NVIDIAs Strong Results vs. Market Positioning Risk A Buffett-Style Analysis of Current Opportunities

Hey folks, Kane Buffett here. As we navigate these turbulent market waters, I’m seeing some fascinating divergences that remind me why staying disciplined with proven investment strategies matters more than ever. Today we’re diving deep into NVIDIA’s impressive results against growing market risks, while exploring some timeless Warren Buffett wisdom that could help you build real wealth over time. The markets are sending mixed signals, but that’s where opportunities are born for those who know where to look.

📊 Looking for reliable stock market insights and expert recommendations? Dive into Eli Lilly and Novo Nordisk The Pharmaceutical Titans Dominating the GLP-1 Revolution and Beyond for comprehensive market insights and expert analysis.

NVIDIA’s Remarkable Performance Amid Market Uncertainty

NVIDIA continues to deliver staggering results that defy market expectations. The chipmaker’s recent earnings demonstrate the relentless demand for AI and computing power, with data center revenue growing at an astonishing pace. However, there’s a concerning disconnect emerging - while NVIDIA’s fundamentals remain robust, the broader market is becoming increasingly focused on positioning risk. This creates a fascinating tension where strong company performance clashes with macroeconomic concerns and crowded trades.

The market is showing clear signs of divergence, particularly between large-cap tech and small-cap stocks. The Russell 2000’s recent underperformance compared to the S&P 500 and Nasdaq suggests investors are growing cautious about economic growth prospects. This isn’t just a temporary blip - we’re seeing fundamental shifts in market structure that could lead to increased volatility in the coming weeks. The VIX patterns and options market activity indicate professional investors are positioning for potential turbulence.

What’s particularly interesting is how this NVIDIA story mirrors broader market themes. The company represents both the incredible potential of AI transformation and the risks of crowded positioning. When everyone piles into the same trade, even the strongest fundamentals can struggle against technical headwinds. This is where Buffett’s wisdom about being fearful when others are greedy becomes particularly relevant.

Looking for both brain training and stress relief? Sudoku Journey: Grandpa Crypto is the perfect choice for you.

The Timeless Wisdom of Buffett-Style Index Investing

While individual stocks like NVIDIA capture headlines, Warren Buffett’s most repeated advice to ordinary investors remains remarkably simple: consistently invest in a low-cost S&P 500 index fund. The math behind this strategy is compelling - turning $500 per month into $1 million is achievable through the power of compound growth over time. This approach eliminates stock-picking stress and leverages the overall growth of the American economy.

The Vanguard 500 Index Fund ETF (VOO) exemplifies this strategy perfectly. With its broad exposure to America’s largest companies and incredibly low expense ratio of 0.03%, it’s a workhorse for long-term wealth building. For those seeking slightly more aggressive growth, the Vanguard Growth Index Fund ETF (VUG) offers higher growth potential while maintaining diversification. Both represent the kind of ‘set it and forget it’ investing that Buffett has championed for decades.

What makes this approach so powerful in today’s environment? It provides automatic diversification across sectors and companies, reducing single-stock risk while capturing overall market growth. In a period where individual stock volatility is increasing, this stability becomes incredibly valuable. The data consistently shows that most active managers fail to beat these simple index strategies over the long run, making them particularly appealing for retirement accounts and core portfolio positions.

Need a secure password fast? This free online password generator creates strong and unpredictable combinations in seconds.

Individual Opportunities: Alphabet, Apple and Emerging AI Plays

Looking beyond broad market strategies, several individual stocks present compelling stories. Alphabet (Google) has caught Warren Buffett’s attention for good reason - the company’s dominant position in digital advertising, cloud computing, and AI innovation makes it a formidable competitor. The question of whether Alphabet could become the world’s next $5 trillion stock isn’t far-fetched given its multiple growth engines and massive cash flow generation.

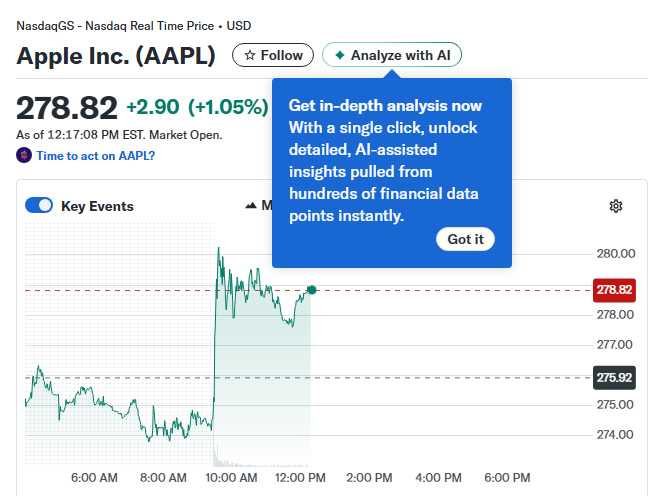

Apple represents another mega-cap opportunity, though its growth trajectory faces different challenges. Over the next five years, Apple’s success will depend on its ability to innovate beyond the iPhone while maintaining its incredible ecosystem loyalty. The services business continues to grow impressively, but new product categories will likely determine whether the stock can deliver market-beating returns.

In the AI space, companies like SoundHound AI represent more speculative opportunities. While the potential for voice AI and conversational intelligence is enormous, these smaller players face significant competition from tech giants. The key question for 2026 is whether SoundHound can establish sustainable competitive advantages in its niche or get overwhelmed by larger competitors with deeper pockets.

These individual stories highlight the balance between growth potential and risk management. While index funds provide the foundation, selective individual stock ownership can enhance returns for those willing to do the research and accept higher volatility.

If you need a quick way to time your workout or study session, this simple online stopwatch gets the job done without any setup.

In today’s complex market environment, the contrast between NVIDIA’s strong fundamentals and broader positioning risks teaches us an important lesson: successful investing requires both recognizing individual opportunities and understanding market context. The Buffett approach of consistent index fund investing provides a solid foundation, while selective stock picking in companies like Alphabet and Apple can offer additional growth potential. Remember that market volatility creates opportunities for disciplined investors, and staying focused on long-term goals matters more than reacting to short-term noise. Keep investing regularly, maintain diversification, and let compound growth work its magic over time. Until next time, this is Kane Buffett reminding you that the best investment strategy is often the simplest one executed with consistency.

🤖 Looking for expert insights on market trends and investment opportunities? Check out this analysis of AI Investment Tsunami Navigating the $40B Compute Boom and Market Volatility for comprehensive market insights and expert analysis.