The Investors Crossroads S&P 500 Gems, Crypto Choices, and Teslas Tumult in a Volatile Market

Hey folks, Kane Buffett here. As we barrel toward the end of the year, the market feels like it’s holding its breath. We’ve got classic blue-chips poised for a run, a crypto debate that never dies, and one of the market’s most-watched CEOs back in the headlines for a staggering reason. I’ve sifted through the latest data and headlines to break down what really matters for your portfolio. Strap in; we’re navigating a fascinating crossroads where conviction, volatility, and long-term vision collide.

📱 Get real-time market insights and expert analysis by checking out this review of Biopharma Breakthroughs Why ADC Drugs and Clinical Pipeline Updates Signal Major Investment Opportunities for comprehensive market insights and expert analysis.

Navigating Year-End Volatility and High-Conviction Plays The market is at a pivotal juncture, with analysts pointing to a “volatility reset” and shifting funding dynamics creating a tense environment for equities. This isn’t a time for guesswork; it’s a time for high-conviction positions. Research highlights 11 S&P 500 stocks considered best positioned to outperform into year-end. These aren’t fleeting momentum plays but companies with strong fundamentals, resilient business models, and catalysts that can weather near-term turbulence. The key theme here is selectivity. In a market where broad indices may churn, identifying companies with pricing power, solid balance sheets, and clear growth runways becomes paramount. This volatility isn’t necessarily a red flag for a bear market but a potential reset that separates the robust from the fragile. Investors should focus on sectors and companies demonstrating earnings resilience and operational excellence, as these are the traits that will drive outperformance when the macro winds are uncertain.

Take your Powerball strategy to the next level with real-time stats and AI predictions from Powerball Predictor.

The Eternal Crypto Debate: Speculative Asset vs. Digital Gold On the more speculative end of the spectrum, the Shiba Inu vs. Bitcoin debate rages on. Framing SHIB as a “long-term play” alongside Bitcoin is a classic narrative of meme-driven speculation versus foundational store-of-value thesis. Bitcoin continues to be viewed by its proponents as digital gold—a decentralized, finite asset for the long haul. Shiba Inu, while having a massive community, operates in a completely different risk-reward universe. Its value is heavily tied to social sentiment, hype cycles, and developments within its own ecosystem, lacking Bitcoin’s first-mover advantage and widespread institutional adoption. For a long-term portfolio, this isn’t a fair fight. Bitcoin represents a strategic bet on the future of decentralized finance and digital scarcity. Shiba Inu represents a high-risk, high-reward punt on community growth and token utility. Understanding this fundamental difference is crucial; conflating them as similar “investments” is a recipe for misguided asset allocation.

Want smarter Powerball play? Get real-time results, AI-powered number predictions, draw alerts, and stats—all in one place. Visit Powerball Predictor and boost your chances today!

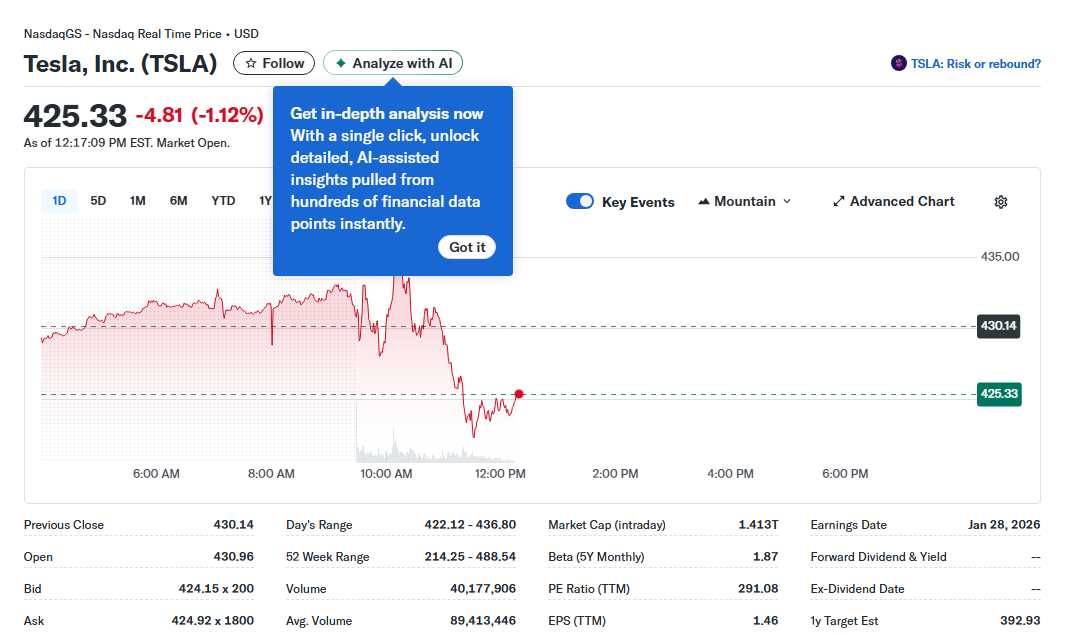

Tesla’s Dual Challenge: Internal Drama and External Competition Tesla finds itself in the spotlight for two major, contrasting reasons. First, new data suggests Tesla risks losing its crown in Europe, with European interest in Chinese electric vehicles surging 16% in 12 months. This isn’t just about price; it’s about quality, features, and the rapid innovation from Chinese EV makers. Tesla’s first-mover advantage is being directly challenged by formidable competitors who are quickly closing the gap in technology and design. Second, and perhaps more startling internally, is the discussion around Elon Musk’s potential $1 trillion pay package. Proponents argue it’s actually “cheap” for shareholders, as it’s heavily performance-based and aligns Musk’s interests astronomically with the company’s success, theoretically driving him to multiply Tesla’s value many times over. Critics see it as an unprecedented dilution event and a governance red flag. This creates a fascinating dichotomy: external competitive pressures are mounting dramatically, while internally, the board is betting the farm on hyper-motivating its CEO. How Tesla navigates this dual challenge—fending off fierce competition while managing extreme executive compensation—will be a defining story for the stock.

Relieve stress and train your brain at the same time with Sudoku Journey: Grandpa Crypto—the perfect puzzle for relaxation and growth.

So, where does this leave us? The landscape is complex but navigable. Focus on high-quality S&P 500 names to anchor your portfolio against volatility. Be brutally honest about your crypto allocations—are you investing or speculating? And with Tesla, understand you’re betting on both Elon Musk’s unparalleled drive and his ability to outmaneuver an army of hungry competitors. As always, do your homework, know what you own, and why you own it. This isn’t about chasing headlines; it’s about building durable wealth. Stay sharp out there. - Kane Buffett

Want smarter Powerball play? Get real-time results, AI-powered number predictions, draw alerts, and stats—all in one place. Visit Powerball Predictor and boost your chances today!