The 2026 Investors Playbook AI, Megatrends, and My Top Picks for the Coming Year

Hey folks, Kane Buffett here. As we close the books on 2025, the market is giving us a masterclass in volatility and momentum. We’ve seen record highs, sharp pullbacks as investors lock in gains, and seismic shifts beneath the surface, particularly in the AI and data center spaces. My inbox is flooded with questions about what comes next. Is the AI bubble about to pop? Where are the real opportunities beyond the usual suspects? Drawing from over a decade of navigating these waters, I’ve sifted through the noise, analyzed the latest developments (including Nvidia’s game-changing Groq deal and the explosive silver rally), and I’m here to lay out my framework for 2026. This isn’t about hot tips; it’s about understanding the powerful, durable trends that will define the next chapter and positioning your portfolio to ride them.

📊 Looking for reliable stock market insights and expert recommendations? Dive into Market Records, Metals Mania, and Your 2026 Blueprint Top Stocks and ETFs to Buy Now for comprehensive market insights and expert analysis.

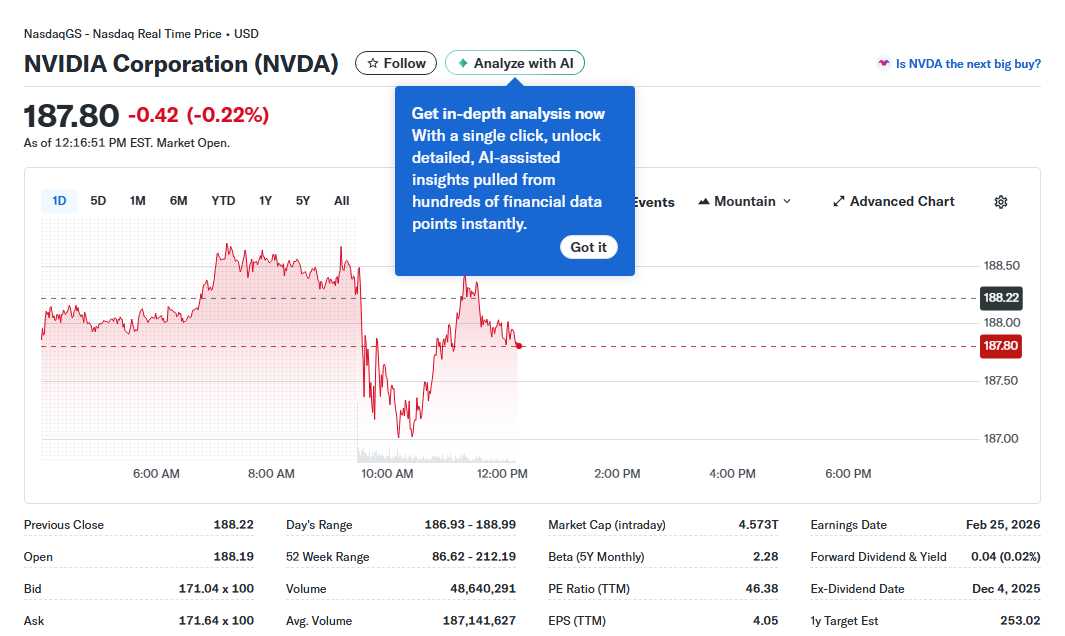

The Unstoppable Engine: AI & The Data Center Infrastructure Boom Let’s cut to the chase: AI is not a bubble waiting to pop in 2026; it’s an industrial revolution entering its infrastructure build-out phase. The recent news perfectly illustrates this shift. Nvidia’s acquisition of Groq isn’t just another deal; it’s a strategic move to consolidate leadership in AI inference, the next frontier as AI models move from training to widespread deployment. This “incredible news for 2026” signals Nvidia’s intent to dominate the entire AI stack. But the real story, the “overlooked winner,” extends far beyond any single chipmaker. The AI data center boom is going public, creating a massive investment tailwind for companies in power, cooling, and grid technology. Think about it: every new data center is a massive consumer of electricity and water. This creates a multi-year runway for companies enabling this build-out. Meanwhile, other AI stocks are quietly outperforming even Nvidia in 2025, proving that the ecosystem is rich with opportunity. My take? The AI trade is evolving from pure-play semiconductor bets to a broader infrastructure play. For investors, this means looking at the entire value chain—from the chips (Nvidia, but also competitors and suppliers like Micron Technology with its crucial memory) to the physical plants and utilities that power them.

