Market Crossroads NVIDIAs Strength vs. Positioning Risk in a Volatile Week Ahead

Welcome back, investors! Kane Buffett here with your weekly market insights. As we navigate through one of the most intriguing periods in recent market history, we’re seeing some fascinating divergences emerge. From NVIDIA’s impressive results facing positioning headwinds to Tesla’s autonomous driving challenges and some major moves by prominent investors like Peter Thiel and Bill Ackman, there’s no shortage of action. This week, we’re diving deep into the key themes that could define your portfolio’s performance in the coming months. Grab your coffee and let’s break down what really matters in today’s complex market environment.

📋 For anyone interested in making informed investment decisions, this thorough examination of Tech Titans Broadcoms Quantum Breakthrough, Data Storage Revolution, and Market Outlook Amid Economic Data for comprehensive market insights and expert analysis.

NVIDIA’s Impressive Results Meet Market Positioning Concerns

NVIDIA continues to deliver outstanding financial performance, yet the market’s reaction tells a more complex story. The chipmaker’s recent earnings demonstrated robust growth in their AI and data center segments, but investors are increasingly concerned about positioning risk. When too many investors crowd into the same trade, even fundamentally strong companies can face headwinds. The semiconductor giant finds itself at a critical juncture where exceptional fundamentals clash with crowded positioning.

What’s particularly interesting is how institutional investors are responding. Peter Thiel’s recent decision to dump NVIDIA shares and significantly reduce his Tesla stake raises important questions about the sustainability of the AI boom. This isn’t just about one investor’s portfolio adjustment; it’s a signal that some of the smartest money in the room is reevaluating the risk-reward proposition in these high-flying tech names.

Meanwhile, the broader market is showing concerning divergences. The Russell 2000’s performance relative to the S&P 500 and Nasdaq suggests we might be in for increased volatility. Small-cap stocks often lead market turns, and their current weakness could be forecasting broader market challenges ahead. This divergence isn’t just a technical pattern—it reflects underlying economic concerns and shifting investor sentiment.

Tesla’s Autonomous Driving Crossroads

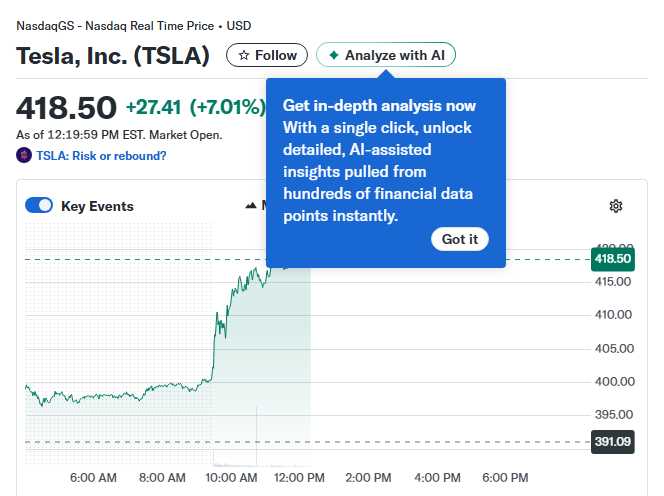

Tesla faces a pivotal moment with the emergence of competitors like Safe Routine’s “Ready” system. The autonomous vehicle race is intensifying, and Tesla’s first-mover advantage is being challenged by new entrants with potentially superior technology. This isn’t just about one company’s struggle; it’s about the entire EV and autonomous driving ecosystem undergoing rapid transformation.

The implications for Tesla investors are significant. Market leadership in the EV space is no longer guaranteed, and the company must demonstrate that it can maintain its technological edge while scaling production and managing costs effectively. The competitive landscape is evolving faster than many anticipated, and Tesla’s response to these challenges will determine its trajectory for years to come.

Make every Powerball draw smarter—check results, get AI number picks, and set reminders with Powerball Predictor.

