The 2026 Investors Guide AI, Quantum Computing, and the Cloud Stocks Billionaires Are Buying Now

Hey folks, Kane Buffett here. For over a decade on this blog, we’ve navigated bull markets, bear markets, and everything in between. The landscape is shifting again, and fast. The convergence of Artificial Intelligence (AI), quantum computing, and next-gen cloud infrastructure isn’t just tech news—it’s the investment story of the coming decade. I’ve been digging through analyst reports, earnings calls, and, crucially, the buying activity of the world’s smartest money. The data points to a massive, multi-trillion-dollar realignment. If you’re wondering where to put your capital to work for the long haul, the path is becoming clearer. Let’s break down the three seismic forces shaping your portfolio’s future.

🤖 Looking for expert insights on market trends and investment opportunities? Check out this analysis of Netflixs Bold Moves Analyzing the Warner Bros Deal, Stock Split, and Your Path to a Millionaire Retirement for comprehensive market insights and expert analysis.

The Quantum Leap: A $198 Billion Revenue Horizon by 2040 Let’s start with the frontier: quantum computing. A recent Jefferies report isn’t just optimistic; it’s painting a picture of a foundational new industry. They project a staggering $198 billion in potential revenue by 2040. This isn’t science fiction anymore. We’re talking about machines that solve problems intractable for classical computers—materials science, complex logistics, drug discovery, and advanced cryptography. While pure-play quantum companies like D-Wave Quantum are often overlooked and carry high risk, they represent the pioneering edge of this wave. The real story, however, is in the enabling infrastructure. Quantum computing requires immense classical computing power for control systems, specialized cooling (MEP services—more on that later), and software layers. This creates a rising tide that will lift many boats in the tech ecosystem long before quantum supremacy becomes mainstream. The takeaway for investors? Exposure to this theme may be less about picking the quantum winner today and more about investing in the companies building the picks and shovels for this new gold rush.

Join thousands of Powerball fans using Powerball Predictor for instant results, smart alerts, and AI-driven picks!

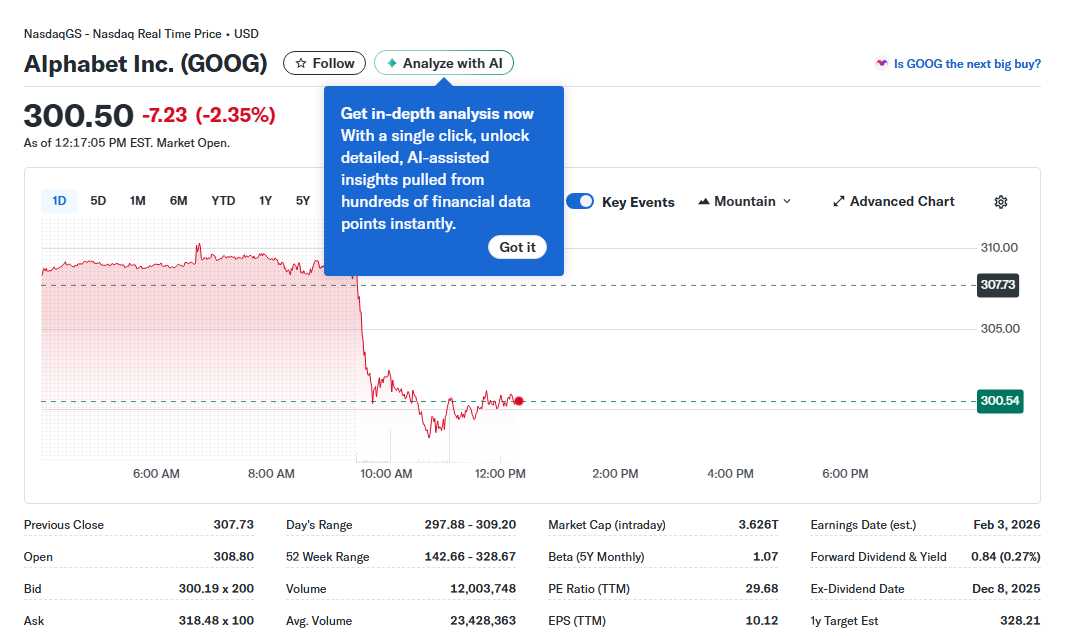

The AI Engine Room: Cloud Infrastructure & The Stocks Smart Money Loves AI models are hungry. They devour data and processing power. This has triggered an arms race in AI infrastructure, fundamentally reshaping the cloud and data center landscape. It’s no longer just about storage and basic compute; it’s about high-performance GPU clusters, custom AI chips, and hyperscale data centers. One cloud stock repeatedly highlighted for its explosive potential in this build-out is well-positioned to be the backbone of this new era. Furthermore, when billionaires and institutional money speak, I listen. Their recent filings show a relentless accumulation of key AI stocks. Names like Nvidia (despite being down from recent highs, its dominance in AI accelerators is questioned but not yet dethroned), Alphabet, and others feature prominently. The thesis is simple: AI is transitioning from a novelty to a core utility, and these companies provide the essential plumbing. Alphabet, for instance, isn’t just Google Search; it’s a leader in AI research (DeepMind), cloud services (Google Cloud), and owns a treasure trove of data. With $1,000 or $5,000 to invest, building a position in these foundational tech stocks is less a trade and more a strategic allocation for the long-term.

Take your Powerball strategy to the next level with real-time stats and AI predictions from Powerball Predictor.

The Physical Layer: MEP, Energy, and the Overlooked Growth Market Here’s the critical, often-missed piece of the puzzle: the physical world. Every AI server and quantum computer needs to be housed, powered, and cooled. This brings us to the MEP (Mechanical, Electrical, and Plumbing) services market. A new report from Astute Analytica forecasts this market to balloon to US $301.10 billion by 2035, driven directly by AI integration and renewable energy infrastructure. This is a powerful insight. The digital revolution has a massive physical footprint. Data centers are becoming the factories of the 21st century, and they require complex, reliable, and increasingly green support systems. Companies that design, build, and maintain these facilities are enablers of all tech growth. Furthermore, renewable energy is no longer just an ESG play; it’s a cost and reliability imperative for power-hungry AI operations. Investing in this theme means looking beyond the shiny software and semiconductors to the industrial and engineering firms building the grid and facilities of tomorrow.

Searching for a fun and engaging puzzle game? Sudoku Journey with Grandpa Crypto’s story offers a unique twist on classic Sudoku.

The message from the market is converging. Quantum computing presents a long-term, high-potential frontier. AI infrastructure is the immediate, high-growth engine, with cloud leaders and semiconductor giants at the core. And beneath it all, the physical infrastructure market (MEP, energy) is set for accelerated, durable growth. As “Kane Buffett,” my approach has always been to identify durable trends, not fleeting fads. This triad—Quantum, AI, and Infrastructure—represents exactly that. Do your own research, consider your risk tolerance (quantum plays are speculative, while cloud giants are more established), and think in terms of years, not days. The builders of the next digital epoch are being funded right now. Let’s make sure we have a seat at the table. Stay sharp out there.

📊 Looking for reliable stock market insights and expert recommendations? Dive into The 2026 Investors Playbook AI, Quantum, and the Unstoppable Tech Trends You Cant Ignore for comprehensive market insights and expert analysis.