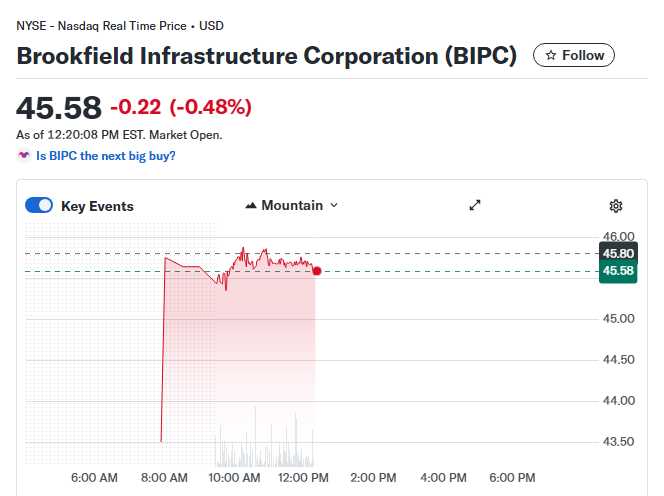

BIPC Stock Why This Infrastructure Giant Could Deliver Massive Earnings Surprise

Hey fellow investors! Kane Buffett here with another deep dive into a stock that’s been generating serious buzz in the options market. Today we’re talking about Brookfield Infrastructure Corporation (BIPC) - a name that might just be setting up for one of the most significant earnings surprises we’ve seen this quarter. As someone who’s been through multiple market cycles, I can tell you when the options market starts whispering, smart investors should start listening. Let me break down why BIPC has caught my attention and why it deserves a spot on your watchlist.

💡 Ready to take your portfolio to the next level? Check out this strategic analysis of Why TSMC, AMD and AI Stocks Are Poised for Major Moves in 2026 for comprehensive market insights and expert analysis.

The Options Market Is Screaming Something Big

The financial markets are speaking volumes about BIPC, and the language they’re using is the options market. Recent data shows unusual activity in BIPC options that suggests institutional investors are positioning for a significant move. When we see elevated options volume, especially in out-of-the-money calls, it typically indicates that sophisticated money is betting on a substantial price movement. This isn’t retail investors making random bets - this is smart money positioning based on fundamental analysis and potential catalysts. The options market is predicting increased volatility around upcoming earnings, which historically has been a reliable indicator of potential surprises. What’s particularly interesting is the timing and strike selection, suggesting that these traders aren’t just hedging but are actively positioning for upside momentum. This kind of activity demands attention because options traders often have access to better research and earlier information than the general public. When they make concentrated bets, it’s worth understanding why.

💼 If you’re serious about building wealth through smart investments, don’t miss this comprehensive review of Warren Buffetts Dividend Strategy Sleep-Well Stocks for Turbulent Times for comprehensive market insights and expert analysis.

Fundamental Strength Meets Global Infrastructure Demand

Brookfield Infrastructure Corporation isn’t just another utility stock - it’s a globally diversified infrastructure powerhouse with assets spanning multiple continents and sectors. The company’s portfolio includes critical infrastructure in utilities, transport, energy, and data infrastructure. What makes BIPC particularly compelling right now is its positioning in sectors that benefit from long-term macroeconomic trends: digitalization, decarbonization, and deglobalization. Their data center assets are riding the AI and cloud computing wave, their renewable energy assets benefit from the global transition to clean energy, and their transportation infrastructure plays into supply chain resilience themes. The company’s guidance has historically been conservative, often setting the stage for positive surprises. Their business model of acquiring, improving, and operating essential infrastructure assets creates durable cash flows that support both dividend growth and reinvestment opportunities. With inflation moderating but still above central bank targets, infrastructure assets with inflation-linked revenues become particularly valuable as they can pass through cost increases to customers.

