Warren Buffetts Index Fund Strategy How to Turn $500 Monthly into $1 Million Plus AI Stock Insights

Hey fellow investors! Kane Buffett here with another deep dive into the strategies that actually work in today’s volatile market. Having spent over a decade analyzing market trends and investment strategies, I’ve seen countless approaches come and go. But one strategy consistently delivers results: Warren Buffett’s legendary index fund approach combined with selective growth opportunities. Today, we’re breaking down how Buffett’s simple advice can transform your financial future while exploring some exciting developments in the AI and technology space that could supercharge your returns.

🤖 Looking for expert insights on market trends and investment opportunities? Check out this analysis of Warren Buffetts Bold Move Berkshires Massive AI Bet on Alphabet and What It Means for Investors for comprehensive market insights and expert analysis.

The Power of Buffett’s Index Fund Strategy

Warren Buffett’s timeless advice about index funds continues to prove its worth. According to recent analysis, investing $500 monthly in an S&P 500 index fund could potentially grow to over $1 million through the power of compound growth. The Vanguard 500 Index Fund ETF (VOO) offers broad exposure to the entire U.S. large-cap market, representing about 500 of the largest U.S. companies. This diversification provides stability while capturing overall market growth. Meanwhile, the Vanguard Growth Index Fund ETF (VUG) focuses specifically on growth-oriented companies, delivering higher potential returns but with increased volatility. The mathematical beauty of this approach lies in dollar-cost averaging - by investing consistently regardless of market conditions, you naturally buy more shares when prices are low and fewer when they’re high, smoothing out your average cost over time. Historical data shows the S&P 500 has delivered approximately 10% annual returns over long periods, though past performance doesn’t guarantee future results. What makes this strategy particularly compelling is its simplicity - you don’t need to be a market expert or spend hours researching individual stocks to achieve solid, market-matching returns.

🔎 Looking for a hidden gem or trending restaurant? Check out Atera to see what makes this place worth a visit.

AI Revolution: NVIDIA’s Stunning Performance and Future Opportunities

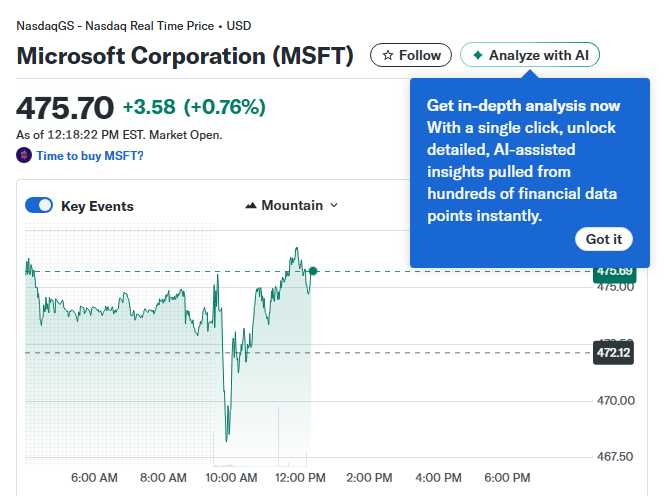

The technology sector, particularly artificial intelligence, continues to deliver extraordinary returns for investors. NVIDIA serves as the prime example - a $100 investment made ten years ago would have grown to approximately $42,000 today, representing one of the most remarkable investment success stories in market history. This phenomenal growth stems from NVIDIA’s dominance in AI chips and data center solutions. Looking forward, Alphabet (Google’s parent company) appears well-positioned to become the world’s next $5 trillion company. With its dominant search business, growing cloud computing division, and leadership in artificial intelligence research, Alphabet represents a compelling growth opportunity. The company’s diverse revenue streams from advertising, cloud services, and emerging AI technologies provide multiple growth engines. Meanwhile, Micron Technology emerges as one of the most underrated AI plays in the market. As a leading memory chip manufacturer, Micron stands to benefit significantly from the AI boom, as AI systems require massive amounts of high-performance memory. The company’s technological advancements in DRAM and NAND flash memory position it perfectly for the growing demands of AI data centers and edge computing applications. The broader Internet of Things (IoT) market is projected to hit $1.14 trillion by 2030, driven by 5G deployment, edge AI, smart homes, industrial automation, and government digital transformation initiatives, creating numerous investment opportunities across the technology ecosystem.

💬 Real opinions from real diners — here’s what they had to say about OHaras Restaurant and Pub to see what makes this place worth a visit.

Strategic Considerations and Risk Management

While growth opportunities abound, prudent investors must also consider valuation and risk. Palantir stock, despite its recent performance, raises valuation concerns that warrant careful analysis. The company’s government contracts and data analytics platform show promise, but current price levels may not justify the risk for conservative investors. Similarly, investors should approach stock split announcements with caution - while they often generate short-term excitement, splits don’t fundamentally change a company’s valuation or business prospects. The recent activity around Simply Good Foods, where McCollum Christoferson liquidated its position, reminds us that even professional investors regularly reassess their holdings and make changes based on new information. For those seeking balanced exposure, low-cost mega-cap ETFs present a compelling option, offering diversification across market leaders while minimizing fees. The key to successful long-term investing lies in maintaining discipline, focusing on fundamentals rather than market noise, and building a portfolio aligned with your risk tolerance and time horizon. Remember that even the most promising companies can experience significant volatility, which is why position sizing and diversification remain critical components of any sound investment strategy.

Want to keep your mind sharp every day? Download Sudoku Journey with AI-powered hints and an immersive story mode for a smarter brain workout.

As we navigate these exciting but uncertain markets, remember the wisdom that has stood the test of time: consistent investing in quality assets, whether through broad market index funds or carefully selected individual stocks, remains the most reliable path to building lasting wealth. The combination of Buffett’s index fund approach for core portfolio stability with selective exposure to high-growth sectors like AI and technology can create a powerful wealth-building strategy. Stay disciplined, keep learning, and remember that the greatest investment you can make is in your own financial education. Until next time, happy investing! - Kane Buffett

To minimize the risk of hacking, it’s smart to rely on a secure password generator tool that creates complex passwords automatically.