The AI & Semiconductor Supercycle Navigating the Boom, the Risks, and the Next Big Bets

Hey folks, Kane Buffett here. If you’ve been watching the markets lately, your head is probably spinning. Nvidia’s on another tear, whispers of a “quiet technological upheaval” are growing louder, and legendary investors are making bold, contrarian moves. It feels like we’re at a critical inflection point. The AI and semiconductor boom isn’t just a trend; it’s reshaping the global economy. But with massive gains come massive volatility and complex risks. In this deep dive, we’ll cut through the noise, analyze the latest headlines from AMD’s stumble to China’s “ghosting” of Nvidia, and unpack where the real opportunities—and pitfalls—lie for the savvy investor. Let’s get into it.

🎯 For investors who want to stay competitive in today’s fast-paced market, explore Critical Market Shifts Navigating Alphabet Risks, AI Competition, and Emerging Opportunities for comprehensive market insights and expert analysis.

The Semiconductor Landscape: Winners, Losers, and Geopolitical Tremors The heart of the AI revolution beats in semiconductor fabs. Lattice Semiconductor’s (LSCC) staggering 165% surge in 2025, as highlighted by The Motley Fool, is a prime example of a niche player riding the wave of edge AI and efficient computing. This isn’t just about raw power anymore; it’s about smart, specialized chips. Conversely, AMD’s 15% drop in November serves as a stark reminder of the fierce competition and execution risks in this space, even for giants. The elephant in the room, however, is geopolitics. The Benzinga report on China developing alternatives to Nvidia’s chips, with CEO Jensen Huang acknowledging a potential $4 trillion global AI market, underscores a massive decoupling. This creates a dual-track market and presents both a risk for U.S. giants and an opportunity for foundries like Taiwan Semiconductor Manufacturing Company (TSMC). Many analysts, including another Fool article, argue TSMC is an undervalued linchpin—the indispensable manufacturer for everyone from Apple to Nvidia, trading at a relative discount despite its critical role.

✨ For food lovers who appreciate great taste and honest feedback, Smalls Jazz Club to see what makes this place worth a visit.

AI Beyond Hype: The Real-World Boom and the “Magnificent” Approach AI investing is risky; chasing headlines can lead to painful losses. The key is to invest in the “picks and shovels” – the foundational infrastructure. A compelling Fool article suggests a “magnificent” way to invest in AI is through the data center boom, which is arguably just starting. The insatiable demand for AI processing power is driving a multi-year expansion cycle for data center REITs, hardware providers, and power/ cooling solutions. This is a more stable, tangible bet on AI adoption. Furthermore, the revolution is spreading to biotech. A GlobeNewswire report projects the deep learning market in drug discovery and diagnostics to reach $34.5 billion by 2035. This represents a massive, high-impact application of AI that goes far beyond chatbots. However, a separate briefing warns of a “quiet technological upheaval” that America isn’t ready for, hinting at systemic risks and displacement that could create volatility for unprepared companies and investors.

📊 Looking for actionable investment advice backed by solid research? Check out Enphase Energy (ENPH) Why This Solar Stock Could Dominate the Energy Sector in 2025 for comprehensive market insights and expert analysis.

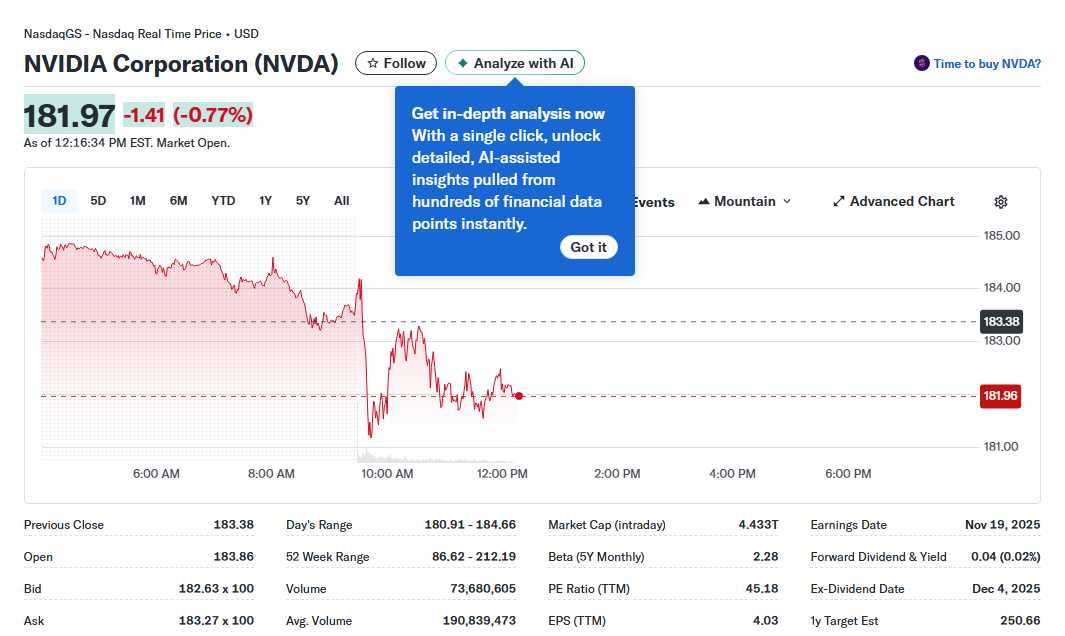

Contrarian Bets, Market Wisdom, and Building a Resilient Portfolio Now, let’s talk strategy. The market is full of conflicting signals. Michael Burry, famous for predicting the 2008 crash, is betting against Palantir. The Fool advises caution, noting that shorting a popular AI name is extremely risky and requires impeccable timing—a lesson for retail investors about the dangers of blindly following gurus. On the other hand, billionaire Ken Griffin is buying broad index funds to “crush” concentrated bets in assets like Bitcoin and even Nvidia. This highlights a core Buffett-esque principle: diversification and long-term ownership of the market often beats speculative frenzies. This aligns with an Investing.com analysis identifying 11 high-conviction S&P 500 stocks poised for a year-end rally, emphasizing quality and fundamentals. Meanwhile, Pure Storage’s recent dive on a slight guidance revision shows how hyper-sensitive AI-adjacent stocks can be. So, should you buy Nvidia in December? The final Fool article suggests it remains a dominant force, but its valuation demands flawless execution. The lesson: balance high-growth AI/semi exposure with the steady compounders in the broader market.

If you need to keep track of previous entries, try using a calculator with built-in history tracking for better accuracy.

The path forward is clear but not easy. The AI megatrend is real and will create enormous wealth, but it will also be a rollercoaster of hype, geopolitics, and brutal competition. Don’t just chase performance. Do your homework: understand the difference between a niche innovator like Lattice, a foundational pillar like TSMC, and a hyperscale enabler like the data center ecosystem. Respect the risks, from geopolitical fractures to valuation air pockets. And most importantly, anchor your portfolio with timeless wisdom—diversification, quality, and a long-term horizon. The greatest technological shift in a generation is underway. Invest in it wisely. Stay sharp, Kane Buffett.

Need a daily brain game? Download Sudoku Journey with English support and start your mental fitness journey today.