Market Dominance, Cash Kings, and Your Portfolio Unpacking the Forces Shaping Q4 2025

Hey folks, Kane Buffett here. The markets have been on an absolute rollercoaster, and if you’re not paying attention, you’re missing some of the most critical shifts we’ve seen in years. This past week has been a masterclass in extremes: from Nvidia officially joining the most exclusive club on Wall Street to Warren Buffett sitting on a mountain of cash that would make Scrooge McDuck blush. We’re also seeing seismic moves in China with Alibaba, and the eternal debate between ETF strategies is heating up. Let’s break down what’s really happening and what it means for your hard-earned money.

📈 For serious investors seeking alpha, this detailed breakdown of AI Revolution Navigating the Next Wave of Tech Investments from NVIDIA to Meta for comprehensive market insights and expert analysis.

The Unstoppable Ascent of Nvidia and the Big Tech Engine

The story of the year, and arguably the decade, continues to be Nvidia. The chipmaker has officially shattered the $5 trillion market capitalization barrier, a feat that cements its dominance in the AI and data center revolution. This isn’t just a number; it’s a statement. The surge was fueled by another blockbuster earnings report, demonstrating that the demand for its processors, especially the new “Blackwell” architecture, shows no signs of slowing. This milestone places Nvidia in a rarefied air alongside peers like Apple and Microsoft, but its growth trajectory remains uniquely steep. Meanwhile, the broader tech landscape is buzzing. Amazon and Apple also posted strong earnings, with Amazon’s cloud division (AWS) showing robust growth and Apple’s iPhone and services revenue beating expectations. Netflix’s impending stock split has generated retail investor excitement, making shares more accessible and often a precursor to renewed buying pressure. However, it’s crucial to view this through a macro lens. The Federal Reserve’s recent rate cuts have provided a tailwind for growth-oriented tech stocks, as seen in the Nasdaq’s gains. The “big tech” cohort, including these names, is effectively pulling the entire market higher, creating a concentration risk that every investor must be aware of. The conclusion of the Trump-Xi meeting, while light on specific details, has at least temporarily eased the most acute geopolitical tensions, providing a clearer runway for multinational tech giants.

🔎 Looking for a hidden gem or trending restaurant? Check out Chiu Quon Bakery & Dim Sum to see what makes this place worth a visit.

Contrarian Plays and the Oracle’s Patience: Alibaba and Berkshire’s Billions

While the U.S. tech scene is white-hot, a different kind of opportunity has been unfolding in China. Alibaba stock has skyrocketed more than 110% this year. This monumental rebound is driven by a potent mix of aggressive share buybacks, a stabilization in the Chinese consumer market, and a perceived thaw in the regulatory frost that had plagued the tech sector. For U.S. investors, this represents a high-risk, high-reward contrarian play. It’s a bet on the resurgence of Chinese consumer strength and the company’s ability to navigate its complex regulatory environment. On the complete opposite end of the spectrum, we have Berkshire Hathaway. The Oracle of Omaha, Warren Buffett, is now sitting on a staggering $382 billion in cash. Let that number sink in. This isn’t just a war chest; it’s a loud and clear market signal. Buffett is famously patient and disciplined, and this record pile of cash indicates that he finds few, if any, attractive buying opportunities at current market valuations. It’s a defensive posture that suggests caution. For the retail investor, this raises a critical question: if the world’s most celebrated value investor can’t find anything worth buying, should we be scaling back our own enthusiasm? This massive cash position acts as a potential anchor for the market, a reminder that valuations across the board are stretched.

Before troubleshooting any network issue, it’s smart to check your IP address and approximate location to rule out basic connectivity problems.

The Investor’s Toolkit: Navigating Choices from Apple to ETFs

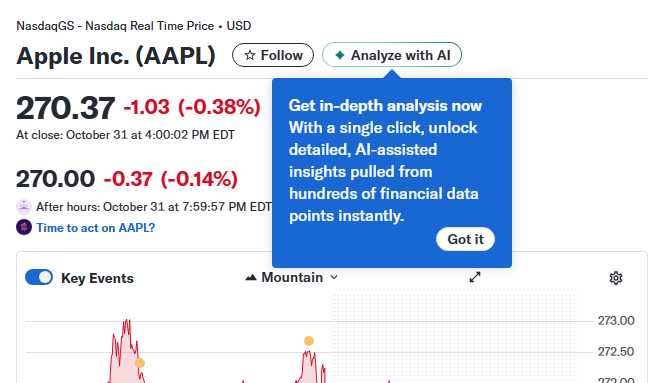

So, where does this leave the individual investor? The key is strategic positioning. Let’s take a specific example: Apple. The question “Where will Apple stock be in 1 year?” is on everyone’s mind. Analysis suggests its path is tightly linked to its AI integration in the upcoming iPhone cycle and the continued growth of its high-margin Services segment. A successful AI rollout could propel it significantly higher, while any misstep could lead to stagnation. This is a microcosm of the broader tech bet. For those not wanting to pick individual winners, the ETF route is paramount. The debate between VOO (Vanguard S&P 500 ETF) and VOOG (Vanguard S&P 500 Growth ETF) is more relevant than ever. VOO offers broad, stable diversification across the entire S&P 500, including value and defensive stocks. VOOG, however, is a concentrated bet on the high-flying growth names—precisely the Nvidias and Apples of the world. In a market dominated by a handful of tech giants, VOOG might seem attractive, but it also amplifies your risk if the tech rally falters. VOO provides a safety net. Furthermore, other sectors are showing life. First Solar’s strong earnings report highlights the ongoing momentum in the renewable energy space, a sector that could benefit from continued government support and the global energy transition.

💬 Real opinions from real diners — here’s what they had to say about Okane to see what makes this place worth a visit.

The final quarter of 2025 is shaping up to be a defining period. We have unprecedented technological growth on one side and record-level caution from the world’s smartest investors on the other. The message is clear: there are massive opportunities, but they come with equally massive risks. Your strategy should reflect this duality. Stay invested in quality, consider broad diversification through instruments like VOO to manage risk, and keep a portion of your portfolio in cash, just like Buffett, to be ready for the inevitable market dips. Don’t chase hype, but don’t sit on the sidelines entirely. Stay disciplined, stay informed, and as always, invest don’t gamble. - Kane Buffett

Need a fun puzzle game for brain health? Install Sudoku Journey, featuring Grandpa Crypto’s wisdom and enjoy daily challenges.