AI Revolution 2026 Navigating NVIDIA, Google, and the Next Wave of Tech Investments

Hey investors! Kane Buffett here. As we approach 2026, the technology landscape is undergoing one of the most dramatic transformations I’ve witnessed in my decade of analyzing markets. Today, we’re diving deep into the seismic shifts happening across AI hardware, cloud computing, and satellite technology - with particular focus on the giants like NVIDIA, Alphabet, and Amazon that are shaping our digital future. The convergence of AI capabilities with next-generation infrastructure is creating unprecedented investment opportunities, but also significant risks that demand careful analysis.

📚 Want to understand what’s driving today’s market movements? This in-depth look at Why Coca-Cola and Dividend Stocks Like J&J Snack Foods Remain Timeless Investments in 2026 for comprehensive market insights and expert analysis.

The NVIDIA Conundrum: TPUs vs GPUs and the Evolving AI Hardware Battle

The semiconductor space is heating up with NVIDIA facing increasing competition in the AI accelerator market. While NVIDIA has long dominated with its GPU technology, the rise of specialized AI chips like TPUs (Tensor Processing Units) is creating new competitive dynamics. The key question investors must ask: Is NVIDIA’s technological moat eroding?

Recent analysis suggests that while NVIDIA maintains significant advantages in software ecosystems and developer communities, the hardware landscape is becoming increasingly fragmented. Companies are developing specialized processors optimized for specific AI workloads, potentially challenging NVIDIA’s general-purpose GPU dominance. However, NVIDIA’s continued innovation in AI-specific architectures and their comprehensive software stack (CUDA, AI libraries) creates substantial barriers to entry that shouldn’t be underestimated.

The presentation software market analysis reveals broader trends that impact NVIDIA - the market is projected to reach USD 22.22 billion by 2033, driven by rising demand for cloud-based collaboration and AI-enabled tools. This growth directly benefits NVIDIA as these platforms increasingly rely on GPU acceleration for AI features like automated design suggestions, real-time collaboration enhancements, and intelligent content generation.

Want smarter Powerball play? Get real-time results, AI-powered number predictions, draw alerts, and stats—all in one place. Visit Powerball Predictor and boost your chances today!

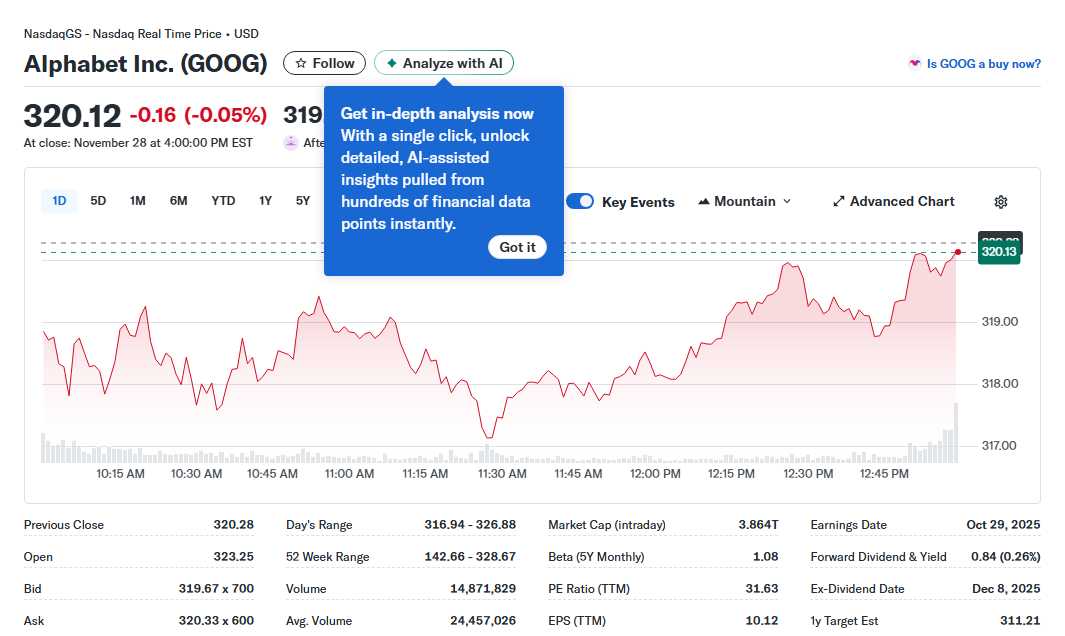

Alphabet’s Overbought Status and the Cloud Computing Revolution

Google’s parent company Alphabet is showing concerning technical signals, with the stock appearing extremely overbought according to recent analysis. This comes amid massive AI-driven rallies across the tech sector, but raises important questions about sustainability and timing for new investments.

Meanwhile, the cloud infrastructure space is experiencing revolutionary changes. Cavli Hubble’s Messaging Service is redefining cloud-to-cloud data routing, creating more efficient and cost-effective solutions for IoT and enterprise applications. This innovation addresses critical pain points in data transmission reliability and latency, potentially disrupting traditional cloud connectivity models.

Amazon, ranked among the top Magnificent Seven stocks to buy for 2026, continues to demonstrate strength across multiple segments. AWS maintains cloud leadership while expanding AI services, e-commerce shows resilient growth, and advertising revenue continues to accelerate. The company’s diversified revenue streams and massive scale create a defensive position while maintaining impressive growth characteristics.

Looking for AI-powered Powerball predictions and instant results? Try Powerball Predictor and never miss a draw again!

Emerging Technologies: Satellite Networks and AI Consumer Electronics

The satellite technology sector is gaining momentum with AST SpaceMobile adding two new satellite factories, significantly expanding their manufacturing capacity for space-based cellular broadband. This expansion signals confidence in the growing demand for global connectivity solutions and represents a strategic bet on the convergence of terrestrial and satellite networks.

On the consumer front, Nework’s MoveMate AI 27 Portable TV represents the next wave of AI-integrated home entertainment. Launching for Black Friday, this device showcases how AI is moving beyond smartphones and computers into everyday household items, creating new markets and investment opportunities in consumer IoT.

The presentation software market growth to $22.22 billion by 2033 underscores the massive opportunity in enterprise software. AI-enabled tools are becoming table stakes for competitive software platforms, driving consolidation and innovation across the sector. Companies that successfully integrate AI to enhance user productivity and collaboration are positioned for outsized growth.

💰 Don’t let market opportunities pass you by - here’s what you need to know about Biopharma Breakthroughs Why ADC Drugs and Clinical Pipeline Updates Signal Major Investment Opportunities for comprehensive market insights and expert analysis.

As we look toward 2026, the technology investment landscape presents both extraordinary opportunities and significant challenges. The AI revolution is real and accelerating, but selectivity is becoming increasingly important. NVIDIA’s hardware dominance faces new tests, Alphabet’s valuation requires careful consideration, while Amazon continues to demonstrate why it remains a cornerstone of growth portfolios. The emerging sectors - from satellite connectivity to AI-enabled consumer electronics - offer exciting growth potential but demand thorough due diligence. Remember, in volatile markets, patience and disciplined valuation work often separate successful investors from the rest. Stay sharp, do your homework, and as always - invest don’t speculate! - Kane Buffett

Get the edge in Powerball! Visit Powerball Predictor for live results, AI predictions, and personalized alerts.