The 2026 Tech Supercycle Why Microsoft, Alphabet, and Amazon Are Just Getting Started

Hey folks, Kane Buffett here. If you’ve been watching the markets lately, you can feel the electricity in the air. It’s not just another earnings season; it feels like a tectonic shift. Analysts like Dan Ives from Wedbush are calling this a “mid-1996 moment” for tech, drawing a direct parallel to the dawn of the internet era. We’re standing at the precipice of the AI and cloud computing revolution, and the Q4 earnings from the giants—Microsoft, Alphabet, and Amazon—are set to be the proof of concept. In this post, we’ll dive deep into why these companies are poised for explosive growth, analyze the broader market rebound, and look at other key players like Nvidia and Uber shaping our future. Buckle up; this is where the real money is made.

💡 Stay ahead of market trends with this expert perspective on The Ultimate 2026 AI Investing Playbook From Nvidias Next Leap to the $3 Trillion Club for comprehensive market insights and expert analysis.

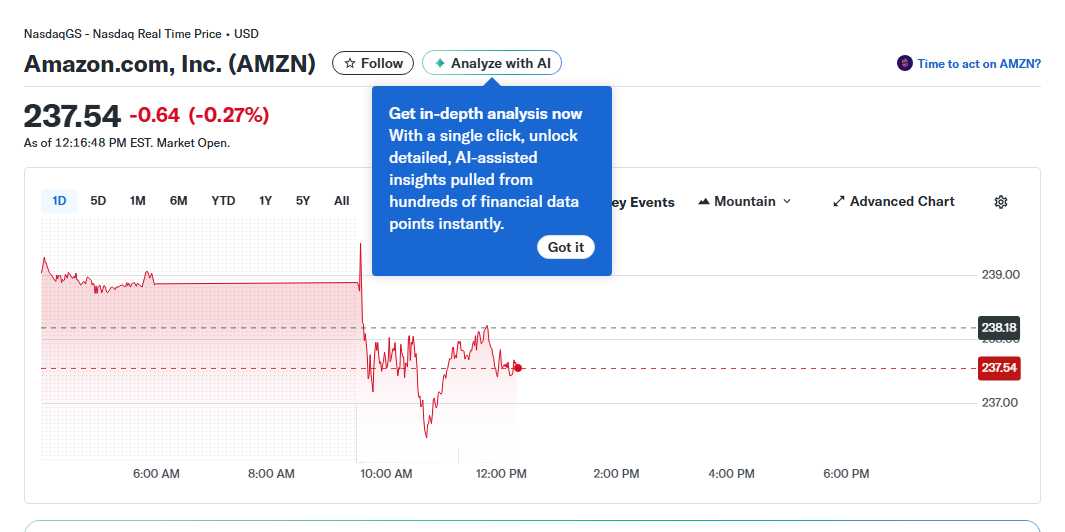

The “Mid-1996 Moment”: Decoding the Tech Earnings Supercycle The buzzword on every analyst’s lips is “mid-1996 moment,” a term popularized by Dan Ives. This isn’t hyperbole. In 1996, the internet’s commercial potential began to crystallize, creating fortunes for early believers. Today, we’re at a similar inflection point with Artificial Intelligence and cloud infrastructure. Microsoft, Alphabet (Google), and Amazon are the undisputed titans powering this transformation. Their upcoming Q4 earnings are expected to be “very strong,” not merely due to cyclical recovery but because of fundamental, structural demand. Microsoft, with its deep integration of AI across Azure, Office, and GitHub, is becoming the operating system for the modern enterprise. Alphabet, having recently joined the elite $5 trillion market cap club, is seeing relentless growth in Google Cloud and its core advertising business, fueled by AI-driven search and automation. Amazon, despite some headline legal battles (like its failed attempt to block Saks’ bankruptcy financing), continues to dominate e-commerce and AWS, its profit engine. The sentiment here is overwhelmingly bullish. The market isn’t just betting on good quarters; it’s betting on a decade-long supercycle. The S&P 500 and Nasdaq futures gaining, led by a rebound in tech stocks and giants like Taiwan Semiconductor, signal broad institutional confidence. This isn’t a speculative bubble; it’s a capital reallocation into the foundational platforms of the next economy.

