AI Revolution 2025 Why NVIDIA, Amazon, and TSMC Are Reshaping the Investment Landscape

Fellow investors, Kane Buffett here. As we navigate the turbulent yet exciting waters of 2025’s AI-driven market, I’m seeing unprecedented opportunities that remind me of the early internet days. The recent flurry of developments from OpenAI’s partnership with Microsoft to NVIDIA’s strategic pivot and Amazon’s surprising surge tells a compelling story about where smart money is flowing. Having weathered multiple market cycles, I can confidently say we’re witnessing a fundamental transformation that will separate the prepared from the passive.

💡 Stay ahead of market trends with this expert perspective on The Dividend King Joining the $1 Trillion Club & Amazons Unstoppable Growth for comprehensive market insights and expert analysis.

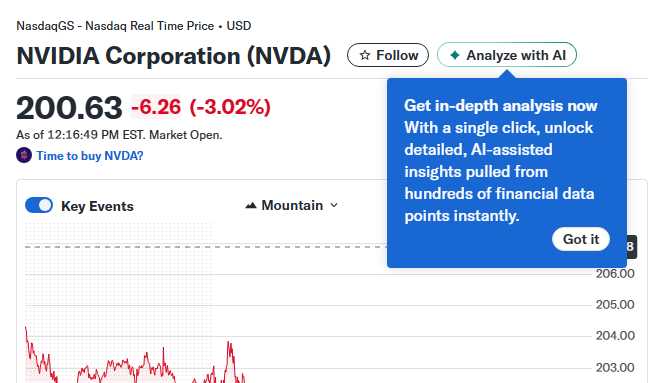

The AI infrastructure war is intensifying, and recent developments reveal clear winners emerging. NVIDIA’s recent ‘game-changing move’ signals a strategic shift from frontline AI chip supplier to a more diversified technology provider, which could actually strengthen their long-term position despite some analysts calling it ‘built on borrowed time.’ Meanwhile, Amazon’s 5% single-day jump demonstrates the market’s enthusiasm for their OpenAI partnership, positioning them as a serious contender in the cloud AI race against Microsoft. The generative AI cybersecurity market, projected to grow to $35.5 billion by 2030, highlights the critical need for secure AI infrastructure as supply chain attacks increase. This creates massive opportunities for companies like Digital Realty Trust, which is delivering essential data center infrastructure that the entire AI ecosystem depends on. The S&P 500’s push toward fresh highs, fueled by AI momentum and trade truces, suggests this isn’t just a temporary rally but a structural market shift.

🔎 Looking for a hidden gem or trending restaurant? Check out Himalayan House to see what makes this place worth a visit.

Beyond the headline giants, strategic opportunities abound in the AI value chain. TSMC represents what I call a ‘pick-and-shovel’ play in the AI gold rush - while everyone focuses on NVIDIA’s chips, TSMC manufactures them with unparalleled expertise. Their stock offers five compelling reasons for investment, including technological leadership and massive capacity expansion. Similarly, SoundHound AI, down nearly 30%, presents a potential buying opportunity for those who believe in voice AI’s long-term potential. The data center REIT sector, particularly Digital Realty Trust, is positioned to benefit regardless of which AI company ultimately wins, as they all need physical infrastructure. Meanwhile, institutional moves reveal sophisticated positioning - Belpointe’s nearly $24 million iShares iBonds ETF purchase and Elevation Capital’s strategic accumulation of USMC shares show smart money building exposure to fixed income and defense sectors as hedges against AI volatility.

Looking for both brain training and stress relief? Sudoku Journey: Grandpa Crypto is the perfect choice for you.

Investment strategy in this AI-dominated landscape requires both conviction and caution. The ‘Magnificent Seven’ stocks continue to drive market performance, with Vanguard index funds heavily weighted toward these giants providing diversified exposure. However, the NVIDIA ‘trap’ narrative serves as an important reminder that even dominant companies face challenges from competition, regulation, and technological shifts. The consumer tech landscape saw NVIDIA surpass a $5 trillion market cap, but also witnessed Beyond Meat’s surprising outperformance relative to NVIDIA in certain periods, reminding us that diversification matters. Earnings season brought mixed results, with Amazon and Apple posting strong numbers while Netflix’s stock split generated additional retail interest. The key insight for investors is to focus on companies with sustainable competitive advantages, strong financials, and clear AI integration strategies rather than chasing pure AI hype.

Looking for a fun way to boost memory and prevent cognitive decline? Try Sudoku Journey featuring Grandpa Crypto for daily mental exercise.

The AI revolution is creating one of the most dynamic investment environments I’ve seen in my career. While NVIDIA, Amazon, and Microsoft dominate headlines, the real opportunities may lie in the essential infrastructure and semiconductor companies that enable the entire ecosystem. Remember the lessons from previous technological transformations: the biggest winners often aren’t the most visible players initially. Stay disciplined, focus on companies with durable competitive advantages, and maintain a long-term perspective. The AI train is leaving the station - make sure you’re on board with the right tickets. Until next time, invest wisely. - Kane Buffett

This nickname generator lets you pick from different categories and even save your favorites for later.