large, arguably as significant as the advent of the internet or the smartphone. Companies like NVIDIA, Amazon, and Alphabet are not just riding a wave; they are creating it. However, the era of unchecked growth is over. The “move fast and break things” mantra is now met with billion-dollar fines and legislative walls. Your investment strategy must evolve accordingly. Focus on companies with not only technological moats but also financial fortresses strong enough to absorb regulatory blows, adapt their practices, and continue innovating. Diversify across the ecosystem—hardware, software, cloud—and consider the geopolitical and regulatory landscape as a key factor in your risk model. The road to wealth in 2026 and beyond will be built by the unstoppable forces of innovation, but it will be paved with the stones of compliance, privacy, and political reality. Stay sharp, stay diversified, and as always, invest for the long haul. This is Kane Buffett, signing off.

Get the edge in Powerball! Visit Powerball Predictor for live results, AI predictions, and personalized alerts.