🥂 Whether it’s date night or brunch with friends, don’t miss this review of Harlowe to see what makes this place worth a visit.

Beyond the Trillion-Dollar Club: Stock-Specific Deep Dives and Opportunities While the mega-caps lead the charge, specific stories within the tech ecosystem offer incredible opportunities. Let’s break down a few. Nvidia: The Millionaire Maker? The Fool poses a tantalizing question: could a $10,000 investment in Nvidia stock make you a millionaire? Given its near-monopoly on AI-accelerator chips (GPUs) and its central role in everything from data centers to autonomous vehicles, the math isn’t as far-fetched as it seems. Its growth trajectory, while volatile, is tied directly to the AI explosion, making it a high-risk, astronomical-reward play. Amazon vs. The Field: E-Commerce and Cloud Dominance A comparison between Amazon and Sea Limited highlights Amazon’s enduring moat. While Sea is a formidable growth story in Southeast Asia, Amazon’s combination of AWS, a global logistics network, and Prime subscriber loyalty creates an unparalleled ecosystem. Even with legal skirmishes, its core business is fortress-like. The “Proof” Year for Uber and UPS 2026 is framed as a year where companies need to prove their long-term models. For Uber, it’s about moving beyond growth-at-all-costs to sustained, profitable expansion in ride-sharing and delivery. For UPS, the challenge is adapting its legacy logistics model to an era dominated by Amazon and instant delivery expectations. Their stocks will be judged on execution, not promise. Microsoft’s Quiet Retail Revolution An interesting analysis points out Microsoft’s strategy to “power retail without competing with it.” Through cloud solutions (Azure), AI analytics, and partnerships, Microsoft is embedding itself into the retail supply chain, competing with Amazon Web Services without needing to sell a single product directly to consumers—a brilliant flanking maneuver.

This nickname generator lets you pick from different categories and even save your favorites for later.

The Undercurrents: Blockchain AI, Marketplaces, and Future Catalysts The tectonic plates shifting beneath the big tech names are just as important. Two press releases highlight massive future trends. First, the Blockchain AI Market is projected to reach a staggering USD 4,036.95 Million by 2033. This convergence of secure, decentralized ledgers with intelligent data processing is the next frontier, promising to revolutionize sectors from finance to supply chain management. Companies that can integrate this (think of cloud providers offering blockchain-as-a-service) will unlock new growth vectors. Second, the expansion of FBAReviews.com, celebrating 8 years and expanding services, underscores the robust and maturing ecosystem around Amazon’s FBA (Fulfillment by Amazon) program. This shows that the “pick-and-shovel” plays—the services that enable others to succeed on these giant platforms—are thriving businesses in themselves. This indicates a deep, healthy, and multi-layered digital economy that extends far beyond the stock tickers of the giants. For investors, this means looking at enablers, integrators, and niche dominators within the tech supercycle, not just the most obvious names.

Stay ahead in Powerball with live results, smart notifications, and number stats. Visit Powerball Predictor now!

So, what’s the takeaway for us investors? We are witnessing a rare, generational setup. The “mid-1996” analogy is apt: we know something huge is happening, but its full scope is still unfolding. Positioning a core part of your portfolio in the foundational players—Microsoft, Alphabet, Amazon—is a bet on the inevitable digitization and AI-ification of the global economy. Supplement that with calculated bets on enablers like Nvidia and watch the emerging trends in blockchain AI. Stay disciplined, focus on companies with unassailable moats and clear paths to profitability, and ignore the short-term noise. The next few earnings reports will be more than numbers; they’ll be the validation of this new era. This is the time for conviction. Keep investing wisely, Kane Buffett out.

Relieve stress and train your brain at the same time with Sudoku Journey: Grandpa Crypto—the perfect puzzle for relaxation and growth.