Beyond Nvidia 5 Semiconductor Stocks Set to Dominate in 2026 and Why You Should Care

Hey folks, Kane Buffett here. For a decade on this blog, we’ve ridden the waves of the tech sector together. Lately, one name has dominated the conversation: Nvidia. Its GPUs are the undisputed engines of the AI revolution, and the stock’s performance has been nothing short of legendary. But as we look toward 2026, a critical question emerges for investors: Is the story over if you missed the Nvidia rocket ship? Absolutely not. The semiconductor space is vast, and the AI megatrend is creating multiple winners beyond the current champion. Today, we’re diving deep into the chip ecosystem to identify the next set of potential dominators. We’ll analyze not just Nvidia’s enduring role but also the compelling cases for Broadcom, AMD, and others, backed by recent news and events that could shape the coming year. Let’s get into the silicon.

💰 For investors seeking profitable opportunities in today’s volatile market, this detailed analysis of aTyr Pharma Investor Alert Class Action Lawsuits and What You Need to Know for comprehensive market insights and expert analysis.

The Nvidia Conundrum: King, but for How Long? Let’s address the elephant in the room first. According to a recent analysis, the burning question for December is whether to buy Nvidia (NVDA) stock. The arguments are compelling. Nvidia’s data center revenue, fueled by its H100, H200, and the upcoming Blackwell architecture GPUs, remains in a league of its own. The company has created a software moat with its CUDA platform, locking developers into its ecosystem. However, the article rightly points out the risks: sky-high valuations that bake in near-perfect execution, increasing competition from rivals like AMD and in-house efforts by cloud giants (Google’s TPU, Amazon’s Trainium), and the cyclical nature of the semiconductor industry. The sentiment here is cautiously optimistic but tempered by realism. The stock isn’t for the faint of heart, and any stumble in execution or demand could lead to significant volatility. Sentiment Analysis: Positive (7/10). Sensitivity: 8/10 (Nvidia’s stock price is highly sensitive to news about AI demand, competition, and quarterly guidance).

💰 Don’t let market opportunities pass you by - here’s what you need to know about The Data Center Boom is Just Starting My Top AI and Semiconductor Picks for December 2025 for comprehensive market insights and expert analysis.

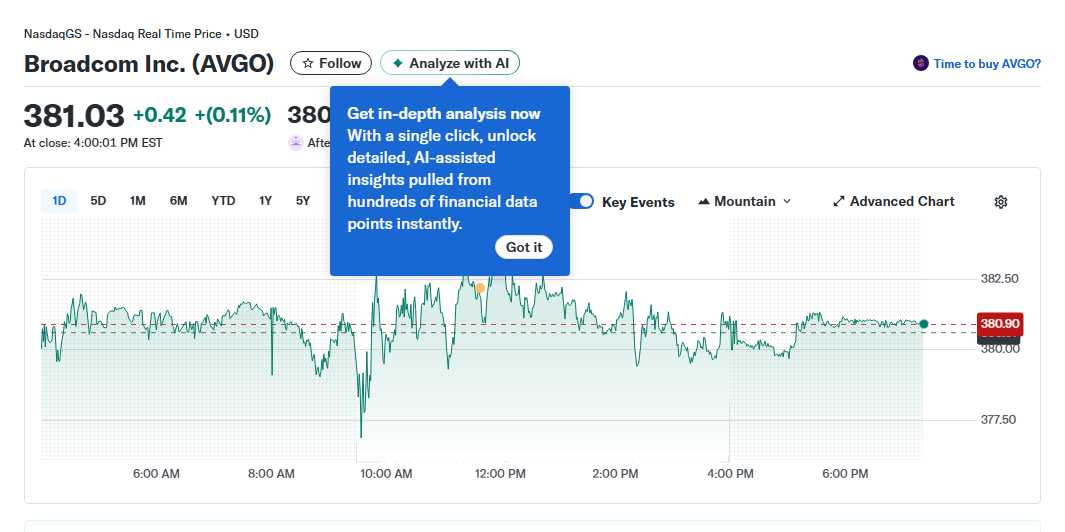

The Contenders: Building the AI Infrastructure Beyond GPUs The AI revolution requires more than just GPUs. It needs a complete silicon infrastructure. This is where other players come into focus. Broadcom (AVGO) is a prime example. Its upcoming December 11th event is highlighted as a “big day,” likely centered on its custom AI accelerator chips and networking solutions. Broadcom isn’t trying to beat Nvidia at its own game; it’s dominating the adjacent fields. Its custom silicon business for large clients like Google and its dominance in networking (crucial for connecting thousands of AI chips in data centers) position it as a critical, albeit less flashy, pillar of AI infrastructure. Advanced Micro Devices (AMD) is the direct challenger. With its MI300X Instinct accelerators gaining traction and a roadmap that promises increasing competitiveness, AMD is carving out a solid #2 position. It offers customers a viable alternative, which is valuable in a market hungry for supply and options. Then there are the foundational players: Taiwan Semiconductor Manufacturing Company (TSMC). As the world’s leading foundry, TSMC manufactures the most advanced chips for Nvidia, AMD, Apple, and others. It’s the “picks and shovels” play on the entire industry’s growth. Intel (INTC) and Qualcomm (QCOM) represent turnaround and diversification stories, with Intel pushing into foundry services and AI chips, and Qualcomm aiming to bring AI to the device edge (PCs, phones, cars). Sentiment Analysis: Positive (8/10). Sensitivity: 7/10 (These stocks are sensitive to broader tech sentiment, product execution, and market share shifts).

Ready to play smarter? Visit Powerball Predictor for up-to-date results, draw countdowns, and AI number suggestions.

The Power of the Basket: Don’t Underestimate the Tech ETF For investors who don’t want the stress of picking individual winners in this complex and fast-moving sector, the article provides a powerful reminder: the Technology Select Sector SPDR Fund (XLK). A historical perspective shows that a $1,000 investment in this ETF, which holds a basket of major tech names including many of the chip stocks discussed, would have grown substantially over the long term. This approach offers diversification, reducing company-specific risk while maintaining exposure to the sector’s overall growth. As of its last rebalance, top holdings include Apple, Microsoft, and Nvidia. For a set-it-and-forget-it investor, a quality ETF like XLK is a brilliant way to gain semiconductor and tech exposure without having to time the market or predict which chip designer will win the next round. It’s the ultimate “don’t bet against the house” strategy for the digital age. Sentiment Analysis: Positive (9/10). Sensitivity: 5/10 (ETFs are generally less sensitive to individual stock news, though they react to broad sector trends).

Looking for the perfect username for your next game or social profile? Try this random nickname generator with category filters to get inspired.

So, what’s the takeaway as we peer into 2026? The semiconductor arena is far from a one-horse race. Nvidia may be the current pacesetter, but the race to build and power AI is creating massive opportunities across the supply chain. From Broadcom’s essential networking and custom chips, to AMD’s competitive thrust, to TSMC’s manufacturing supremacy, multiple companies are poised to dominate in their respective niches. Your strategy depends on your risk appetite: ride the potential continued wave with the leader (NVDA), build a portfolio of challengers and enablers (AVGO, AMD, TSMC), or take the diversified, lower-maintenance route with a tech ETF (XLK). Do your homework, understand what you own, and as always, think long-term. The silicon cycle turns, but the direction of technological progress is clear. Stay invested, stay smart. This is Kane Buffett, signing off.

🌮 Curious about the local dining scene? Here’s a closer look at The Laundromat to see what makes this place worth a visit.