2026 Investing Outlook AI, Teslas Robotaxi, and the Stocks Poised to Dominate

Hey folks, Kane Buffett here. As we wind down 2025, the chatter about 2026 is already reaching a fever pitch. The tape is mixed, records are being notched, and the narratives around AI, EVs, and the Fed are colliding. I’ve been sifting through the latest analysis from top strategists and earnings reports to separate the signal from the noise. Buckle up, because 2026 is shaping up to be a year defined by technological execution, economic resilience, and make-or-break moments for several high-profile companies. Let’s dive into what the smart money is watching.

💡 Want to understand the factors influencing stock performance? This analysis of The AI Investment Tsunami 3 Megatrends and 5 Stocks Poised to Dominate 2026 for comprehensive market insights and expert analysis.

The Macro Backdrop: A Resilient Economy Meets Cautious Optimism The S&P 500 is hovering near all-time highs, fueled by a stronger-than-expected Q4 GDP report. This economic strength is a double-edged sword: while it signals a robust economy, it has also cooled Wall Street’s expectations for early Federal Reserve rate cuts. The market is in a “Goldilocks” phase—not too hot to spur aggressive Fed tightening, but not too cold to suggest imminent recession. This environment has supported a “risk-on” trade during the holidays, with falling market volatility (VIX) encouraging investment. However, strategists like Ed Yardeni warn that while a soft landing is the base case, investors should remain vigilant for signs of overheating or a sudden slowdown. Concurrently, we’re seeing a “metals mania,” with gold and silver prices surging. This isn’t just a flight to safety; it’s a bet on persistent geopolitical tensions and a hedge against potential future inflation, should the Fed’s eventual easing cycle be more aggressive than anticipated.

🌮 Curious about the local dining scene? Here’s a closer look at Maison Nico to see what makes this place worth a visit.

The Unstoppable Force: AI and the 2026 Tech Thesis If 2025 was the year of AI hype and infrastructure build-out, 2026 will be the year of monetization and tangible product cycles. Dan Ives of Wedbush is pounding the table on this theme, declaring 2026 as a “Year of Tech” powered by AI. The focus is shifting from training models to deploying them. Nvidia (NVDA) remains the undisputed backbone of this ecosystem. Analysis suggests buying Nvidia before Tesla for 2026, as its data center business is expected to see another wave of growth from enterprise and sovereign AI deployments. Beyond chips, the application layer is exploding. Meta (META) is accelerating its push into AI wearables, aiming to embed AI assistants into everyday glasses and devices, a move that could open a new consumer frontier. Furthermore, the unveiling of a national U.S. air taxi strategy points to massive, long-term investment in advanced mobility and the AI systems that will power it. The “Magnificent Seven” remain central, but they are diverging. Ranking them for 2026, analysts highlight companies with the clearest AI monetization paths and resilient core businesses, suggesting a more selective approach is needed rather than buying the basket blindly.

Stay ahead in Powerball with live results, smart notifications, and number stats. Visit Powerball Predictor now!

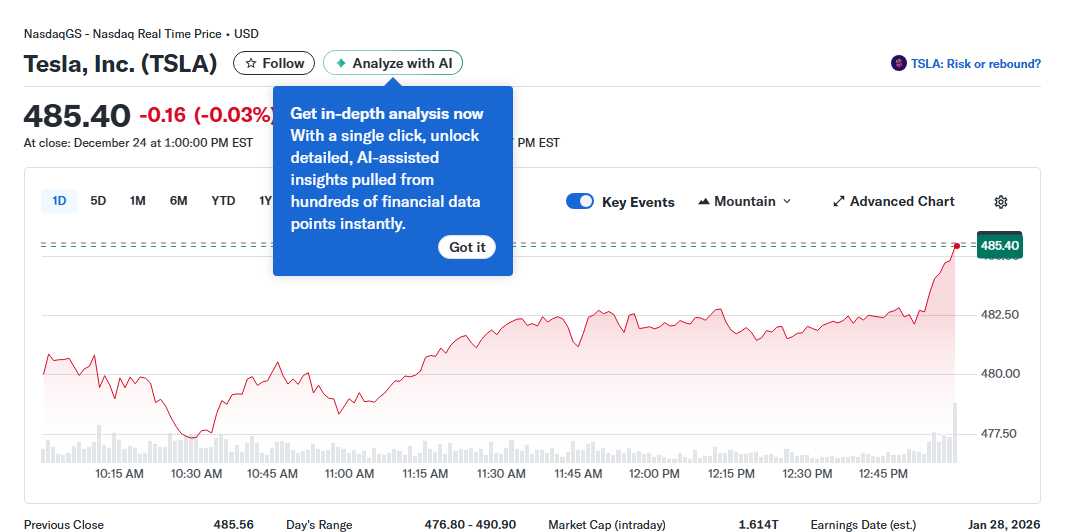

Company Spotlights: Tesla’s Pivot and Rivian’s Crossroads Two stories capture the extreme potential and peril in the market: Tesla and Rivian. Tesla (TSLA) is all about the Robotaxi. 2026 is being hailed as “The Year of the Tesla Robotaxi,” with Elon Musk promising a dedicated unveiling event. This isn’t just about a new car; it’s about launching an entirely new business model and validating Tesla’s full self-driving (FSD) technology. Success could re-rate the entire company, while delays or setbacks could severely damage sentiment. Meanwhile, Rivian (RIVN) presents a fascinating recovery play. The stock has popped on signs of operational efficiency improvements and strong demand for its R2 platform. Analysts see room for more gains if the company can continue to burn less cash, ramp production smoothly, and navigate the still-competitive EV landscape. The question isn’t just about survival anymore—it’s about whether Rivian can transition to a sustainable, growth-phase automaker. On the speculative fringe, the analysis on Dogecoin is unequivocally negative, citing its lack of utility, infinite supply, and purely meme-driven nature as three core reasons it’s not a serious investment.

🥂 Whether it’s date night or brunch with friends, don’t miss this review of Atrium to see what makes this place worth a visit.

So, what’s the play for 2026? It’s a year for disciplined optimism. Lean into the secular winners of the AI revolution, with a preference for companies like Nvidia that are essential infrastructure. Watch Tesla’s Robotaxi day like a hawk—it could be a market-moving event. Consider recovery stories like Rivian, but size those positions appropriately for the higher risk. And most importantly, don’t let the macro noise of Fed timing or daily volatility knock you out of your long-term thesis. The economy is strong, innovation is accelerating, and opportunities are abundant for the prepared investor. Stay sharp, do your homework, and here’s to a prosperous 2026. This is Kane Buffett, signing off. Keep investing wisely.

🔎 Looking for a hidden gem or trending restaurant? Check out The Stonewall Inn to see what makes this place worth a visit.