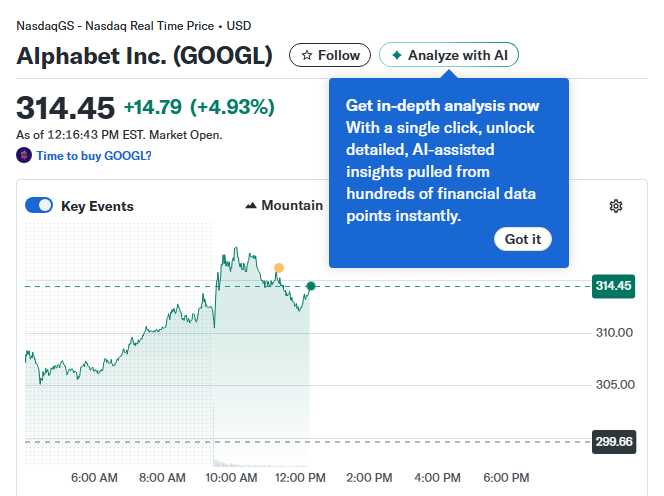

Warren Buffetts AI Bet Why Alphabet Could Be the Next Trillion-Dollar Winner in the AI Revolution

Hey fellow investors! Kane Buffett here with another deep dive into the markets. As we approach December, the Federal Reserve’s recent hints about potential rate cuts have created exciting opportunities, particularly in the AI sector. With major investors like Warren Buffett making bold moves into Alphabet and other tech giants, there’s never been a more crucial time to understand where the smart money is flowing. In today’s analysis, we’ll explore why AI stocks, particularly Alphabet, represent one of the most compelling investment opportunities of our generation.

📋 For anyone interested in making informed investment decisions, this thorough examination of Why Northrop Grumman (NOC) Represents a Compelling Buy Opportunity in the Expanding Space Economy for comprehensive market insights and expert analysis.

The Federal Reserve’s recent signals about potential December rate cuts have created a bullish sentiment across equity markets. According to Benzinga, Dow Jones and S&P 500 futures are rising as investors anticipate easier monetary policy. This macroeconomic backdrop provides fertile ground for growth stocks, particularly in the technology sector. Meanwhile, Investing.com analysis highlights key divergences between the Russell 2000, S&P 500, and Nasdaq, suggesting increased volatility ahead. These market conditions create both challenges and opportunities for savvy investors. The real story, however, lies in the artificial intelligence revolution. As multiple Fool.com articles emphasize, the AI battle isn’t just about chips - it’s about compute efficiency. Companies that can deliver superior computational performance while managing costs will emerge as long-term winners. This shift represents a fundamental change in how we should evaluate tech investments, moving beyond traditional metrics to consider computational advantages and AI infrastructure capabilities.

To minimize the risk of hacking, it’s smart to rely on a secure password generator tool that creates complex passwords automatically.

Warren Buffett’s Berkshire Hathaway has made a monumental bet on Alphabet, and the reasoning behind this move reveals profound investment wisdom. Multiple Fool.com analyses indicate that Alphabet is well-positioned for the next decade of AI growth, with some experts suggesting it could become the world’s next $5 trillion company. Since Buffett’s Berkshire initiated its position, Alphabet stock has surged significantly, validating the Oracle of Omaha’s timing and selection. But why Alphabet specifically? The company’s dominance in search, cloud computing through Google Cloud, and AI research through DeepMind creates a powerful trifecta. More importantly, Alphabet’s massive data resources and computational infrastructure give it unprecedented advantages in the AI arms race. As one analysis notes, Berkshire’s stake in Alphabet could be transformative for both companies. Meanwhile, other billionaires are making similar moves - Stanley Druckenmiller recently bought significant positions in AI-related stocks, while some are selling traditional holdings like Philip Morris International to reallocate toward technology. This represents a fundamental shift in how the world’s most successful investors are positioning their portfolios.

Want to boost your memory and focus? Sudoku Journey offers various modes to keep your mind engaged.

Beyond Alphabet, several other AI stocks present compelling opportunities. Micron Technology, as analyzed by Fool.com, may be the most underrated artificial intelligence stock currently available. The company’s memory and storage solutions are critical components in AI infrastructure, yet it often flies under the radar compared to more prominent semiconductor names. Other top AI stocks to consider include companies focused on compute efficiency - the real bottleneck in AI development. As BCC Research’s new Model Context Protocol connections demonstrate, access to proprietary market data and advanced analytical tools is becoming increasingly valuable in this space. For investors with $5,000 to deploy right now, the best AI stocks represent companies with sustainable competitive advantages, strong financial positions, and clear paths to AI-driven growth. The key is focusing on companies that aren’t just AI beneficiaries but are actively shaping the AI landscape through innovation and strategic positioning. This approach mirrors Buffett’s philosophy of investing in businesses with durable competitive advantages, applied to the modern technological landscape.

💡 Want to understand the factors influencing stock performance? This analysis of Why Johnson & Johnsons Strategic Moves Make It a Compelling Healthcare Investment for comprehensive market insights and expert analysis.

As we navigate these exciting but volatile markets, remember that successful investing requires both conviction and patience. The AI revolution is still in its early innings, and companies like Alphabet represent not just technological innovators but fundamentally strong businesses with multiple growth drivers. While market volatility may continue in the short term, particularly with the Russell 2000 showing divergences from larger indexes, the long-term trajectory for well-positioned AI stocks remains compelling. As always, do your own research, consider your risk tolerance, and think like Warren Buffett - focus on wonderful businesses at fair prices rather than fair businesses at wonderful prices. The AI gold rush is here, but the real wealth will be built by those who identify the picks and shovels companies powering this transformation.

💬 Real opinions from real diners — here’s what they had to say about Californios to see what makes this place worth a visit.