The AI Investment Landscape Uncovering Opportunities Beyond the Hype

Hey folks, Kane Buffett here. As we navigate through 2025’s volatile markets, I’m seeing incredible opportunities and significant risks in the AI sector that demand our attention. Having analyzed thousands of tech cycles over my decade of blogging, the current AI revolution feels different - more substantial, yet filled with potential traps. Today, we’re diving deep into ten critical developments that could shape your portfolio for years to come. From Alphabet’s monster quarter to Nvidia’s concerning fundamentals, and from PayPal’s OpenAI partnership to emerging cybersecurity threats, we’re covering it all with the clear-eyed analysis you’ve come to expect.

💰 Don’t let market opportunities pass you by - here’s what you need to know about AI Revolution 2025 Why NVIDIA, Amazon, and TSMC Are Reshaping the Investment Landscape for comprehensive market insights and expert analysis.

The cryptocurrency mining sector is showing fascinating developments, particularly with Cipher Mining’s recent announcement of a proposed $1.4 billion senior secured notes offering. This massive capital raise signals both confidence in Bitcoin’s long-term prospects and the increasing institutionalization of crypto mining operations. However, such substantial debt offerings always carry risk - particularly in the volatile crypto space. Meanwhile, the broader AI infrastructure story continues to unfold with Digital Realty Trust delivering exactly what the market needs: robust data center capacity. As AI models grow exponentially in size and complexity, the physical infrastructure supporting them becomes increasingly valuable. Digital Realty represents a critical piece of the AI puzzle that many investors overlook in their rush to buy pure-play AI companies. The company’s strategic positioning in data center real estate makes it an intriguing indirect play on AI growth, though REITs come with their own unique considerations around interest rates and property valuations.

📊 Looking for actionable investment advice backed by solid research? Check out AI Stock Slump Exposes Reality Check Navigating the Volatile Tech Landscape for comprehensive market insights and expert analysis.

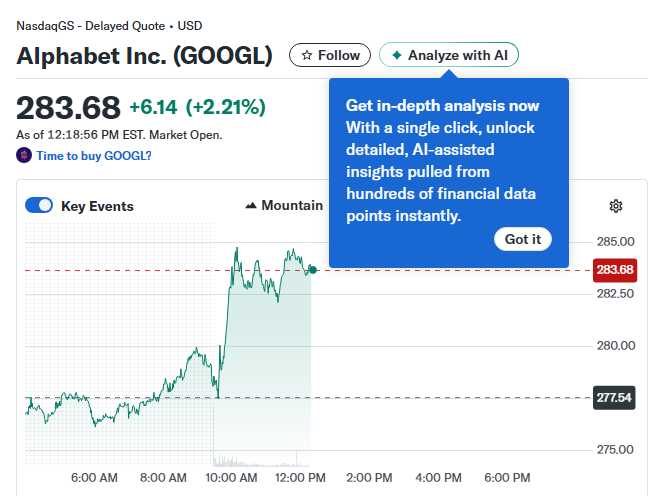

Alphabet just delivered a staggering $100 billion quarter that sent a clear message to the market: Google’s AI integration is driving phenomenal financial performance. This isn’t just incremental growth - we’re witnessing fundamental transformation as AI enhances search, cloud services, and advertising efficiency. However, the most concerning development comes from Nvidia, where analysis suggests the world’s most valuable company might be built on borrowed time. The “Nvidia trap” refers to the unsustainable expectations baked into its current valuation, with competition intensifying from AMD, Intel, and custom silicon developers. Meanwhile, Vanguard index funds heavily weighted toward the Magnificent Seven stocks present both opportunity and concentration risk. While these tech giants have driven market returns for years, history teaches us that leadership eventually rotates. Elon Musk’s recent comments about quantum computing add another layer to the tech discussion, though investors should approach quantum computing stocks with appropriate caution given the technology’s early stage development.

Whether it’s for gaming, YouTube, or online forums, this customizable nickname generator gives you options that match your style.

The generative AI cybersecurity market represents one of the most compelling investment opportunities, projected to grow rapidly from $35.5 billion between 2025-2030. This growth is driven by rising AI supply chain attacks and increasing demand for secure model execution. As AI systems become more integrated into critical infrastructure, the need for robust cybersecurity solutions becomes paramount. Intuitive’s doubling down on AI with their new “Intuitive AI powered by aiE framework” demonstrates how enterprises are building intelligent systems for competitive advantage. Perhaps the most immediate actionable development comes from PayPal’s partnership with OpenAI, which sent shares soaring on strong outlook. This collaboration represents a fascinating convergence of payment processing and AI capabilities, potentially creating new revenue streams and competitive moats. The deal signals how established fintech companies are leveraging AI to stay relevant against disruptive newcomers.

✨ For food lovers who appreciate great taste and honest feedback, Levante to see what makes this place worth a visit.

After analyzing these ten significant developments, the picture that emerges is complex but navigable for disciplined investors. The AI revolution is real and creating enormous value, but it’s also creating valuation bubbles and concentration risks. My advice? Focus on companies with sustainable competitive advantages, reasonable valuations, and multiple growth drivers beyond just AI hype. Consider indirect plays like infrastructure providers alongside direct AI companies, and always maintain proper diversification. The coming years will separate the AI winners from the hype casualties - make sure your portfolio is positioned accordingly. Remember, the goal isn’t to chase every hot trend, but to build wealth steadily through thoughtful, research-driven investing.

If you want a daily Sudoku challenge, download Sudoku Journey with both classic and story modes for endless fun.