Huntington Ingalls Industries (HII) Comprehensive Analysis of Americas Premier Shipbuilder

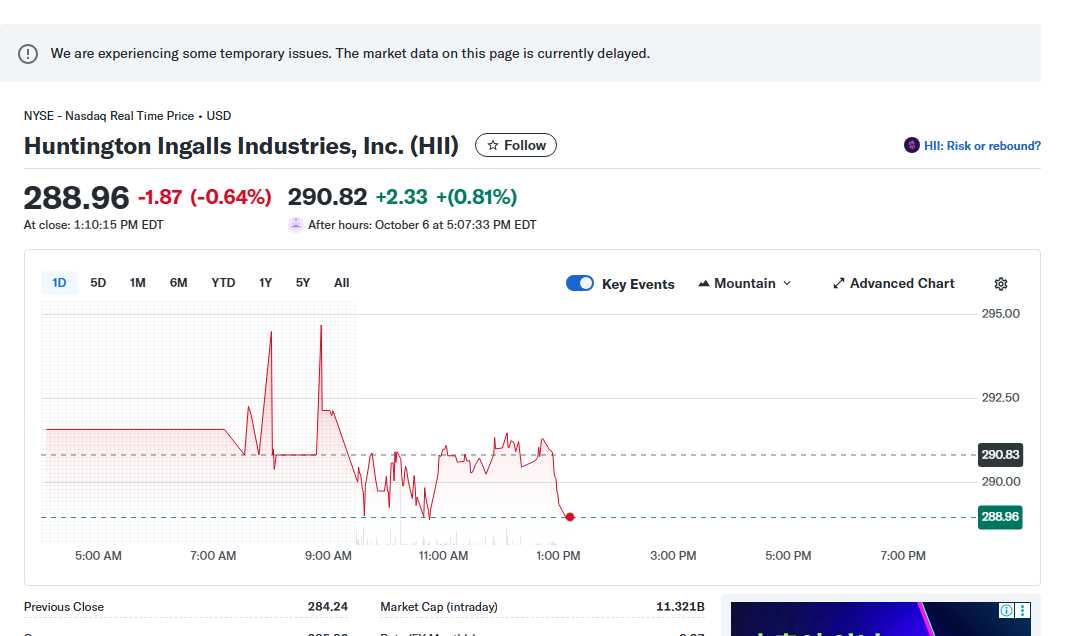

Welcome back, fellow investors! Kane Buffett here with another deep dive into a cornerstone of American defense - Huntington Ingalls Industries. As we approach their Q3 2024 earnings call on October 30th, I’ve been closely monitoring HII’s positioning in the evolving defense landscape. With multiple institutional moves and mixed performance signals, this analysis will give you the complete picture of whether HII deserves a spot in your portfolio.

💼 If you’re serious about building wealth through smart investments, don’t miss this comprehensive review of Why Amazons European Expansion and Prime Events Make It a Compelling Investment Opportunity for comprehensive market insights and expert analysis.

Upcoming Q3 2024 Earnings: What to Expect

Huntington Ingalls Industries has scheduled their third quarter 2024 earnings conference call and webcast for October 30, 2024, at 8 a.m. Eastern Time. This event represents a critical moment for investors to assess the company’s performance amid ongoing global defense spending increases. The shipbuilding giant, America’s largest military shipbuilder, will provide insights into their current contracts, backlog status, and future projections.

Historically, HII has demonstrated resilience in their shipbuilding segments, particularly in nuclear-powered aircraft carriers and submarines. The upcoming earnings call comes at a time when global naval modernization programs are accelerating, with the U.S. Navy continuing to prioritize shipbuilding in their budget allocations. Investors should pay close attention to margin improvements, contract awards, and any updates on their digital transformation initiatives that aim to enhance manufacturing efficiency.

The company’s consistent track record of meeting delivery schedules for complex naval vessels positions them well for continued government support. However, supply chain challenges and labor market constraints remain areas requiring management’s attention during the upcoming call.

If you want to improve focus and logical thinking, install Sudoku Journey with classic, daily, and story modes and challenge yourself.

Financial Performance and Institutional Confidence

Recent institutional activity reveals continued confidence in HII’s long-term prospects. Old National Bancorp IN significantly increased their position by acquiring 3,808 shares of Huntington Ingalls Industries, demonstrating institutional belief in the company’s valuation and growth trajectory. This move aligns with the broader trend of financial institutions maintaining exposure to defense stocks during periods of geopolitical uncertainty.

