Broadcoms AI Boom & My Top 5 AI Stocks for 2026 Navigating the Volatility

Hey folks, Kane Buffett here. If you’ve been watching the markets this week, you’ve seen the classic tug-of-war between explosive earnings and sky-high expectations, especially in the AI space. Broadcom (AVGO) just delivered a knockout quarter, yet its stock pulled back. Meanwhile, Oracle got slapped with a downgrade, Bitcoin and silver are making moves, and the VIX is whispering about volatility. It’s a messy, fascinating picture. As a long-term investor, this noise is where opportunity is born. Today, I’m breaking down the Broadcom phenomenon and, more importantly, sharing my top 5 AI stocks that are built to thrive through these cycles. Let’s cut through the hype and find real value.

⚡ Don’t miss out on potential market opportunities - here’s the latest analysis of The AI Investment Crossroads Googles EU Woes, 2026 Split Candidates, and the Real Capex Winners for comprehensive market insights and expert analysis.

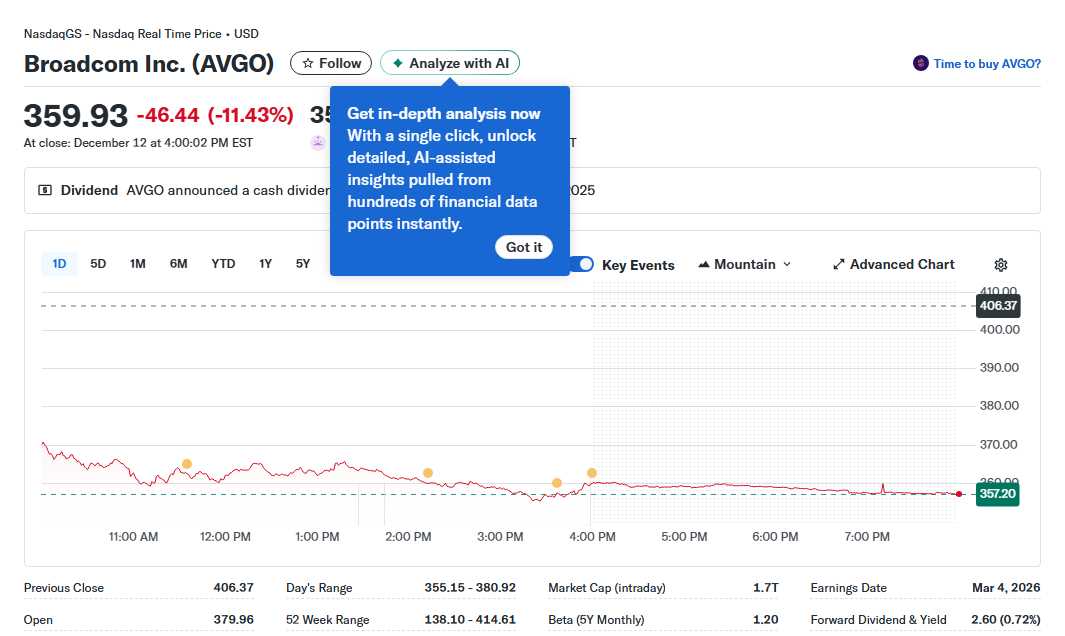

Broadcom’s Incredible Quarter Meets Unforgiving Expectations Let’s start with the elephant in the room: Broadcom. CEO Hock Tan just reported fiscal Q4 results that were, by any traditional measure, spectacular. AI-related revenue skyrocketed, with their AI accelerator business (those crucial chips powering data centers for giants like Google) now representing a massive portion of their semiconductor sales. The company’s guidance was strong, and the fundamental story of being a critical plumbing supplier to the AI revolution is intact. So why did the stock sell off? This is a masterclass in market psychology. The “beat and raise” was already priced in to an extreme degree. When the incredible growth failed to surpass already stratospheric expectations, short-term traders took profits. As an Investing.com analysis noted, it was a classic “sell the news” event. The takeaway for us long-term investors? This pullback in a fundamentally dominant company is not a signal of weakness, but a potential entry point. Broadcom isn’t just a chip play; it’s a diversified tech titan with software and infrastructure assets, making its AI-driven growth more sustainable.

📍 One of the most talked-about spots recently is Quarter Sheets Pizza Club to see what makes this place worth a visit.

The Broader AI Landscape: Winners, Losers, and Political Winds Broadcom’s story doesn’t exist in a vacuum. The entire AI ecosystem felt the tremors. Oracle, a major cloud and database player benefiting from AI workloads, saw its stock hit after a Wall Street downgrade, reminding us that valuations across the sector are stretched and susceptible to shifts in sentiment. Meanwhile, political risk entered the chat with a new executive order from the Trump administration focusing on AI. The details are still emerging, but any regulatory framework introduces uncertainty, which markets hate in the short term. Stepping back, this volatility underscores a critical point: not all “AI stocks” are created equal. The real money will be made in companies with durable competitive advantages (moats), essential hardware/software, and realistic paths to monetization. The sell-off in names like Broadcom is separating the weak hands from the strong, long-term convictions.

Looking for AI-powered Powerball predictions and instant results? Try Powerball Predictor and never miss a draw again!

My Top 5 AI Stocks for the Long Haul So, where am I putting my money amidst this chaos? I’m looking beyond the daily headlines at companies built for the next decade. Here are my top 5 AI stocks for a long-term portfolio: 1. NVIDIA (NVDA): The undisputed king. Its GPUs are the gold standard for AI training. While cyclical and volatile, its software ecosystem (CUDA) is an unassailable moat. 2. Broadcom (AVGO): As discussed, a cornerstone of AI infrastructure. Its custom silicon and networking solutions are vital. The post-earnings dip is a watchlist moment. 3. Microsoft (MSFT): The enterprise AI gateway. With Azure OpenAI and Copilot integrated across its empire, it’s monetizing AI at scale right now. 4. Taiwan Semiconductor (TSM): The foundational pick. Every advanced AI chip from NVDA, AMD, and Apple is made by TSM. It’s a toll-bridge on the AI highway. 5. Alphabet (GOOGL): A dual threat. Its DeepMind research is world-class, and its cloud division is aggressively competing for AI workloads. It has the data, talent, and capital. This list focuses on enablers and monetizers, not just hype.

🥂 Whether it’s date night or brunch with friends, don’t miss this review of Oooh Wee It Is to see what makes this place worth a visit.

The AI revolution is real, but it will be a bumpy road. This week’s action with Broadcom is a perfect microcosm: phenomenal business results met with a fickle market. For the “Kane Buffett” style of investing, we use these emotional sell-offs to research and accumulate shares in great businesses at better prices. Don’t chase the hot story of the day. Build a portfolio of essential AI players, hold through the volatility, and let compound growth work its magic over the years. Stay disciplined, folks.

🥂 Whether it’s date night or brunch with friends, don’t miss this review of b&b - Banh Mi & Boba to see what makes this place worth a visit.