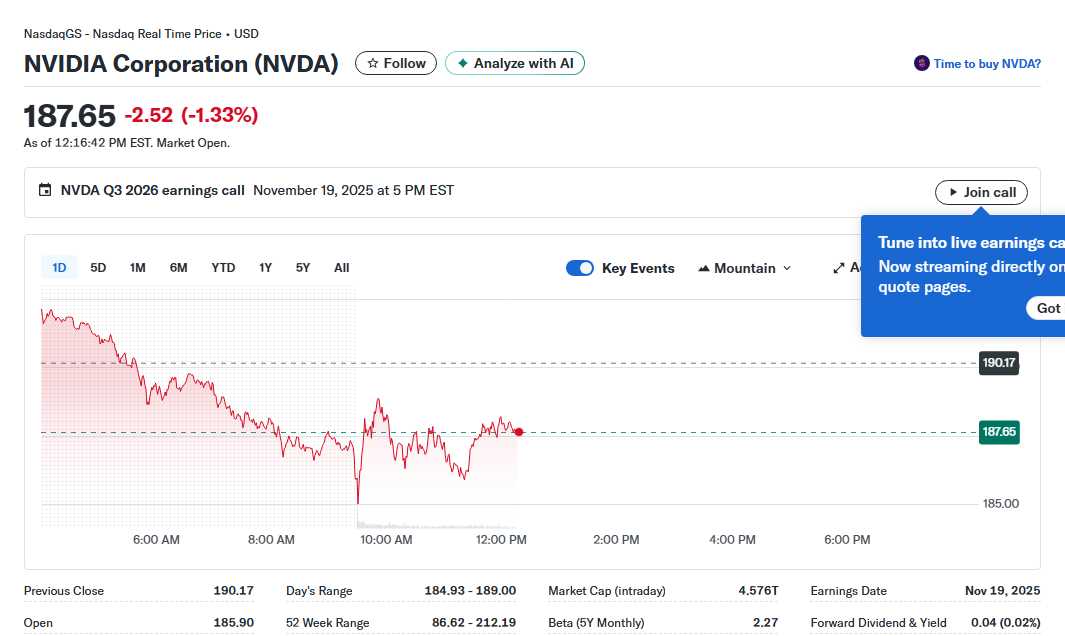

Market Crossroads Nvidia Earnings, Employment Data, and Small-Cap Resilience Define Investment Landscape

Hey fellow investors! Kane Buffett here. We’re standing at one of the most fascinating market junctions I’ve seen in recent months. With S&P 500 and Dow futures pointing higher, all eyes are laser-focused on two critical events: Nvidia’s upcoming earnings report and the latest employment data. But beneath these headline events, there are compelling stories unfolding across small-caps, quantum computing, and the broader semiconductor space that could define our investment returns for quarters to come.

💡 Ready to take your portfolio to the next level? Check out this strategic analysis of Datavault AIs Bold Moves Fighting Back Against Short Sellers While Expanding Operations for comprehensive market insights and expert analysis.

The Russell 2000 small-cap index faces a crucial $709 billion test as investors scrutinize balance sheet strength ahead of potential economic tightening. What makes this particularly interesting is that we’re seeing a market signal that’s appeared only once before in recent history - a pattern that historically preceded significant moves. Meanwhile, Michael Burry’s latest bearish bets add another layer of complexity to the market sentiment. The small-cap space presents both extraordinary risk and potential reward, with companies like Joby Aviation capturing imagination in the flying car space, though investors should approach with careful due diligence. The balance sheet strength of these smaller companies will be paramount as we navigate potential economic headwinds.

Stop recycling the same usernames—this nickname tool with category suggestions and favorites helps you create unique, brandable names.

The AI semiconductor revolution continues to dominate market narratives, with Nvidia sitting squarely at the epicenter. The company has $500 billion reasons why investors might want to buy like there’s no tomorrow, but SoftBank’s decision to dump its entire stake raises legitimate questions. Elon Musk’s comments about “mind-blowing” AI compute spending, coupled with Google’s $40 billion announcement, underscore the massive infrastructure build-out underway. AMD continues to post impressive gains, while Micron Technology presents an intriguing case as a potential millionaire-maker stock if the memory cycle thesis plays out. Broadcom remains a solid contender in the AI semiconductor space, though each player brings different risk-reward profiles to the table.

Join thousands of Powerball fans using Powerball Predictor for instant results, smart alerts, and AI-driven picks!

Beyond the semiconductor giants, quantum computing represents one of the most exciting frontiers. One particular quantum computing ETF stands out with compelling fundamentals and growth potential. IonQ, as a pure-play quantum computing stock, offers exposure to this transformative technology, though it requires careful evaluation given the early-stage nature of the industry. The technology sector continues to offer opportunities beyond the obvious names, with one tech stock potentially positioned for 67% gains by year-end according to some analyses. These emerging technologies represent the next wave of innovation that could drive market returns for the next decade.

💬 Real opinions from real diners — here’s what they had to say about Gucci Osteria da Massimo Bottura to see what makes this place worth a visit.

As we navigate these complex market dynamics, remember that successful investing requires both conviction and flexibility. The employment data and Nvidia earnings will provide crucial direction, but the real opportunities often lie in understanding the broader trends. Whether it’s the resilience of small-caps, the AI semiconductor boom, or quantum computing’s potential, staying informed and maintaining a disciplined approach remains our best strategy. Until next time, invest wisely!

🔍 Curious about which stocks are making waves this week? Get the inside scoop on James Hardie Industries (JHX) Class Action Critical December 23 Deadline for Investors with Substantial Losses for comprehensive market insights and expert analysis.