Market Structure and Volatility Outlook

The current market setup presents several warning signs that demand attention. The Russell 2000’s underperformance relative to large-cap indices isn’t just a temporary anomaly—it reflects deeper concerns about economic growth, interest rates, and corporate profitability. Small companies are often more sensitive to economic conditions, and their struggles could foreshadow broader market challenges.

Key technical indicators suggest we’re entering a period of increased volatility. Market breadth has been deteriorating, with fewer stocks participating in rallies. This narrowing leadership typically precedes market corrections. Additionally, sector rotation is accelerating as investors reposition for potential economic shifts.

The divergence between the Nasdaq and other major indices is particularly noteworthy. While tech continues to drive market performance, the lack of confirmation from other sectors suggests the rally may be on shaky foundations. Investors should prepare for potential turbulence by reviewing their risk exposure and ensuring their portfolios are properly diversified.

Bill Ackman’s Strategic Move and IPO Landscape

Bill Ackman’s plan for a Pershing Square new fund IPO in early 2026 represents a significant development in the hedge fund space. This move suggests that prominent investors see opportunities in current market conditions, but it also raises questions about market timing and valuation concerns.

The IPO market itself has been showing mixed signals. While some companies are rushing to go public, investor appetite appears to be selective. Ackman’s timing suggests he believes there are undervalued opportunities, but the broader IPO environment remains challenging due to valuation concerns and market volatility.

This development is worth monitoring because hedge fund IPOs often signal turning points in market sentiment. When successful investors like Ackman make major structural moves, it’s usually based on sophisticated market analysis and forward-looking assessments of opportunity sets.

Instead of opening a bulky app, just use a fast, no-login online calculator that keeps a record of your calculations.

Energy Storage Revolution and Lithium Iron Phosphate Batteries

The Lithium Iron Phosphate (LFP) battery industry is undergoing a massive transformation that represents one of the most promising investment opportunities in the clean energy space. Industry research from 2025-2030 indicates a fundamental shift from conventional power systems to scalable energy storage solutions.

This transition is being driven by multiple factors: expanding renewable energy capacity, emphasis on grid stability, and the growing demand for efficient energy storage across multiple applications. LFP batteries offer several advantages over traditional lithium-ion alternatives, including better safety profiles, longer cycle life, and reduced reliance on scarce materials like cobalt.

The growth trajectory here is substantial. As renewable energy adoption accelerates, the need for reliable energy storage becomes increasingly critical. Companies positioned in the LFP supply chain—from raw material producers to battery manufacturers and system integrators—stand to benefit from this multi-year growth trend.

Bitcoin’s Correction and Cryptocurrency Outlook

Bitcoin’s recent 30% decline from its highs has many investors wondering whether this represents a buying opportunity or the beginning of a more sustained downturn. The cryptocurrency’s volatility continues to challenge even experienced investors, but the underlying fundamentals remain compelling for those with appropriate risk tolerance.

The current correction needs to be viewed in the context of Bitcoin’s historical price patterns. Previous cycles have seen similar drawdowns before resuming their upward trajectories. However, the regulatory environment, institutional adoption rates, and macroeconomic factors all play crucial roles in determining Bitcoin’s medium-term direction.

For investors considering adding exposure at current levels, it’s essential to understand both the technological promise and the significant risks involved. Position sizing and portfolio allocation become particularly important when dealing with assets that exhibit Bitcoin’s characteristic volatility.

Take your Powerball strategy to the next level with real-time stats and AI predictions from Powerball Predictor.

As we navigate these complex market conditions, remember that successful investing requires both conviction and flexibility. The divergences we’re seeing across indices, the positioning risks in popular tech names, and the emerging opportunities in sectors like energy storage all point to a market in transition. Stay disciplined, maintain your long-term perspective, and don’t let short-term volatility derail your strategic objectives. Until next time, this is Kane Buffett reminding you that the best investment you can make is in your own knowledge. Happy investing!

☁️ Want to stay ahead of the market with data-driven investment strategies? Here’s what you need to know about Datavault AIs Bold Moves Fighting Back Against Short Sellers While Expanding Operations for comprehensive market insights and expert analysis.