Buffetts Google Windfall & The AI Megatrend Your 2026 Investing Blueprint

Howdy, folks. Kane Buffett here. For a decade from this digital pulpit, we’ve talked about patience, value, and the power of identifying unstoppable trends. Today, we’re looking at a perfect storm where those principles collide. The Oracle of Omaha himself, Warren Buffett, is reportedly sitting on massive, previously undisclosed gains from Google. Meanwhile, the AI revolution isn’t slowing down—it’s accelerating into every corner of the economy, from your living room to the open road. Let’s connect the dots between a legendary investor’s legacy move and the concrete opportunities shaping the market in 2026. This isn’t just news; it’s a roadmap.

💰 For investors seeking profitable opportunities in today’s volatile market, this detailed analysis of The 2026 Stock Market Blueprint AI Dominance, Top Picks, and Navigating the New Bull Run for comprehensive market insights and expert analysis.

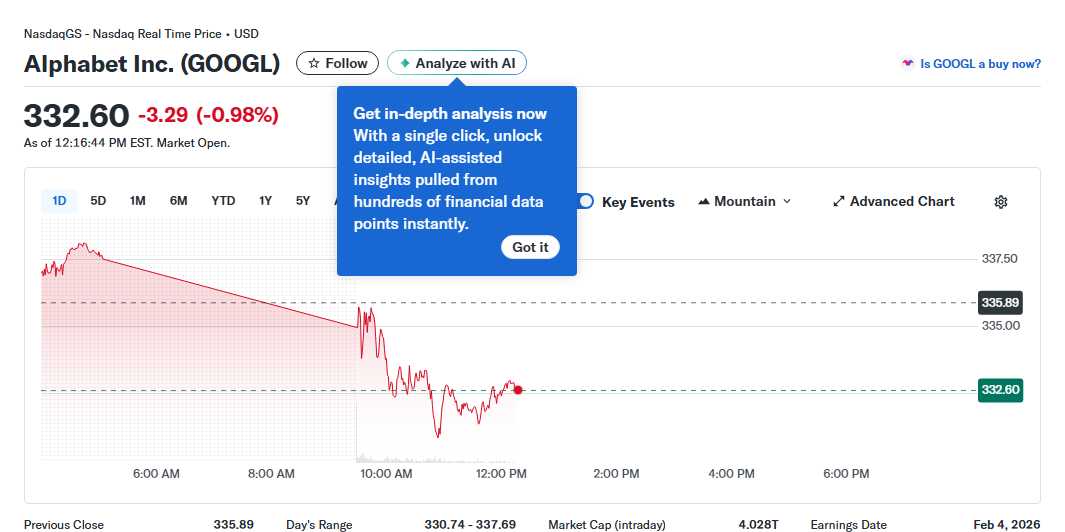

The Buffett Blueprint: Legacy Built on Tech Titans The recent revelation that Warren Buffett’s Berkshire Hathaway secured enormous gains from an early, quiet investment in Google is a masterclass in strategic patience. This wasn’t a flashy trade; it was a conviction play on a company with a durable competitive advantage—its search and advertising moat. Fast forward to today, and that moat is fortified by AI. Alphabet (GOOGL) stock jumped 65% in 2025, driven not by hype, but by the tangible monetization of its AI advancements across Search, Cloud, and its ecosystem. Buffett’s move underscores a critical lesson for 2026: the winners in the AI race are often the established giants who can integrate and scale intelligence, not just the pure-play startups. The sentiment here is profoundly positive (+9), reflecting validated, long-term strategic genius. The sensitivity is moderate (6), as it confirms an existing narrative about Buffett’s adaptability.

🔎 Looking for a hidden gem or trending restaurant? Check out YAZAWA to see what makes this place worth a visit.

The AI Ecosystem in Overdrive: From Chips to Checkout The engine of this revolution is firing on all cylinders. At CES 2026, semiconductors—the literal brains of AI—stole the show, highlighting relentless demand. NVIDIA continues to tighten its grip on the autonomous vehicle stack, moving beyond just hardware to provide the full software suite. This vertical integration creates a formidable barrier to entry and suggests sustained, high-margin growth. On the enterprise side, Microsoft is executing a brilliant “power without competition” strategy in retail, offering AI and cloud tools that empower retailers rather than competing with them directly. This partnership model is a scalable goldmine. Meanwhile, the fusion of Blockchain and AI is emerging as a mega-trend, with the market projected to reach over $4 trillion by 2033. This addresses the critical needs of secure, transparent, and intelligent data processing. The collective sentiment across these sector-specific advances is very positive (+8). The sensitivity is high (8), as these are competitive, fast-moving fronts with significant regulatory attention (as noted in tightening AI regulations).

Want to boost your memory and focus? Sudoku Journey offers various modes to keep your mind engaged.

Building Your 2026 AI Portfolio: Actionable Strategies So, how do you, the individual investor, position yourself? Throwing $2,000 or $10,000 at the “AI” theme isn’t a strategy. We need a plan. First, consider the “picks and shovels” approach: companies like NVIDIA and leading semiconductor firms that enable AI everywhere. Second, look at the dominant platforms integrating AI: Alphabet and Microsoft are prime examples, turning AI into cash flow now. Third, explore targeted adopters. Wayfair’s partnership with Google AI to create a smarter online buying experience is a case study in using AI to solve a core business problem (conversion rates, customer satisfaction)—this can be a stock-specific catalyst. Analysis of top AI stock lists for 2026 consistently highlights a mix of enablers, hyperscalers, and software leaders. A key debate is whether to “forget NVIDIA” for other AI plays. The answer isn’t to forget it, but to understand its role. It may be a core holding, but diversification into other AI vectors (like the Blockchain-AI convergence or enterprise software) is prudent. The sentiment here is constructive and optimistic (+7). The sensitivity is also high (8), as investment timing and stock selection in a frothy theme carry risk.

Need a daily brain workout? Sudoku Journey supports both English and Korean for a global puzzle experience.

The message for 2026 is clear. The AI megatrend is maturing from speculation to execution and monetization. Warren Buffett’s Google gains remind us that the biggest rewards often go to those who identify transformative, wide-moat businesses early and hold with conviction. Your task is to apply that same lens to the current landscape. Build a plan you can stick with—one focused on companies with real AI-driven earnings, sustainable advantages, and clear paths to growth. Don’t just chase the wave; understand the ocean currents. Stay disciplined, stay informed, and let’s navigate this exciting market together. This is Kane Buffett, signing off.

Curious about the next winning numbers? Powerball Predictor uses advanced AI to recommend your best picks.