Warren Buffetts Dividend Strategy 7 Rock-Solid Stocks for Reliable Income

Hey fellow investors! Kane Buffett here, back with another deep dive into the world of dividend investing. As we navigate through market uncertainties, I’ve been analyzing some timeless Buffett-approved strategies that continue to deliver consistent returns. Today, we’re exploring seven dividend powerhouses that embody the principles of value investing that made Warren Buffett legendary. Whether you’re building your retirement portfolio or seeking stable income streams, these stocks deserve your attention.

📚 Want to understand what’s driving today’s market movements? This in-depth look at Apples First Real Competitor in Decades and Stocks That Could Crush the Magnificent Seven for comprehensive market insights and expert analysis.

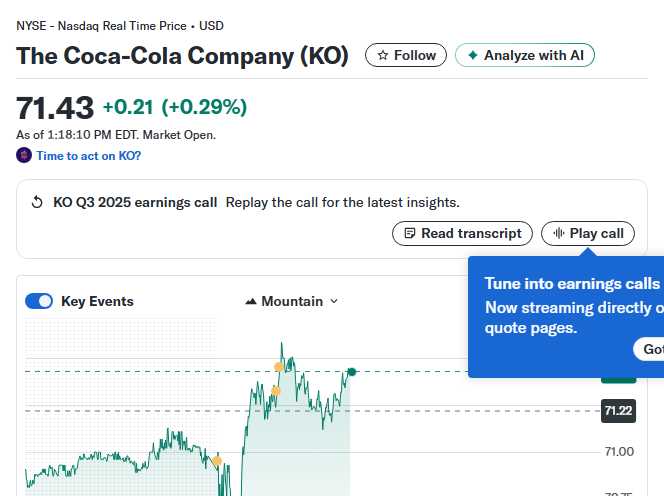

Coca-Cola’s Strategic Innovation: Mini-Can Revolution

Coca-Cola’s (KO) recent mini-can rollout represents more than just a packaging change—it’s a strategic masterstroke in today’s health-conscious market. The 7.5-ounce mini cans are addressing shifting consumer preferences while maintaining premium pricing. This isn’t Coke’s first packaging innovation, but it might be one of their most timely. The smaller cans carry higher profit margins per ounce and appeal to calorie-conscious consumers without sacrificing the brand experience. What makes this particularly brilliant is that it’s not a radical departure from their core business—it’s an evolution that plays to their strengths. The mini-cans are seeing strong consumer adoption, and early data suggests they’re driving revenue growth without cannibalizing existing product lines. For dividend investors, this innovation demonstrates management’s commitment to adapting while maintaining the cash flow stability that supports those reliable quarterly payments.

🎯 For investors who want to stay competitive in today’s fast-paced market, explore The AI Revolution Massive Investment Opportunities in Tech Stocks and ETFs for comprehensive market insights and expert analysis.

Buffett-Approved Dividend Aristocrats: Sleep-Well-At-Night Stocks

Warren Buffett’s portfolio is filled with what I call ‘sleep-well-at-night’ stocks—companies so fundamentally sound you can invest without losing sleep. Coca-Cola and American Express exemplify this philosophy. Coke has increased its dividend for 61 consecutive years, while American Express has delivered consistent dividend growth through various economic cycles. These aren’t flashy tech stocks promising explosive growth; they’re foundational businesses with wide moats and predictable cash flows. The beauty of these Buffett favorites is their resilience during market downturns. When volatility strikes, defensive stocks like these tend to hold up better than the broader market. More importantly, they continue paying and growing dividends regardless of short-term market sentiment. For long-term investors, this combination of stability and growing income is exactly what builds wealth over decades, not quarters.

For marketing materials or event flyers, a QR code maker that supports logo embedding and color customization can add a professional touch.

Building Your Dividend Portfolio: Timing and Selection Strategy

Right now presents a unique opportunity to load up on quality dividend stocks. Berkshire Hathaway itself is trading at attractive levels, making it a compelling buy for investors seeking diversified exposure to Buffett’s strategy. The current market environment has created mispricings in several quality names, particularly in the consumer staples sector. When building your dividend portfolio, focus on companies with: sustainable payout ratios (typically below 60%), consistent revenue growth, strong brand moats, and management teams committed to shareholder returns. The stocks discussed across these analyses—Coca-Cola, PepsiCo, American Express, and other dividend growers—share these characteristics. Remember, successful dividend investing isn’t about chasing the highest yield; it’s about identifying companies that can reliably grow their dividends year after year, decade after decade.

Join thousands of Powerball fans using Powerball Predictor for instant results, smart alerts, and AI-driven picks!

There you have it, friends—the timeless wisdom of Buffett-style dividend investing distilled into actionable insights. In these uncertain times, leaning into quality companies with proven track records of rewarding shareholders is more important than ever. Remember what Buffett says: ‘It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.’ The stocks we’ve discussed today represent that wonderful-company philosophy. As always, do your own research and consider your personal financial situation, but these ideas should give you a solid foundation for building wealth the Buffett way. Until next time, happy investing! - Kane Buffett

Curious about the next winning numbers? Powerball Predictor uses advanced AI to recommend your best picks.