✨ For food lovers who appreciate great taste and honest feedback, My Fathers Kitchen to see what makes this place worth a visit.

Portfolio Construction for 2026: Stocks, ETFs, and Thematic Plays With the macro backdrop in mind, how do you build a resilient yet growth-oriented portfolio? First, let’s talk ETFs. The debate between diversified growth (like VONG) and mega-cap concentration (like MGK) is central. In a market led by a few giants, concentration has won recently, but 2026 might favor more diversification as opportunities broaden. For aggressive investors seeking high returns, the leveraged ETF debate (SOXL vs. SPXL) is pertinent, but these are tactical, high-risk tools, not forever holds. For a “set it and forget it” approach, the identified growth ETFs to buy with $1,000 and hold forever offer a smarter path. Now, for individual stocks. The “Magnificent Seven” concept has morphed; even hedge fund titan Chase Coleman has formed his own version. My analysis of the “5 magnificent stocks and 1 ETF you must own for 2026” points to high-conviction picks across tech and beyond. Beyond the giants, look for stocks set to start strong in January and lead through 2026—these are often companies with clear catalysts and momentum. Specific themes to watch: Quantum Computing is moving from theory to reality, with three genius stocks poised to benefit in 2026. Silver had a stunning 168% return in 2025. While past performance doesn’t guarantee future results, the structural drivers for silver (industrial demand, green tech) remain intact, making select silver stocks a compelling speculative buy for 2026. Finally, consider contrarian value. Is Micron Technology a good value in this economy? Given its cyclical nature and pivotal role in the AI memory boom, it might be. Should you buy Applied Digital while it’s under $10? As a data center play, its risk/reward profile is worth deep due diligence.

🥂 Whether it’s date night or brunch with friends, don’t miss this review of Harlowe to see what makes this place worth a visit.

Navigating Risks, Psychology, and The Fed’s Hand No outlook is complete without a risk assessment. The market slide on December 29th, as investors locked in gains, is a healthy reminder of volatility. The question of an AI bubble popping in 2026 is valid. My stance? We will see corrections and sector rotations, but a full-scale collapse of the AI thesis is unlikely given the tangible enterprise spending. The key is to own AI stocks you’d happily hold through any crash—companies with robust balance sheets, durable competitive advantages, and essential roles in the ecosystem. Three such AI stocks have been identified that fit this bill. On the macroeconomic front, all eyes will be on the Federal Reserve and Chair Jerome Powell. Their decisions on interest rates in 2026 will be the single biggest driver of market multiples. The “stock market earning” potential in 2026 is tightly linked to the Fed’s pivot and the soft landing narrative. This environment demands that you “want to be a better investor in 2026.” The #1 skill isn’t stock picking—it’s emotional discipline. Avoiding the fear of missing out (FOMO) at tops and the panic selling at bottoms is what separates great investors from the rest. Use tools like Robinhood not for gambling, but for executing a disciplined, long-term plan based on the megatrends we’ve discussed.

Stay ahead in Powerball with live results, smart notifications, and number stats. Visit Powerball Predictor now!

So, there you have it. 2026 is shaping up to be a year of execution—where the AI promise gets built into physical infrastructure, where portfolio concentration is tested, and where investor psychology will be paramount. The trends are powerful: AI infrastructure, data center demand, quantum computing, and strategic commodities. Your job is to align your portfolio with these currents, manage your risks, and tune out the daily noise. Do that, and you’ll be positioned not just for a year, but for a decade. Stay disciplined, stay curious, and here’s to a prosperous 2026. This is Kane Buffett, signing off. Remember, the best investment you can make is in your own knowledge.

Whether you’re working on a pomodoro routine or timing a run, this free stopwatch with basic controls is easy to use and accessible anywhere.