Inflation-Proof Growth Stocks Mastercards Challenges and Casino Payment Opportunities in 2025

Welcome back, investors! Kane Buffett here with another deep dive into the market trends that matter. As we navigate the complex economic landscape of 2025, I’ve been analyzing some fascinating developments in the payment processing and growth stock sectors. Today, we’re examining inflation-resistant investment opportunities, insider trading activity, and the evolving relationship between payment giants and the burgeoning online casino industry. Grab your favorite beverage and let’s unpack what these developments mean for your portfolio.

☁️ Want to stay ahead of the market with data-driven investment strategies? Here’s what you need to know about The AI Boom Meets Streaming Wars Unprecedented Investment Opportunities in 2025 for comprehensive market insights and expert analysis.

Inflation-Proof Growth Stocks: Finding Stability in Uncertain Times

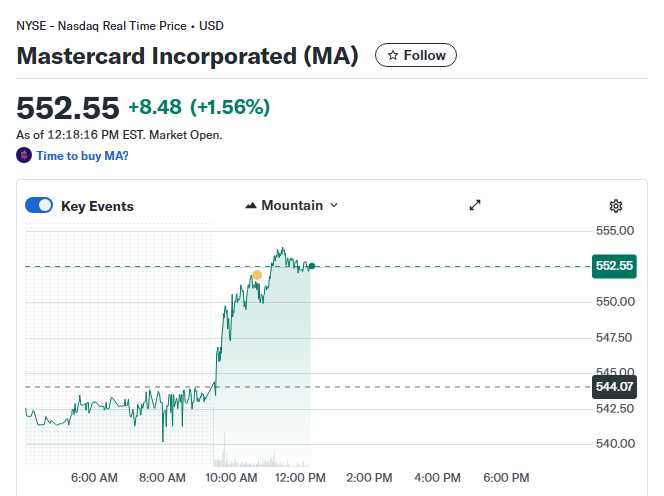

The search for inflation-resistant investments has never been more critical, and several growth stocks are positioned to outperform despite economic pressures. Companies with strong pricing power, recurring revenue models, and essential services tend to weather inflationary periods better than others. The payment processing sector, particularly companies like Mastercard, represents an interesting case study in inflation resilience due to their transaction-based revenue models that naturally scale with price increases.

However, recent analyst reports suggest Mastercard may face headwinds. According to Benzinga analysis, Capital One’s roll-off will soften Mastercard’s volume growth into 2026. This development is significant for investors seeking inflation-proof opportunities, as it highlights how even strong companies can face temporary challenges. The analyst community is closely watching how Mastercard adapts to this changing landscape and whether they can maintain their growth trajectory despite these volume pressures.

Meanwhile, the insider trading activity in Chemed (CHE) reveals another dimension of market behavior during inflationary periods. Schwartz’s decision to offload $13 million worth of Chemed shares raises questions about insider sentiment toward healthcare stocks in the current economic environment. Such substantial moves by company insiders often signal their assessment of near-term performance and valuation levels.

Whether you’re promoting a website or a special offer, this online QR code tool lets you personalize your code and export it with ease.

Payment Technology Evolution: Mastercard’s Casino Integration and Market Position

The payment technology landscape continues to evolve rapidly, with Mastercard expanding its presence in the online casino sector. Recent announcements from BetWhale highlight Mastercard’s strategic positioning in the secure online gambling market. According to GlobeNewswire, BetWhale has been recognized as a secure Mastercard online casino for US players in 2025, demonstrating the payment giant’s continued expansion into regulated gambling markets.

This development represents a significant opportunity for Mastercard to capture growing transaction volumes in the online casino space. The certification process for secure payment processing in online gambling involves rigorous security standards, and Mastercard’s approval signals their commitment to this high-volume sector. For investors, this expansion into casino payments represents a potential growth driver that could help offset some of the volume challenges from the Capital One roll-off.

Furthermore, BetWhale’s multi-payment platform integration, including American Express, Visa, and Flexepin, shows the competitive landscape Mastercard operates within. The company’s ability to maintain and grow its market share in the face of multiple competitors will be crucial for long-term performance. The online casino sector’s growth, particularly in markets where regulation is evolving, presents both opportunity and regulatory risk that investors must carefully consider.

Searching for a fun and engaging puzzle game? Sudoku Journey with Grandpa Crypto’s story offers a unique twist on classic Sudoku.

Market Analysis and Investment Strategy: Navigating Current Challenges

Looking at the broader investment landscape, several key themes emerge for 2025-2026. The combination of inflationary pressures, changing payment volumes, and sector-specific opportunities requires a nuanced approach to portfolio construction. Mastercard’s situation exemplifies how even industry leaders face complex challenges that require careful analysis.

The analyst community’s assessment of Mastercard’s volume growth challenges suggests that investors should look for companies with multiple growth drivers and diversified revenue streams. While the Capital One roll-off presents a near-term headwind, Mastercard’s expansion into sectors like online gambling and their continued innovation in payment technology provide counterbalancing growth opportunities.

For investors seeking truly inflation-proof stocks, characteristics to prioritize include: strong competitive moats, pricing power, recurring revenue models, and exposure to growing market segments. The online casino payment processing sector, while carrying specific regulatory risks, represents a high-growth area that benefits from digital transformation trends and changing consumer behaviors.

Additionally, monitoring insider trading activity like the Chemed transaction can provide valuable insights into how company executives view their own stocks’ valuations in the current economic environment. Such moves don’t always signal fundamental problems, but they warrant closer examination of the company’s prospects and competitive position.

✨ For food lovers who appreciate great taste and honest feedback, The Dock At Montrose Beach to see what makes this place worth a visit.

In today’s complex market environment, successful investing requires looking beyond surface-level headlines and understanding the interconnected dynamics shaping different sectors. Mastercard’s story illustrates how even industry giants must navigate challenges while pursuing new growth opportunities. The expansion into secure online casino payments represents an innovative approach to capturing transaction volume, while the Capital One roll-off reminds us that even the strongest companies face headwinds.

As Kane Buffett, I recommend maintaining a balanced perspective—recognizing both the challenges and opportunities in today’s market. The search for inflation-proof growth stocks continues, and the companies that can adapt, innovate, and maintain their competitive advantages will likely emerge strongest. Stay vigilant, keep analyzing, and remember that market volatility creates opportunities for disciplined investors.

Until next time, happy investing!

If you want to improve focus and logical thinking, install Sudoku Journey with classic, daily, and story modes and challenge yourself.