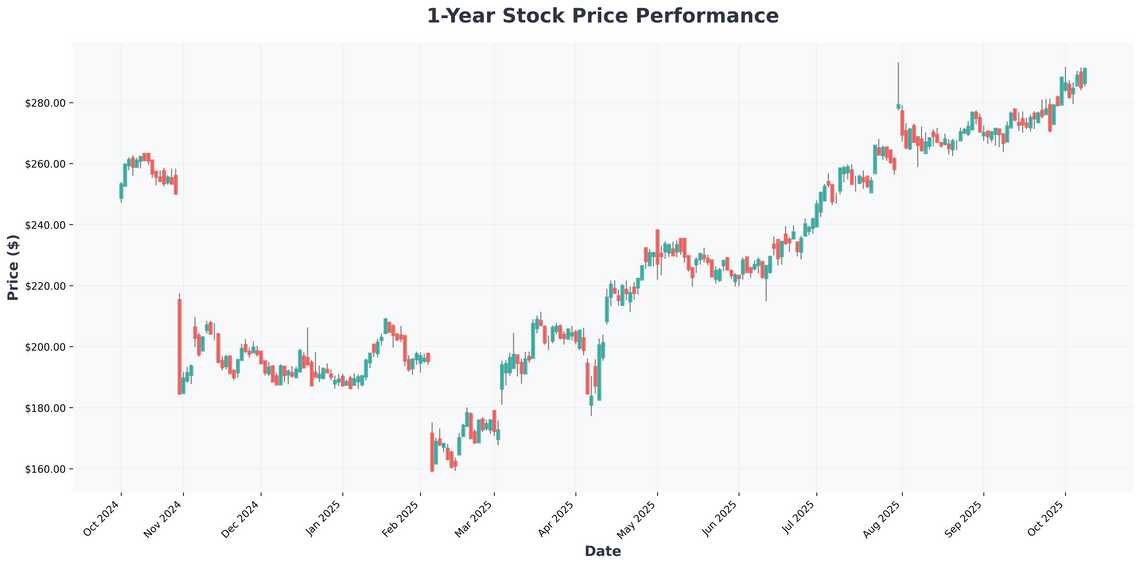

However, a deeper analysis of HII’s five-year earnings growth reveals some concerns. While the company has maintained stability, their earnings growth has trailed impressive shareholder returns over the same period. This divergence suggests that market multiples have expanded rather than earnings driving the appreciation. The company’s current valuation requires careful consideration of whether future earnings can justify current price levels.

HII’s dividend history and share repurchase programs have contributed to total returns, but investors should monitor whether operational performance can catch up with market expectations. The defense contractor’s backlog, currently standing at substantial levels, provides revenue visibility but execution remains key to converting contracts into sustainable earnings growth.

Whether it’s for gaming, YouTube, or online forums, this customizable nickname generator gives you options that match your style.

Risk Assessment and Investment Considerations

Every investment carries inherent risks, and HII is no exception. Primary concerns include their heavy reliance on U.S. government contracts, which subjects them to budgetary uncertainties and political cycles. Any reduction in defense spending or delays in contract awards could significantly impact their revenue stream. Additionally, the complex nature of shipbuilding creates execution risks, including cost overruns and schedule delays that can affect profitability.

The company’s concentration in naval shipbuilding, while a strength, also represents a diversification challenge. Unlike broader defense contractors with aerospace and technology segments, HII’s focus on maritime defense limits their addressable market. However, this specialization has created significant barriers to entry and established their dominant position in naval construction.

Labor relations, supply chain dependencies, and technological disruption from new shipbuilding methodologies represent additional risk factors. Investors should monitor the company’s progress in addressing these challenges through workforce development initiatives and digital transformation programs aimed at improving productivity and cost management.

Make every Powerball draw smarter—check results, get AI number picks, and set reminders with Powerball Predictor.

In conclusion, Huntington Ingalls Industries represents a unique investment proposition within the defense sector. Their upcoming Q3 earnings call on October 30th will provide crucial insights into their ability to navigate current challenges and capitalize on defense spending trends. While earnings growth has lagged shareholder returns historically, their strategic position in naval shipbuilding and substantial backlog provide stability. As always, conduct your own due diligence and consider your investment timeframe and risk tolerance. Stay tuned for my post-earnings analysis following their October call!

📍 One of the most talked-about spots recently is Red Window to see what makes this place worth a visit.