The AI Revolution Top Stocks to Dominate the Next Decade of Artificial Intelligence

Fellow investors, Kane Buffett here. As we stand at the precipice of what I believe will be the most transformative technological revolution of our lifetimes, the artificial intelligence boom presents unprecedented opportunities for savvy investors. Having navigated multiple market cycles over my decade-long blogging journey, I’ve rarely witnessed a technological shift with this much potential. The recent flood of developments from cloud giants, chip manufacturers, and specialized AI companies suggests we’re still in the early innings of this game-changing trend. In this comprehensive analysis, we’ll dive deep into the most promising AI investments that could deliver life-changing returns over the coming years.

💡 Want to understand the factors influencing stock performance? This analysis of Molina Healthcare Investor Alert Critical Lead Plaintiff Deadline in Class Action Lawsuit - What You Need to Know for comprehensive market insights and expert analysis.

The Cloud AI Infrastructure Boom: Amazon’s AWS Transformation

Amazon is executing a brilliant strategic pivot, turning its cloud division into a powerful AI growth engine. The company’s AWS segment, traditionally focused on general cloud computing, is now aggressively positioning itself as the backbone of the AI revolution. What makes Amazon particularly compelling is their dual approach: they’re both building AI tools and services for their cloud customers while simultaneously integrating AI across their entire e-commerce ecosystem. This creates a powerful flywheel effect where improvements in one area benefit the other. Amazon’s investment in custom AI chips and their partnership with various AI startups positions them uniquely to capture value across the entire AI stack. The scale of AWS provides them with massive datasets to train increasingly sophisticated models, creating a competitive moat that’s difficult for newcomers to breach. Meanwhile, CoreWeave represents the specialized infrastructure play in this space. As a cloud provider focused specifically on GPU-intensive workloads, they’ve carved out a niche serving the most demanding AI training and inference tasks. Their growth trajectory suggests there’s substantial room for both general-purpose clouds like AWS and specialized providers like CoreWeave in the evolving AI infrastructure landscape.

Join thousands of Powerball fans using Powerball Predictor for instant results, smart alerts, and AI-driven picks!

Beyond NVIDIA: The Expanding AI Semiconductor Universe

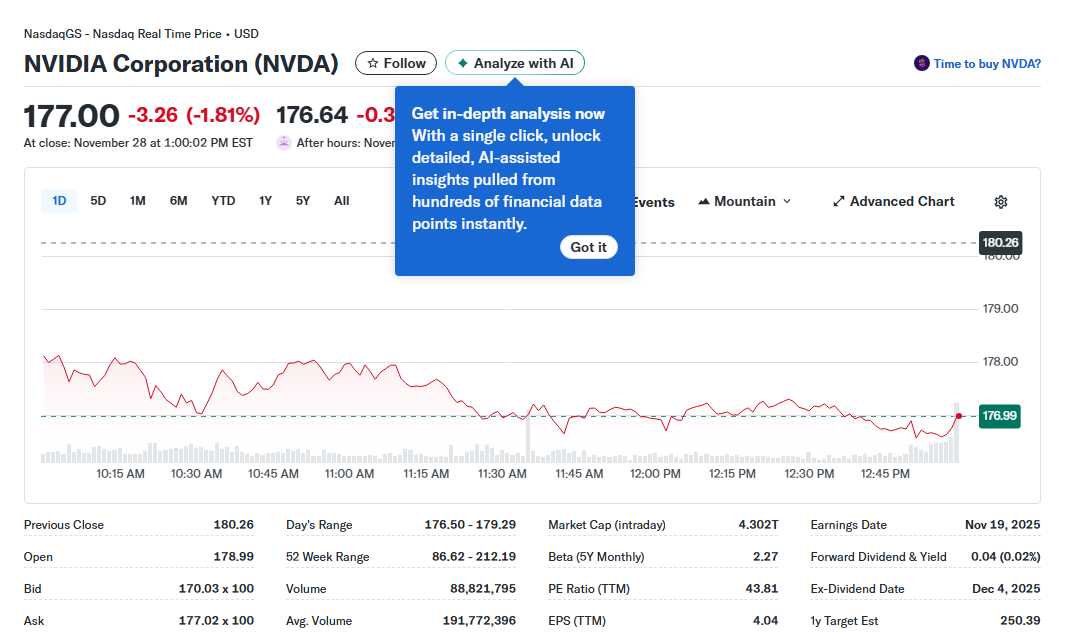

The semiconductor space is heating up with intense competition, particularly around the TPU vs GPU debate that’s challenging NVIDIA’s dominance. While NVIDIA has established an impressive moat with their GPU technology and CUDA software ecosystem, the landscape is evolving rapidly. Companies are developing specialized AI chips (TPUs) that could potentially offer better performance or efficiency for specific AI workloads. However, NVIDIA isn’t standing still - they continue to innovate at a breathtaking pace, and their software ecosystem remains a significant barrier to entry for competitors. The quantum computing space represents another frontier, with several companies positioning themselves as potential ‘next NVIDIA’ stories in the making. While still early stage, quantum chips could eventually solve problems that are intractable for classical computers, opening up entirely new markets. For investors, this means diversifying across different segments of the AI semiconductor space rather than betting everything on one company. The companies developing alternatives to NVIDIA aren’t necessarily trying to replace them entirely but rather capture specific segments of the market where specialized architectures make sense.

📊 Looking for actionable investment advice backed by solid research? Check out Market Crossroads Russell 2000 Resilience, AI Spending Boom, and Rivians Tesla Playbook for comprehensive market insights and expert analysis.

AI Application Layer: SoundHound and the Undervalued Opportunities

While infrastructure companies capture most of the headlines, the application layer of AI presents compelling investment opportunities. SoundHound AI represents an interesting case study in specialized AI applications. Their focus on voice AI and conversational intelligence has positioned them well as more devices and services incorporate voice interfaces. The company’s technology stack, which includes speech recognition, natural language understanding, and voice search, has applications across automotive, hospitality, and smart devices. What makes SoundHound particularly interesting is their potential to become the voice AI platform of choice for industries undergoing digital transformation. Meanwhile, there are several undervalued AI stocks trading at discounts to their more famous counterparts. These companies often have solid technology and business models but lack the market recognition of larger players. The key to identifying these opportunities lies in understanding their specific competitive advantages, market positioning, and path to profitability. Dan Ives’ analysis of AI ETFs highlights another approach - gaining diversified exposure to the AI theme while mitigating individual company risk. For investors uncomfortable picking individual winners, high-quality AI ETFs can provide balanced exposure to this transformative trend.

Join thousands of Powerball fans using Powerball Predictor for instant results, smart alerts, and AI-driven picks!

The AI investment landscape reminds me of the early days of the internet - full of promise, speculation, and genuine transformation. While risks certainly exist, particularly around valuation and execution, the companies building the foundational technologies of AI appear well-positioned for long-term growth. Amazon’s cloud transformation, the evolving semiconductor competition, and specialized AI applications like SoundHound all represent different ways to participate in this megatrend. As always, successful investing requires patience, diversification, and a long-term perspective. The companies mentioned here represent just a fraction of the opportunities in this rapidly evolving space. Do your own research, understand your risk tolerance, and consider dollar-cost averaging into positions rather than making large bets all at once. The AI revolution is here, and for disciplined investors, the potential rewards could be substantial. Until next time, invest wisely! - Kane Buffett

📍 One of the most talked-about spots recently is Gyro Xpress to see what makes this place worth a visit.