📊 Looking for actionable investment advice backed by solid research? Check out Mohawk Industries Q3 2025 Strong Earnings Signal Recovery in Flooring Sector for comprehensive market insights and expert analysis.

Why Institutional Confidence Is Growing

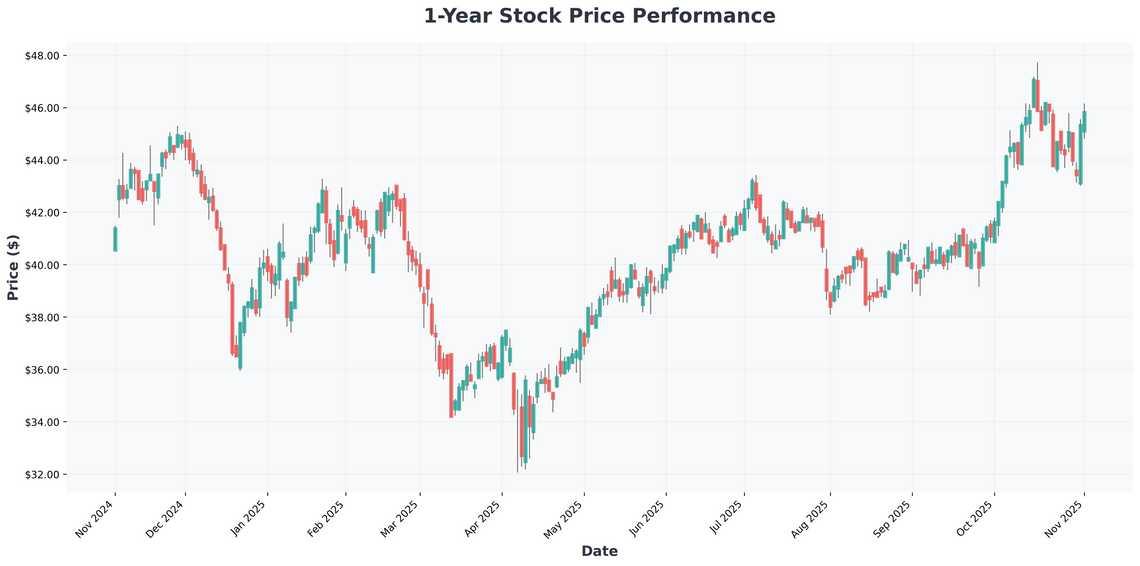

Multiple factors suggest BIPC could deliver better-than-expected results in the coming quarters. First, the global infrastructure spending boom, particularly in North America and Europe, creates a favorable backdrop for companies like Brookfield. Second, their recent acquisitions and asset rotations have positioned the portfolio toward higher-growth segments like data infrastructure and renewable energy. Third, the company’s financial discipline and access to Brookfield’s global platform provide competitive advantages that are difficult to replicate. Analyst sentiment has been gradually improving, with several firms maintaining BIPC on their top picks list due to its defensive characteristics coupled with growth potential. The stock’s current valuation doesn’t fully reflect the embedded growth in their development pipeline and the potential for multiple expansion as interest rates stabilize. For income-focused investors, the dividend yield combined with growth potential creates a compelling total return proposition that’s rare in today’s market environment.

Need a fun puzzle game for brain health? Install Sudoku Journey, featuring Grandpa Crypto’s wisdom and enjoy daily challenges.

In my decade of analyzing stocks, I’ve learned that when multiple indicators align - options activity, fundamental strength, and favorable macro trends - it’s worth paying attention. BIPC represents exactly that kind of convergence. While past performance never guarantees future results, the setup for Brookfield Infrastructure Corporation suggests potential for positive surprises in the coming quarters. As always, do your own research and consider your risk tolerance, but this is one infrastructure play that deserves serious consideration for any diversified portfolio. Remember: the best time to plant a tree was 20 years ago; the second-best time is now. Happy investing!

Need to measure time accurately without installing anything? Try this no-frills web stopwatch that runs directly in your browser.