The Ultimate AI Investment Strategy From Hedge Fund Moves to Long-Term Growth Opportunities

Welcome back, fellow investors! Kane Buffett here with another deep dive into the market movements that matter. As we navigate the complex landscape of 2025, I’m seeing incredible opportunities in the AI and tech sectors that remind me of the early days of Amazon and Apple. Today, we’re breaking down everything from hedge fund positioning in emerging strategies to the unstoppable rise of AI stocks and the continued dominance of index investing. Having weathered multiple market cycles, I can confidently say we’re witnessing a transformational period in investing that demands both strategic thinking and disciplined execution.

💡 Ready to take your portfolio to the next level? Check out this strategic analysis of The AI Economys Quiet Winners Main Street Capitals 117% Yield Opportunity Amid Rising Risks for comprehensive market insights and expert analysis.

The hedge fund world is buzzing with activity, and TB Alternative Assets’ recent position in strategic investment firms signals a major shift in institutional thinking. This isn’t just about picking individual stocks anymore - it’s about positioning for the structural changes reshaping our economy. Meanwhile, the Vanguard S&P 500 Growth ETF continues to demonstrate why it’s a cornerstone of any serious long-term portfolio. A $10,000 investment made a decade ago would have grown to approximately $45,000 today, showcasing the power of disciplined index investing through market cycles. This performance underscores why even sophisticated investors maintain core positions in broad market ETFs while pursuing alpha through strategic stock selection. The data clearly shows that time in the market beats timing the market, and the S&P 500 Growth ETF’s track record proves this fundamental truth year after year.

💰 Don’t let market opportunities pass you by - here’s what you need to know about The AI Revolution Stock Splits, Quantum Computing, and Trillion-Dollar Opportunities You Cant Miss for comprehensive market insights and expert analysis.

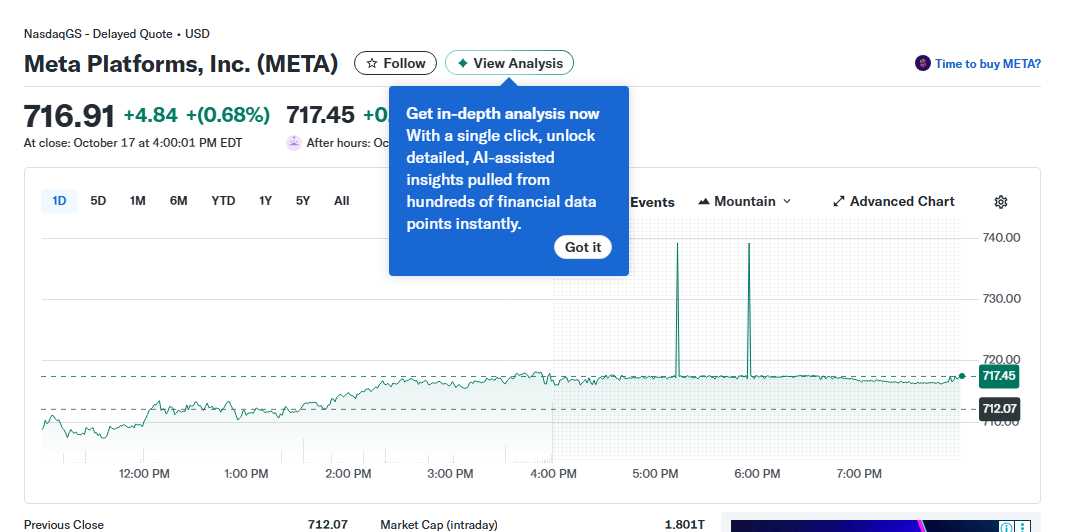

Oracle presents one of the most fascinating investment cases of 2025. Despite setting an ambitious $225 billion revenue target and securing a landmark partnership with Meta, investor skepticism remains elevated. The company’s cloud infrastructure business is showing remarkable growth, but concerns about competitive pressures and execution risk are weighing on sentiment. However, this creates potential opportunity for contrarian investors who believe in Oracle’s ability to execute its strategic vision. Meanwhile, several unstoppable stocks are positioning themselves to join the trillion-dollar club alongside NVIDIA, Apple, and Microsoft. These companies share common characteristics: massive total addressable markets, sustainable competitive advantages, and visionary leadership. The AI revolution continues to create winners across multiple sectors, from semiconductor manufacturers to cloud infrastructure providers and software platforms. Companies that successfully leverage machine learning and AI capabilities are seeing unprecedented growth and market recognition.

💰 For investors seeking profitable opportunities in today’s volatile market, this detailed analysis of Biotech Boom Analyzing ATAI, EyePoint, and Spyre Therapeutics Public Offerings - Investment Insights for comprehensive market insights and expert analysis.

The artificial intelligence sector offers two particularly compelling investment opportunities this October. These companies aren’t just riding the AI wave - they’re driving it with innovative technologies and sustainable business models. One key player is dominating the infrastructure layer of AI, providing the essential tools and platforms that enable other companies to build AI applications. Another is focused on applied AI, creating transformative solutions for specific industries. The machine learning job market is exploding, with Interview Kickstart recently integrating TinyML training to address the growing demand for edge AI expertise. This trend highlights the massive workforce transformation underway as companies scramble to hire talent capable of implementing AI solutions. Edge AI represents the next frontier, enabling real-time processing and decision-making without constant cloud connectivity. This technology has applications across autonomous vehicles, smart cities, industrial automation, and consumer devices, creating multiple investment avenues for forward-thinking investors.

Need a cool nickname that fits your vibe? Use this creative nickname generator with history tracking to find one that stands out.

As we wrap up today’s analysis, remember that successful investing requires both conviction and patience. The opportunities in AI and technology are real and substantial, but they require careful selection and long-term thinking. Whether you’re following hedge fund moves, building positions in promising AI stocks, or maintaining core ETF holdings, the key is staying disciplined through market volatility. The companies leading the AI revolution today could become the household names of tomorrow, much like how Microsoft and Apple dominated previous technological shifts. Stay curious, keep learning, and as always, invest wisely. Until next time, this is Kane Buffett reminding you that the best investment you can make is in your own financial education.

💡 Whether you’re day trading or long-term investing, this comprehensive guide to Rogers Blue Jays Contest A Home Run for Investors? for comprehensive market insights and expert analysis.