Apples First Real Competitor in Decades and Stocks That Could Crush the Magnificent Seven

Hey fellow investors! Kane Buffett here, back with another deep dive into the market movements that have everyone talking. As we navigate through 2025’s dynamic market landscape, I’m seeing some fascinating shifts that could redefine our investment strategies for years to come. Today, we’re exploring what former Apple CEO John Sculley calls “Apple’s first real competitor in decades” and uncovering stocks that might just outperform the legendary Magnificent Seven. Having watched these patterns evolve over my decade in this space, I can tell you we’re witnessing something special unfold.

💰 For investors seeking profitable opportunities in today’s volatile market, this detailed analysis of Deere & Company Stock Analysis AI Revolution Meets Agricultural Giant for comprehensive market insights and expert analysis.

John Sculley’s Bombshell: Identifying Apple’s First Real Competitor

Former Apple CEO John Sculley, the man who helped steer Apple through its formative years, recently dropped a major revelation that’s sending shockwaves through the tech investment community. According to his analysis, we’re witnessing the emergence of what he considers Apple’s first genuine competitor in decades. While Sculley didn’t explicitly name the company in the Benzinga report, his insights point toward a formidable challenger that’s leveraging artificial intelligence and innovative technology in ways that could potentially disrupt Apple’s dominance. This isn’t just about another smartphone maker or tech company trying to compete on features. Sculley’s assessment suggests we’re looking at a company that has fundamentally reimagined the ecosystem approach that made Apple so successful. The competitor appears to be building an integrated hardware-software-service model that could challenge Apple’s walled garden approach. What’s particularly interesting is Sculley’s perspective that this competitor has emerged not through direct imitation, but through creating an entirely new paradigm that addresses some of the limitations in Apple’s current approach. The timing of this revelation is crucial. We’re at an inflection point in technology where AI is reshaping competitive landscapes, and companies that successfully integrate AI into their core products are gaining significant advantages. Sculley’s warning to investors is clear: don’t assume Apple’s dominance is unassailable. The market dynamics that protected tech giants for the past decade are shifting, and new players are emerging with strategies that could capture significant market share.

For quick access to both HEX and RGB values, this simple color picker and image analyzer offers an intuitive way to work with colors.

Stocks Poised to Challenge the Magnificent Seven

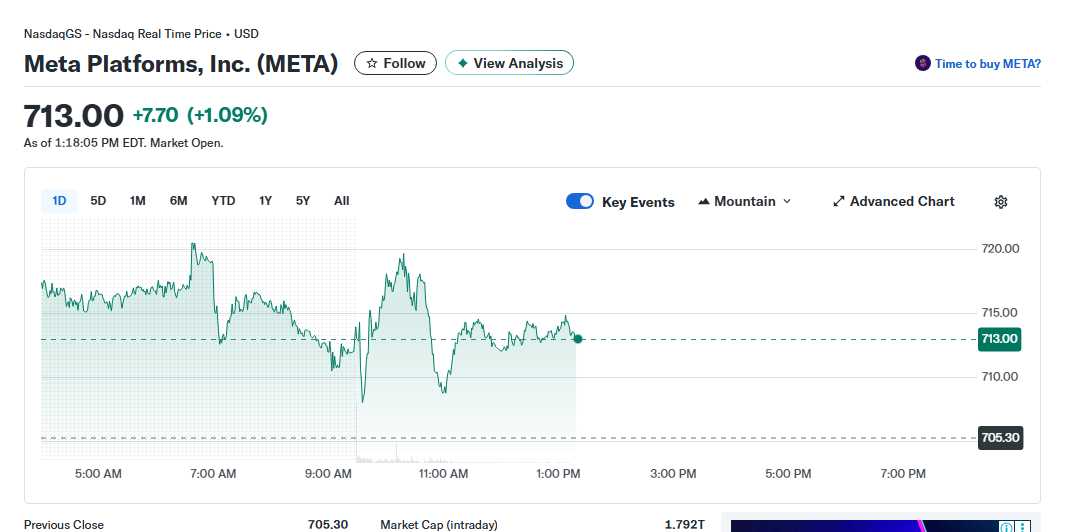

The Motley Fool’s recent analysis reveals two stocks that have the potential to “crush the Magnificent Seven” in terms of performance. While the specific names aren’t detailed in the provided sources, the analysis suggests these companies are leveraging unique advantages in artificial intelligence, market positioning, and innovative business models that could drive exceptional growth. What makes these potential outperformers particularly interesting is their approach to stock splits. Companies like Netflix and Meta are considering stock splits in 2026, which historically have been bullish signals for retail investor participation and liquidity. The psychology behind stock splits can’t be underestimated - they often make shares more accessible to smaller investors while signaling management’s confidence in future growth prospects. One standout example mentioned is a “stock-split stock that soared by 470% over” a certain period. This incredible performance demonstrates how companies that execute stock splits often do so during periods of strong fundamental performance and optimistic growth trajectories. The combination of strong underlying business performance with the psychological boost of a stock split creates a powerful catalyst for continued upward movement. Meanwhile, we’re seeing the rise of “1 trillion company artificial intelligence (AI)” players that are positioning themselves to become the next generation of market leaders. These companies aren’t just adding AI features to existing products - they’re building their entire business models around artificial intelligence, creating sustainable competitive advantages that could propel them to trillion-dollar valuations and beyond.

Looking for a game to boost concentration and brain activity? Sudoku Journey: Grandpa Crypto is here to help you stay sharp.

The Broader Market Context: Thiel’s Warning and Investment Implications

Peter Thiel’s recent warning to Elon Musk about philanthropy adds another layer to our market analysis. Thiel reportedly cautioned Musk to “rethink donating his wealth,” suggesting it might be “much worse to give it to Bill” Gates’ foundation-style approaches. This philosophical debate among tech billionaires reflects broader concerns about how massive wealth concentrations should be deployed and whether traditional philanthropy delivers the impact these innovators seek. From an investment perspective, Thiel’s warning underscores the importance of strategic capital allocation - whether we’re talking about billionaire wealth or our own investment portfolios. The same principles that make these tech leaders successful in business often inform their views on philanthropy and capital deployment. For us as investors, this reinforces the need for thoughtful, strategic approaches to building our portfolios rather than following trends or making emotional decisions. The convergence of these factors - emerging competitors to tech giants, stock split opportunities, AI-driven growth stories, and philosophical debates about capital allocation - creates a fascinating market environment. Companies that successfully navigate these dynamics while maintaining strong fundamentals and clear growth trajectories represent the most compelling investment opportunities in today’s market.

Curious about the next winning numbers? Powerball Predictor uses advanced AI to recommend your best picks.

As we wrap up today’s analysis, remember that identifying the next wave of market leaders requires looking beyond current market caps and toward fundamental innovation, strategic positioning, and sustainable competitive advantages. Whether it’s Apple’s emerging competitor, stock-split candidates, or AI-driven growth stories, the common thread is innovation and strategic execution. Stay disciplined, keep researching, and as always - invest don’t speculate. Until next time, this is Kane Buffett reminding you that the best investment you can make is in your own knowledge.

🎯 For investors who want to stay competitive in today’s fast-paced market, explore The AI Revolution Top Stocks to Watch in 2025s Explosive Market for comprehensive market insights and expert analysis.