TLX and LFMD Investor Alert Critical Deadlines Loom in Major Securities Class Actions

Hey folks, Kane Buffett here. As we navigate these turbulent market waters, I need to bring your attention to some urgent developments that could significantly impact your portfolio. Today, we’re diving deep into two concerning situations involving Telix Pharmaceuticals (TLX) and LifeMD (LFMD) where investors are facing critical deadlines in securities class action lawsuits. These cases highlight the importance of staying vigilant about your investment rights and understanding the legal protections available when companies potentially mislead their shareholders.

🔍 Curious about which stocks are making waves this week? Get the inside scoop on 3 Monster AI Stocks to Hold for the Next Decade Why Palantir is Crushing NVIDIA for comprehensive market insights and expert analysis.

Telix Pharmaceuticals (TLX) Investor Crisis: Understanding Your Legal Rights

The situation with Telix Pharmaceuticals (NASDAQ: TLX) has reached a critical juncture. The Rosen Law Firm, a globally recognized investor rights litigation firm, has officially announced an investigation into potential securities claims on behalf of Telix shareholders. This development suggests there may be substantial concerns about the company’s disclosures or business practices that could have negatively impacted the stock’s performance and investor value.

What’s particularly alarming is that the Rosen Law Firm is specifically encouraging investors who have suffered losses in Telix Pharmaceuticals to contact them about their rights. This type of public encouragement typically indicates the firm has identified potentially meritorious claims. When a firm of Rosen’s caliber takes such public action, it often signals they’ve conducted preliminary research suggesting possible violations of securities laws.

The timing and nature of these developments are crucial for current and former TLX investors. The company, which focuses on pharmaceutical developments, appears to be facing scrutiny that could have far-reaching implications for its stock valuation and corporate reputation. Investors need to carefully assess their exposure and understand the legal options available to them, especially given the complex regulatory environment surrounding pharmaceutical companies.

Looking for AI-powered Powerball predictions and instant results? Try Powerball Predictor and never miss a draw again!

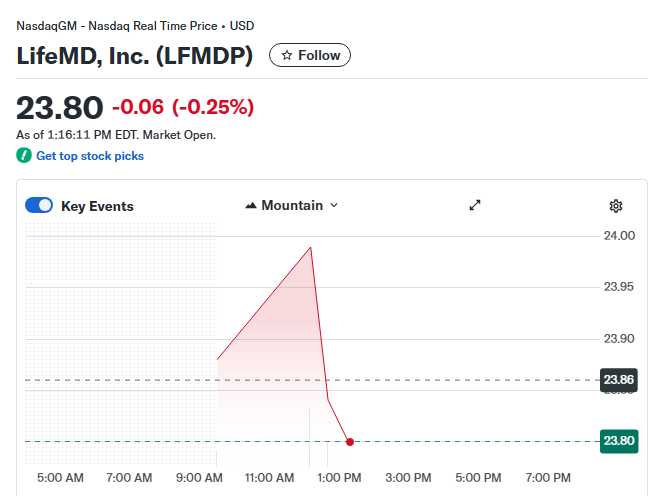

LifeMD (LFMD) Legal Storm: Multiple Law Firms Sound Alarm Bells

The situation with LifeMD (NASDAQ: LFMD) is even more urgent, with not one but two prominent law firms issuing alerts about impending deadlines. The Rosen Law Firm has set an important October 27 deadline for investors to secure counsel in a securities class action against the telehealth firm. Simultaneously, Hagens Berman has issued a 2-day deadline alert, emphasizing the time-sensitive nature of this litigation.

According to the legal filings, the lawsuit targets LifeMD over alleged misleading statements made by the company. The core allegations suggest that LifeMD may have made false and/or misleading statements and/or failed to disclose material information that would have been important for investors to make informed decisions. This type of allegation strikes at the heart of securities law compliance and corporate transparency.

What makes the LFMD situation particularly noteworthy is the involvement of multiple respected law firms, each emphasizing the urgency of the October 27 deadline. The convergence of attention from firms like Rosen and Hagens Berman typically indicates they’ve identified substantial legal grounds for their actions. For a telehealth company like LifeMD, which operates in a rapidly evolving regulatory landscape, these allegations could have significant implications for both its business operations and stock performance.

Need a secure password fast? This free online password generator creates strong and unpredictable combinations in seconds.

Critical Analysis: What These Cases Mean for Healthcare Investors

These parallel situations with TLX and LFMD reveal important patterns that every healthcare sector investor should understand. Both cases involve companies in the healthcare space - pharmaceuticals and telehealth - sectors that are particularly sensitive to regulatory compliance and disclosure requirements. The simultaneous emergence of these class actions suggests potential systemic issues in how healthcare companies communicate with their investors.

The legal theories being pursued in these cases likely revolve around Sections 10(b) and 20(a) of the Securities Exchange Act, which prohibit making false statements or omitting material facts in connection with securities transactions. For pharmaceutical companies like Telix, this could involve issues related to drug development timelines, regulatory approvals, or clinical trial results. For telehealth companies like LifeMD, concerns might include subscriber metrics, revenue recognition practices, or regulatory compliance matters.

What’s particularly concerning from an investment perspective is the timing of these revelations. Both companies are facing legal scrutiny that could lead to substantial financial settlements, management changes, or regulatory interventions. The stock price volatility that typically accompanies such legal developments can create both risks and opportunities for investors, though the primary focus right now should be on protecting existing investments and understanding legal rights.

📊 Looking for actionable investment advice backed by solid research? Check out AI Boom Evolution Dividend Opportunities and Market Shifts in the Tech Transformation Era for comprehensive market insights and expert analysis.

As we wrap up this critical update, remember that being an informed investor means not just watching stock prices but understanding the legal and regulatory landscape surrounding your investments. The situations with TLX and LFMD serve as important reminders that due diligence should extend beyond financial metrics to include corporate governance and disclosure practices. If you’re affected by these developments, I strongly encourage you to consult with qualified legal professionals before the rapidly approaching deadlines. Stay vigilant, stay informed, and as always, invest wisely. - Kane Buffett

���🌮 Curious about the local dining scene? Here’s a closer look at Humboldt Haus Sandwich Bar to see what makes this place worth a visit.