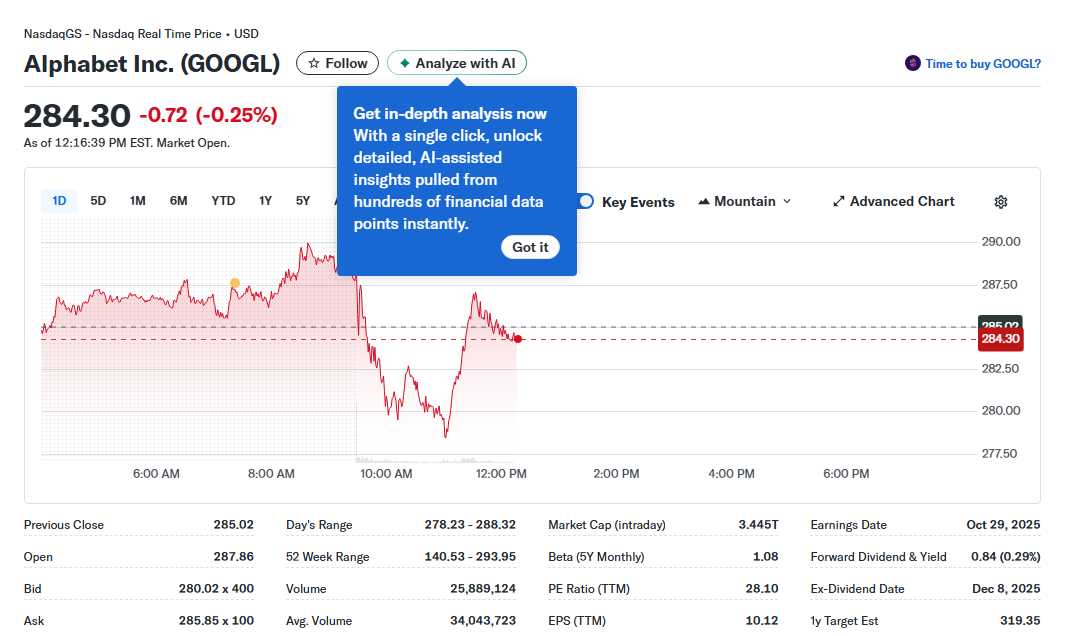

Warren Buffetts AI Bet Why Alphabet Could Dominate 2026

Hey folks, Kane Buffett here. As we approach 2026, the investment landscape is undergoing a seismic shift, and the Oracle of Omaha himself is leading the charge into artificial intelligence. Recent filings reveal Warren Buffett’s Berkshire Hathaway has made a massive bet on Alphabet (Google), while trimming Apple positions. This comes as AI transforms everything from e-commerce to compute infrastructure. Let’s dive into why this might be the smartest move of Buffett’s career and what it means for your portfolio.

📊 Looking for actionable investment advice backed by solid research? Check out The AI Semiconductor Boom Why Nvidia, AMD, and Broadcom Are Still Dominating the Market for comprehensive market insights and expert analysis.

The AI shopping revolution is here, and it’s bigger than anyone predicted. BrightEdge data confirms 2025 as the first AI-driven e-commerce holiday season, with AI-powered shopping experiences skyrocketing. This isn’t just about chatbots - we’re talking about personalized product discovery, dynamic pricing optimization, and predictive inventory management at scale. Meanwhile, Elon Musk notes the “mind-blowing” amounts being spent on AI compute infrastructure, with Google announcing a staggering $40 billion investment. This massive capital expenditure signals that the AI arms race is just beginning. For investors, this creates a clear dichotomy: companies investing heavily in AI infrastructure (like Google) versus those lagging behind. The holiday shopping data suggests consumers are rapidly adopting AI shopping tools, creating a flywheel effect for companies that get it right early.

💼 If you’re serious about building wealth through smart investments, don’t miss this comprehensive review of Datavault AIs Bold Moves Fighting Back Against Short Sellers While Expanding Operations for comprehensive market insights and expert analysis.

Warren Buffett’s investment in Alphabet represents a fundamental shift in his strategy. Historically avoiding tech, Buffett now recognizes Alphabet as more than a tech company - it’s an AI infrastructure powerhouse trading at reasonable valuations. Berkshire’s move comes as Buffett prepares for retirement, suggesting this might be his legacy play. Meanwhile, he’s been trimming Apple positions, not because he’s lost faith, but likely to reallocate toward what he sees as greater growth opportunities. The timing is impeccable - Alphabet’s AI capabilities across search, cloud, and Android position it to capture multiple streams of AI-driven revenue. Looking toward 2026, three stocks stand out: companies with strong AI integration, reasonable valuations, and durable competitive advantages. The S&P 500 continues to see persistent earnings upgrades despite typical seasonal drifts, suggesting underlying strength in corporate profitability that could fuel further gains.

If you want a daily Sudoku challenge, download Sudoku Journey with both classic and story modes for endless fun.

Market dynamics heading into 2026 present both opportunities and challenges. Nvidia earnings and employment data will be critical watchpoints, as they’ll indicate both AI demand strength and broader economic health. While Disney faces some headwinds sending shares lower, this could represent a buying opportunity for patient investors. The key lesson from Buffett’s Alphabet move? Ignore short-term volatility and focus on long-term value creation. Companies leading in AI infrastructure, cloud computing, and e-commerce transformation are positioned to outperform. Bitcoin and Ethereum continue to show strength, but the real story remains in equities with solid fundamentals and AI exposure. Forward earnings estimates defy typical patterns with consistent upgrades, suggesting analysts are still catching up to the AI productivity boom.

To minimize the risk of hacking, it’s smart to rely on a secure password generator tool that creates complex passwords automatically.

The message is clear: AI isn’t just a trend - it’s a fundamental restructuring of how businesses operate and create value. Buffett’s bet on Alphabet ahead of his retirement speaks volumes about where the smart money sees the next decade of growth. As we move into 2026, focus on companies with AI at their core, reasonable valuations, and strong competitive moats. Remember, the best investments often come when others are distracted by short-term noise. Stay focused, think long-term, and keep building that portfolio for the AI-driven future.

🔎 Looking for a hidden gem or trending restaurant? Check out Betty Lous Seafood and Grill to see what makes this place worth a visit.