The Data Center Boom is Just Starting My Top AI and Semiconductor Picks for December 2025

Hey everyone, Kane Buffett here. As we roll into December, the market’s focus is laser-sharp on the engines of the modern economy: artificial intelligence and the data centers that power it. This isn’t just a fleeting trend; we’re witnessing the foundational build-out of the next digital era. I’ve been digging through the latest earnings, news, and industry shifts, and the message is clear: the opportunity is massive, but so is the selectivity required. Let’s break down why the data center boom has legs and which players are positioned to win—and which ones might be facing some serious headwinds.

💰 Don’t let market opportunities pass you by - here’s what you need to know about The AI Investment Megatrend Navigating Nvidia, Palantir, and AI ETFs for Explosive Growth for comprehensive market insights and expert analysis.

The Unstoppable Data Center Megatrend: More Than Just a Cycle The recent analysis from The Motley Fool hits the nail on the head: the data center boom is just starting. This isn’t about a few companies building server racks; it’s a global, capital-intensive infrastructure arms race driven by the insatiable demand for AI processing. Every query to ChatGPT, every AI model training run, and every advanced cloud service requires immense computational power, which translates directly to demand for data center space, power, and cooling. This creates a powerful tailwind not just for chip designers like Nvidia, but for the entire ecosystem: semiconductor manufacturers (like TSMC), memory providers (like Micron), and even data center real estate investment trusts (REITs). The key takeaway? We are in the early innings of a multi-decade shift. Companies are planning data center projects that won’t come online for years, signaling deep, long-term conviction in AI’s infrastructure needs. This foundational growth provides a relatively stable floor for related investments, even amid short-term stock market volatility.

Take your Powerball strategy to the next level with real-time stats and AI predictions from Powerball Predictor.

Spotlight on the Champions: Nvidia and Micron In this landscape, two stocks stand out for their seemingly unshakable strategic positions. First, Nvidia (NVDA). The question isn’t “if” you should buy Nvidia, but “how to think about it” in December. Its recent earnings once again shattered expectations, demonstrating that its dominance in AI accelerators (GPUs) is not just maintained but expanding. The company is effectively the “picks and shovels” vendor to the AI gold rush. While its valuation is rich and any stumble would be punished, its technological moat and integration into every major AI project make it a core holding for any tech investor. The current dip in December might be a buying opportunity for those with a long-term horizon. Second, Micron Technology (MU). Touted as a top AI stock to buy, Micron’s role is critical. AI doesn’t just need processing power (GPUs); it needs vast amounts of high-speed memory (HBM - High Bandwidth Memory) and storage. Micron is a leader in HBM and is seeing explosive demand that is transforming its financials. Unlike some cyclical downturns of the past, this demand is driven by a structural shift toward AI, suggesting stronger and more sustained pricing power. For investors looking for an AI play beyond the usual suspects, Micron offers a compelling and essential link in the value chain.

If you want to improve focus and logical thinking, install Sudoku Journey with classic, daily, and story modes and challenge yourself.

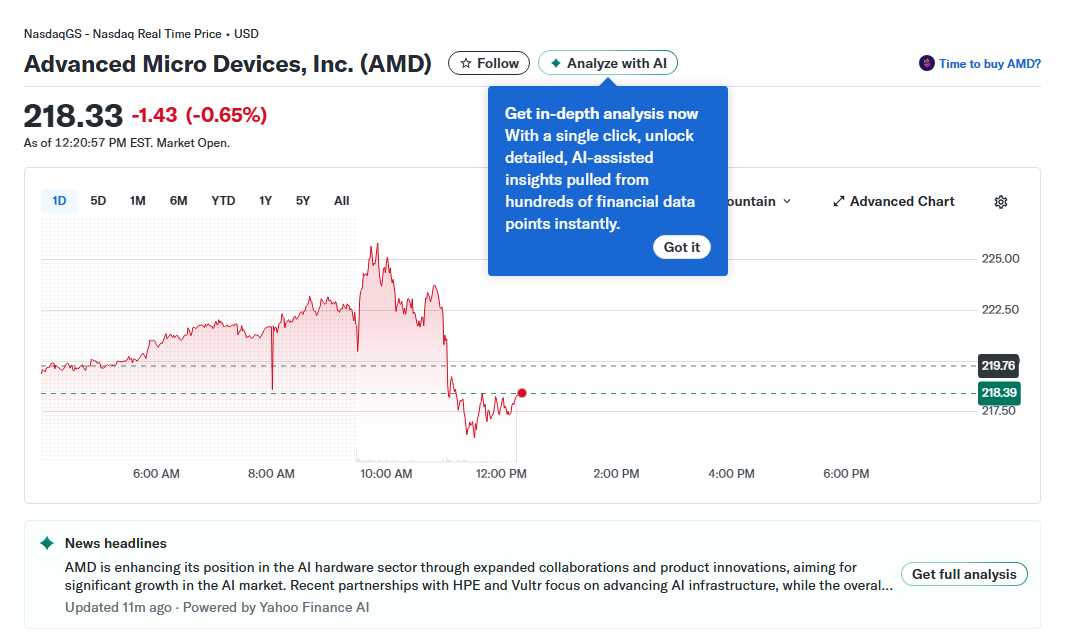

Navigating the Volatility: AMD’s Slide and Broader Sector Shakes Not every story is a straight line up. Advanced Micro Devices (AMD) stock fell about 15% in November, serving as a stark reminder of the high expectations baked into these names. Despite strong overall performance and competitive products, AMD faces the daunting task of competing directly with Nvidia’s ecosystem. The market’s reaction shows that “good” isn’t always “good enough” when you’re measured against a behemoth. This creates potential opportunities, but it requires careful timing and conviction in AMD’s long-term execution. Beyond individual stocks, the sector is buzzing with news that impacts sentiment. The lawsuit between TSMC and a former employee over trade secrets highlights the intense, high-stakes nature of semiconductor manufacturing IP. Meanwhile, Baidu’s reported layoffs in its cloud and AI groups signal the intense competitive and financial pressures in China’s tech sector, even as it pushes for AI independence. These events contribute to a sensitivity score of 8/10 for the sector—news moves prices quickly. The sentiment from the collected news is cautiously optimistic but grounded in reality. The foundational trend is powerfully positive (+8), but individual company execution risks and competitive battles introduce notes of caution and volatility.

🌮 Curious about the local dining scene? Here’s a closer look at Gyro Xpress to see what makes this place worth a visit.

So, what’s the play for December? Focus on the infrastructure beneficiaries of the AI boom. The data center build-out is a tangible, capital-heavy trend that will persist regardless of which AI application wins next. Nvidia and Micron represent two pillars of this infrastructure. Keep a watchful eye on AMD for potential entry points during pessimism, but understand the competitive landscape. Always do your own research and consider your risk tolerance—this sector isn’t for the faint of heart. But for those willing to ride the volatility, the structural growth story is one of the most compelling of our time. Stay sharp, invest wisely.

📈 For serious investors seeking alpha, this detailed breakdown of Why Coca-Cola and Dividend Stocks Like J&J Snack Foods Remain Timeless Investments in 2026 for comprehensive market insights and expert analysis.